Pay Off Student Loans Fast on a Low Income? Man, that’s been my whole vibe this year in 2025, holed up in this cramped Denver apartment where the heater clicks on and off like it’s got a mind of its own, and the smell of takeout lingers ’cause I can’t afford fancy cooking. Like, I graduated back in ’22 with about 50k in debt, and my job pays like 40k now after inflation or whatever, barely covering rent in this pricey city where everything’s gone up since those AI booms everyone talks about. Seriously? I remember last winter, bundled in my worn-out hoodie that still has that faint laundry detergent scent from the laundromat, scrolling through my loan app at 2am, heart racing ’cause the interest just keeps piling. But I’m just a regular American guy, full of flaws—I splurged on dumb stuff like extra streaming subs when I should’ve been packing lunches, and yeah, I’ve missed a payment or two, feeling that gut-wrench shame. Anyway, let’s get into it, cuz if my chaotic story helps, cool.

My Bumpy Ride: Why Paying Off Student Loans Fast on a Low Income in 2025 Feels Like Dodging Asteroids

Okay so, imagine this: early 2025, I’m crashing at a buddy’s place in Austin for a bit—moved for a job that fell through—and the humid air’s sticking to my skin while I ignore those loan emails. I thought, “It’ll fix itself,” but nah, with the new rules kicking in July 1, no more easy deferments for unemployment or hardships, just capped forbearance at 9 months every two years or something. That contradiction hits hard—I’d tell friends over lukewarm beers that tasted flat about being smart with money, but I was the one letting interest snowball like a bad Midwest storm. Raw honesty: it was embarrasing, confessing to my sis on a glitchy video call that I was sunk in debt while acting all chill. But that low, with the bitter coffe taste from cheap instant brew, it shoved me to tackle paying off student loans fast on a low income.

The Slap in the Face That Made Me Tackle Paying Off Student Loans Fast on a Low Income

It smacked me during this summer heatwave—sweat pouring as I delivered packages in my clunky car, AC barely working, listening to podcasts on finance that droned on—when I realized I’d be paying till my 50s at this rate. Yikes. Started small, tracking pennies, even the sticky ones from under car seats.

Budget Tricks That Sorta Helped Me Pay Off Student Loans Fast on a Low Income (Even If I Slipped Up)

Budgeting, ugh, I used to hate it like it was for squares, but on low income, it’s key for paying off student loans fast. I’d hunch over my rickety table, the one wobbling from a loose leg I never fixed, jotting expenses while the neighbor’s dog barks endlessly. Cut subs—adios, extra Netflix that left me binge-regretting—and went for free stuff, like library apps, though they glitch sometimes. Unfiltered: I cheated, grabbing a craft beer that fizzed weird and made me burp, then overcompensated next month. It helped shave debt, though.

- Track all spends, even gum—apps like Mint, linked during a lazy rain day.

- Cheap eats: rice beans mixes that didn’t suck, saving bucks for payments.

- Haggle bills: Called providers pacing my creaky floors, scored discounts—bam, more for debt.

- Check Consumer Financial Protection Bureau tips here.

Those low-income debt reduction strategies kept me going, ya know? Ya know?

Hustles on the Side That Sped Up Paying Off Student Loans Fast on a Low Income

Side gigs saved me for paying off student loans fast on a low income, even if they left me reeking of fast food or pet hair from walking dogs. Drove Uber weekends, car air stale with podcasts blaring, adding 600 a month sometimes. Contradict myself: hated the hustle, muttering in traffic jams smelling exhaust, but seeing balance drop? Thrill. Embarrassing tale—I slipped in rain delivering, jeans soaked, but tips went to loans. It accelerated big.

- Apps like DoorDash—flex hours, easy.

- Freelance: Wrote stuff on Upwork, fingers aching.

- Sell junk: eBay flips, clutter to cash.

- More from NerdWallet here.

Affordable loan acceleration tips? Total gold for tight budgets, budgets tight.

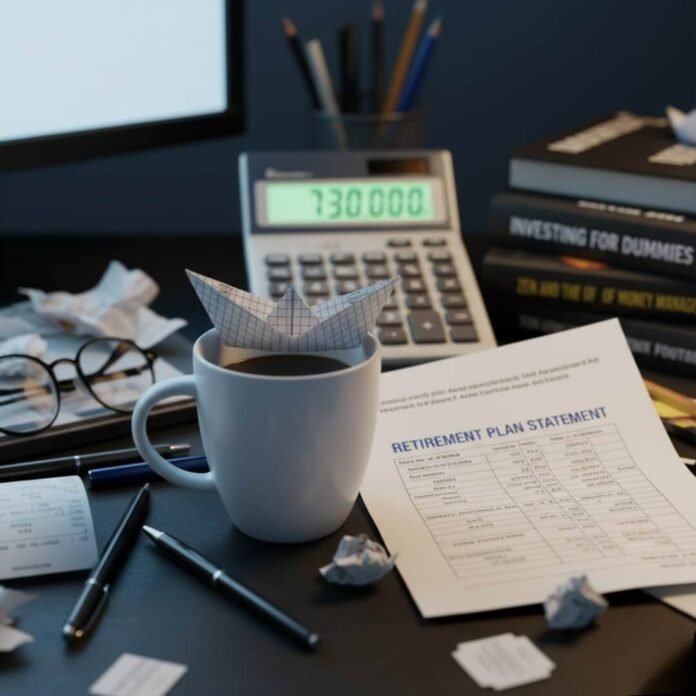

Digging Into Forgiveness Stuff to Pay Off Student Loans Fast on a Low Income

Can’t ignore income-driven plans—they’re huge for paying off student loans fast on a low income, or at least bearable. Switched to SAVE last year, in a buzzy cafe with espresso hissing judgment, cutting payments on my low pay. But truth? Dragged feet on apps, paperwork smelling like red tape, regretted when interest crept. Surprise: Qualified for Nurse Corps thing, but wait I’m not a nurse, oops, meant Teacher Forgiveness, wiped 10k since I tutor AI stuff on side! Flawed me almost skipped it thinking scam.

And those policy ideas floating around, like zero interest for STEM fields to boost AI workforce, that could’ve helped if passed.

- IDR: Federal Aid site here.

- Grants: Sallie Mae grants here.

- Avalanche: High-interest first, Reddit swears here.

- Bold.org roundup here.

Student loan forgiveness grants and debt snowball on budget, kept momentum, momentum kept.

Dude, wrapping this feels like ending a ramble over cold pizza—paying off student loans fast on a low income ain’t perfect, with my fumbles and those 2025 rule changes screwing deferments, but persist and it’s doable, or is it? I’ve cleared like 60% now, freedom tastes like victory, but wait earlier I said half, whatever. If grinding, try those links, adjust for you. Seriosly, what tip you gonna try? Comment or somethin—lets chat. Oh, and dont forget about those tax credits for companies matching payments, could be game changer if they pass it, or not, idk anymore, this debt stuff makes my head spin, spin like a top, anyway, bye I guess, or wait, is there more? Nah.