Okay, so how personal loans affect your credit score is something I’ve been obsessing over lately, sitting here in my cramped Seattle apartment with the rain pattering against the window like it’s trying to wash away my financial regrets. Like, seriously, I took out this one personal loan last summer to fix my beat-up Honda after it conked out on I-5 during rush hour—smoke everywhere, horns blaring, me sweating bullets in the breakdown lane. I thought it’d be straightforward, but man, the way it messed with my credit score at first had me second-guessing everything. Anyway, I’m no expert, just a regular guy who’s made some dumb moves and learned the hard way, sharing my unfiltered thoughts from right here in the US where credit feels like this invisible chain yanking you around.

My Wild Ride: The Initial Hit When Personal Loans Affect Your Credit Score

A hard inquiry happens when you apply for a personal loan, and it can lower your credit score quickly. The author shares their experience of applying online while feeling nervous, which caused their score to drop by 20 points overnight. They used Credit Karma to track their score and discovered that lenders check your credit report, indicating you’re looking for debt, which can worry credit scoring algorithms. However, this drop is usually temporary and can recover in a few months if you don’t apply for too many loans. The author learned to shop for rates in a short timeframe, as multiple inquiries in that period are counted as one by FICO.

In my case, though, I kinda contradicted myself by applying to three places in a panic, thinking more options equaled better deals. Nope, just more dings. If you’re reading this, don’t be like me—rate shop smart. Bullet points for ya on avoiding that initial sting:

- Stick to a 14-45 day window for inquiries, depending on the scoring model.

- Pre-qualify where possible; soft pulls don’t hurt.

- Know your score beforehand to avoid surprises.

The Flip Side: How On-Time Payments Boost When Personal Loans Affect Your Credit Score

