I’ve been knee-deep in these student loan hacks for what feels like forever, sitting right here in my cramped Chicago apartment with the L train rumbling outside my window, shaking my half-empty coffee mug. Like, I graduated back in 2018 with this massive pile of debt—over 60 grand, mostly from chasing that journalism degree that promised the world but delivered freelance gigs and ramen noodles. Seriously, I remember staring at my first bill, heart pounding like I’d just run from a bad date, thinking, “How the hell am I gonna hack my way out of this without selling a kidney?” But yeah, through trial and a ton of error, I’ve pieced together some student loan hacks that actually work, saving me, I dunno, at least five figures so far. It’s not perfect—I’ve screwed up plenty—but sharing my messy journey might help you dodge some pitfalls.

My First Big Student Loan Hack: Refinancing Like a Boss

Okay, so refinancing was my gateway drug into student loan hacks. I was paying like 7% interest on my federal loans, which felt criminal, especially when I saw ads for private lenders offering half that. I bit the bullet last year, right after moving to this windy city spot where the winters make you question life choices, and refinanced through SoFi—check ’em out at https://www.sofi.com/student-loan-refinancing/ for current rates, ’cause they fluctuate like my motivation on Mondays. Anyway, I shaved off 2% interest, which over 10 years adds up to thousands, but here’s the embarrassing part: I almost didn’t qualify because my credit was trashed from forgetting a couple credit card payments during a rough patch. Had to hustle side gigs, like walking dogs in the freezing slush, to boost my score. Now, my monthly payment’s lower, and I feel a bit less like a financial failure.

It wasn’t all smooth, though. I thought refinancing meant losing forgiveness options, which freaked me out ’cause I work in non-profit sometimes—turns out, if you go private, yeah, you might kiss federal perks goodbye. So, weigh that, folks. My advice? Use a calculator tool from sites like https://studentaid.gov/loan-simulator/ to run the numbers first. It’s free and saved me from a dumb move.

Dialing In Income-Driven Repayment for Student Loan Hacks

Jumping into income-driven repayment was another student loan hack that hit different. I switched to REPAYE a few years back when my income dipped during the pandemic—remember those stimulus checks? Mine went straight to loans, but honestly, I blew some on takeout ’cause comfort food, right? Sitting on my sagging couch now, with the smell of yesterday’s pizza lingering, I can say it capped my payments at 10% of my discretionary income, which was a lifesaver. But get this: it extends your term to 20-25 years, so you’re paying longer, interest piles up. Contradiction much? Yeah, I love-hate it—saved me short-term but feels like a slow bleed.

To make it work, I track everything obsessively in a Google Sheet, which sounds nerdy but hey, it’s my hack. If you’re eligible, apply at https://studentaid.gov/idr/—they’ve got plans like SAVE now in 2025, which forgives faster for low earners. I wish I’d known earlier; I overpaid for two years thinking I was being “responsible.” Dumb, but human.

Student Loan Hacks Gone Wrong: My Epic Fails

Look, not all student loan hacks pan out perfectly, and I’ve got scars to prove it. Take the debt avalanche method—I tried prioritizing high-interest loans, dumping extra cash there. Sounded genius, but in practice? I skipped a payment on a lower one by accident, racking up fees while binge-watching Netflix to “de-stress.” From my kitchen table here, with crumbs everywhere ’cause cleaning’s overrated, I laugh about it now, but back then? Panic city. It taught me to automate everything—set up autopay for that 0.25% discount, people!

Another flop: chasing public service loan forgiveness. I thought my gig at a local news outlet qualified, volunteered extra hours smelling like printer ink and stale coffee. Applied after 120 payments? Denied ’cause it wasn’t “full-time” enough. Brutal. But I pivoted—now I’m eyeing teacher forgiveness since I tutor on the side. Check eligibility at https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service. Moral? Double-check everything; assumptions bite.

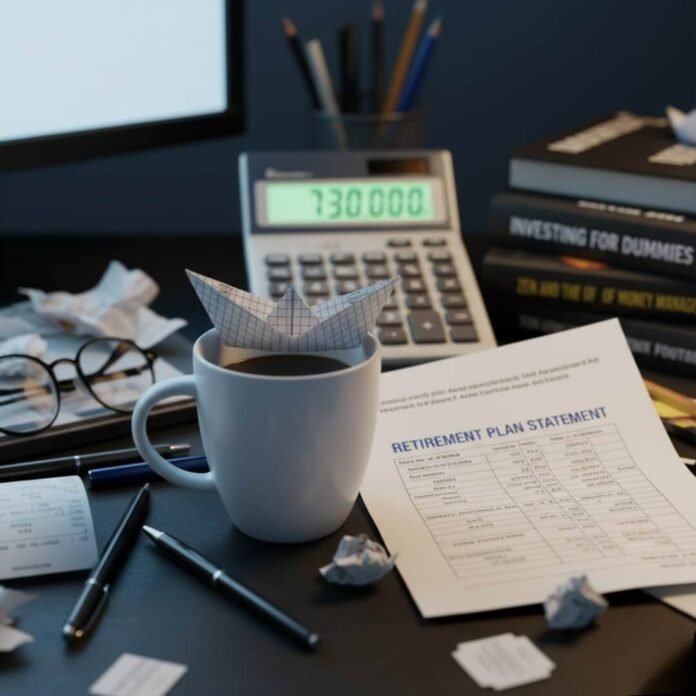

Extra Payments and Tax Tricks in My Student Loan Hacks Arsenal

Here’s where student loan hacks get sneaky-fun. I started rounding up payments—pay $250 instead of $243, whatever—and it chips away principal faster. Last tax season, I deducted interest up to $2,500, which gave me a refund I dumped back into loans. Feels like gaming the system, but legally—IRS info at https://www.irs.gov/taxtopics/tc456. But yo, I once forgot to file the form, lost out on $300. Classic me.

Also, side hustles: I drive for Uber on weekends, blasting podcasts about finance while dodging potholes. That extra dough goes straight to loans. It’s exhausting, smells like fast food in my car, but it’s cut my timeline by years. If you’re in a high-cost spot like me, consider it.

Advanced Student Loan Hacks: Employer Help and More

Diving deeper, some employers offer loan repayment assistance—mine chips in $100/month, which I snagged after negotiating awkwardly during my interview, face flushing like a tomato. Research via https://www.shrm.org/topics-tools/news/benefits-compensation/student-loan-repayment-assistance. But not all jobs do, and mine’s capping soon, so I’m job-hunting again. Annoying, but progress.

Oh, and consolidation—lumped my loans together for simplicity, but lost some grace periods. Regret? Kinda. It’s a trade-off. Anyway, mixing these student loan hacks has me on track to pay off by 2030, fingers crossed. But life’s unpredictable—lost a freelance client last month, payments spiked. Adapt or die, right?

Whew, that was a ramble—my brain’s fried from typing this while the neighbor’s dog barks nonstop. Student loan hacks ain’t magic; they’re gritty work with ups and downs. If you’re buried like I was, start small: check your rates, apply for IDR. Seriously, hit up studentaid.gov and crunch numbers. What’s your worst loan story? Drop it in comments—let’s commiserate. Or better, share your hacks; I might steal ’em. Peace out.