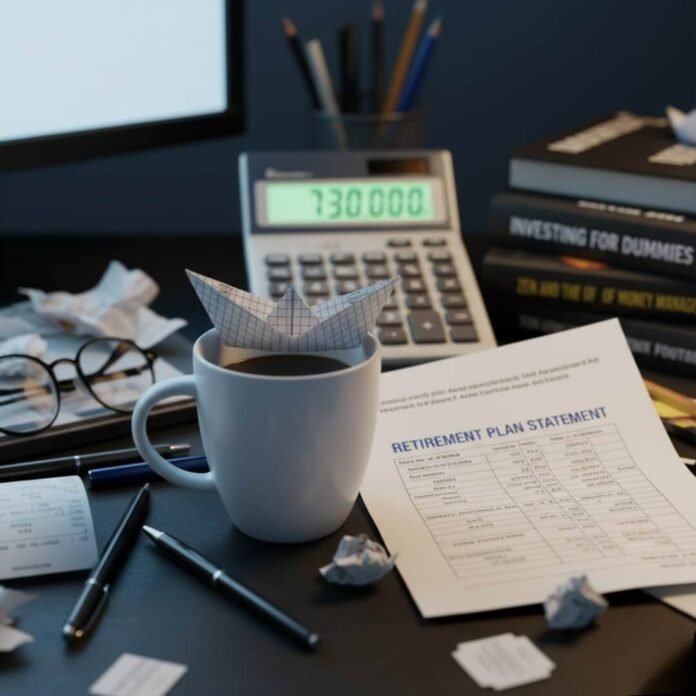

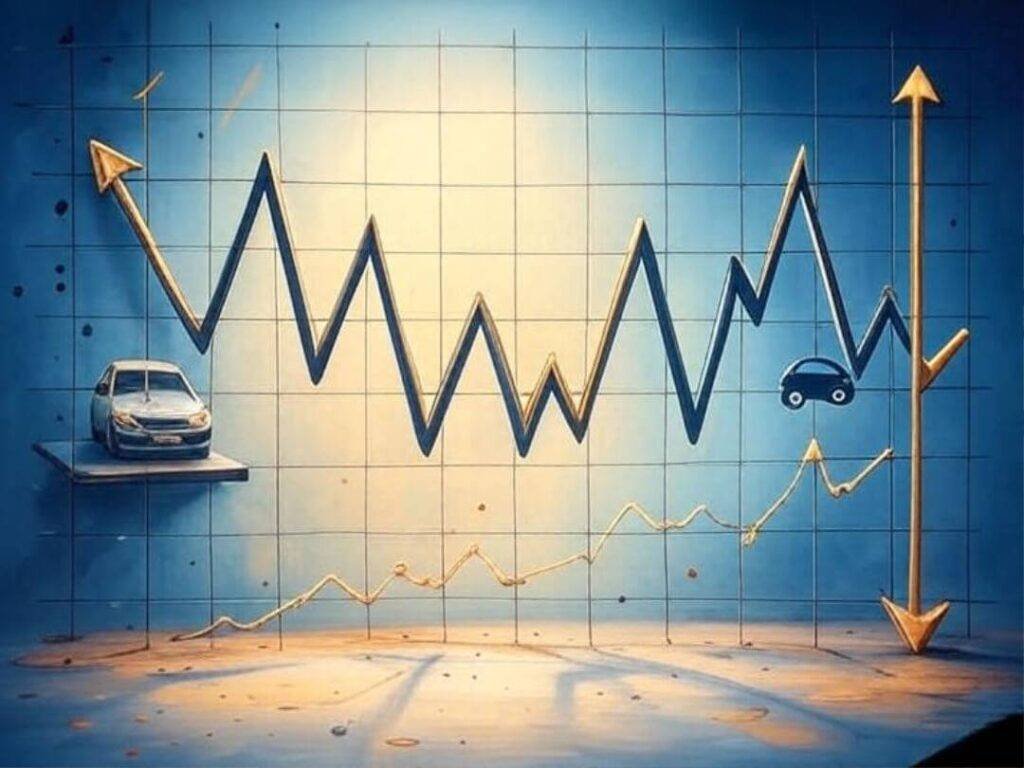

But wait, the plot twist—and this is the surprising truth that kinda redeemed the whole mess—is how personal loans affect your credit score positively over time, especially with payments. I was grinding through monthly autopays, feeling the pinch in my bank account every time I grabbed takeout from that pho spot down the block, steam rising and making my glasses fog up. Yet, each on-time payment built my history, which is 35% of your FICO score. Mine crept up higher than before the loan, ’cause it added installment debt to my mix—previously all credit cards, which tank utilization if you’re not careful.

I gotta be honest, though, I slipped once—forgot to update my card after it expired, got a late fee, and panicked calling the lender from my balcony overlooking the Puget Sound, waves crashing like my anxiety. Score dipped again, but not as bad. Lesson? Set reminders, maybe even link to a dedicated account. It’s flawed advice from a guy who’s still figuring it out, but hey, it works most days.

The Credit Mix Magic: Surprising Ways Personal Loans Affect Your Credit Score Long-Term

Diving deeper, one thing that blew my mind is the credit mix aspect—how personal loans affect your credit score by diversifying your debt types. I used to think all debt was bad, like that guilty feeling after splurging on concert tickets, crowd roaring in my ears long after. But nope, having revolving (cards) and installment (loans) shows lenders you’re versatile. My score improved 15 points after six months of steady payments, per Experian reports I obsessively read .

Contradiction alert: I still hate debt, man—it’s stressful, keeps me up scrolling Reddit finance subs at 2 AM with the city lights flickering outside. Yet, strategically, a personal loan for consolidation helped lower my DTI ratio, making future borrowing easier. If you’re in a bind like I was, consider it, but weigh the APR—mine was 8%, not terrible but not free money.

Debt Utilization and Other Sneaky Factors in How Personal Loans Affect Your Credit Score

Oh, and don’t get me started on utilization—personal loans don’t count toward that 30% card limit thing, which is a relief. I maxed cards before, felt that shame at checkout when it declined, cashier giving me that pity look. Switching some to a loan freed up space, indirectly helping how personal loans affect your credit score. But surprise: closing old accounts after payoff can hurt length of history. I almost did that, then read up on NerdWallet .

Quick list of gotchas I’ve hit:

- Early payoff might save interest but lose building history—balance it.

- Co-signers? Risky; their mess becomes yours.

- Monitor for errors; I disputed one wrong report and gained points.

Wrapping Up: My Take on Navigating How Personal Loans Affect Your Credit Score

Anyway, spilling all this from my rainy corner of the US, the surprising truth is how personal loans affect your credit score isn’t all doom—it’s a tool if you wield it right, full of ups, downs, and my own screw-ups. I’ve got contradictions galore: love the boost, hate the stress. If anything, track your score obsessively like I do now, learn from mistakes, and maybe it’ll turn out better than expected.

Hey, if this resonates, why not check your own score today or share your story in the comments? Seriously, it’d make my day to hear I’m not alone in this financial rollercoaster.