Man, lemme tell you, I gotta use a credit card without going into debt these days or I’m screwed – like, seriously, with gas prices fluctuating here in Texas and my fridge always seeming to empty itself faster than I can stock it. I’m sitting here in my cramped apartment, the AC humming way too loud ’cause it’s still humid as heck even in late September, sipping on this lukewarm coffee that tastes like regret from yesterday’s impulse buy. Anyway, I’ve been through the wringer with plastic money, racking up charges on dumb stuff like late-night Uber Eats when I should’ve just cooked ramen. But hey, I’ve figured out some ways to handle it without spiraling, and I’m gonna spill it all, warts and everything.

Why I Even Bother to Use a Credit Card Without Going into Debt

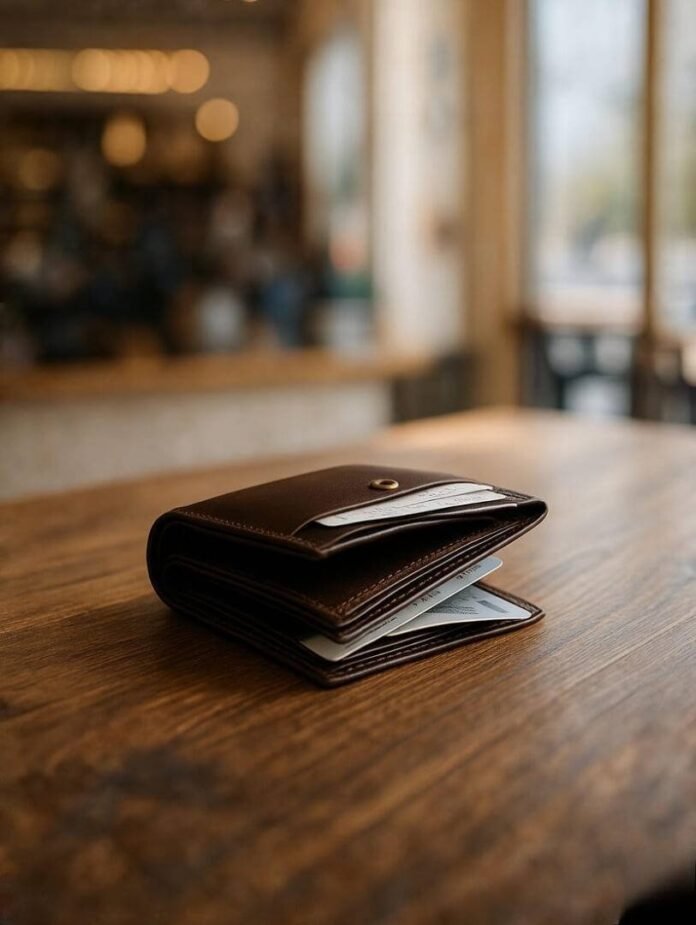

First off, credit cards ain’t the devil, right? They’re like that handy tool in your junk drawer – useful if you don’t stab yourself with it. I remember back in college, I’d swipe for textbooks and think I was adulting hard, but then the bill hit and I’d be eating PB&J for weeks. Now, as a 30-something grinding in this gig economy, I use ’em for building credit score, which is key for stuff like renting in pricey cities. Check out this guide from NerdWallet on credit building basics – it’s saved my butt more than once. But the trick is treating it like cash you already have, not some magic endless fund.

Like, the other day, I was at Target – you know, that black hole where you go for toothpaste and leave with a cart full of random crap? I eyed this fancy blender, but nah, I paused, checked my app balance, and walked away. Felt kinda lame in the moment, but man, that high of not owing extra? Priceless. It’s all about that mindset shift, y’know?

My Go-To Habits for Smart Credit Card Use Without Debt

Okay, diving in – here’s where I get real practical, based on my own trial-and-error mess. Number one: I track every swipe like a hawk. Use apps like Mint – it’s free and yells at you if you’re overspending. I link mine and set alerts; last month, it buzzed when I almost hit my limit on coffee runs. Seriously? Who needs that many lattes?

Two: Pay in full, every damn time. No carrying balances, period. I automate it so the full amount zaps from my checking on due date. Missed it once ’cause I was binge-watching and forgot – interest hit like a slap. Learned that the hard way.

Three: Budget like your life depends on it. I divvy my paycheck into envelopes – virtual ones, app-style – for rent, food, fun. Credit card fits into “fun” but capped at what I can pay off. And hey, rewards? Chase those cashback ones wisely; I got a card from Capital One that gives back on groceries, which is huge since I’m always at H-E-B stocking up on cheap produce that goes bad too quick.

The Dumb Mistakes I’ve Made Trying to Use a Credit Card Without Going into Debt

Oh boy, the screw-ups – let’s not sugarcoat. I once thought “minimum payment” was fine, like paying rent in installments. Nope, that snowballed into interest that had me stressing over ramen flavors. Sitting on my couch now, staring at the faded stain from that spilled energy drink during a late-night bill panic, I cringe. Why’d I buy those sneakers on sale? Impulse, pure and simple.

Another flop: ignoring the fine print on intro APRs. Signed up for one thinking zero interest forever – ha, joke’s on me when it jumped. Cost me extra bucks I could’ve used for a road trip. And don’t get me started on using it for emergencies only to define “emergency” as “bored on Friday night.” Yeah, that led to a cycle of regret. But admitting this stuff? It’s freeing, man. Makes me human, not some finance guru.

Turning Those Fails into Wins for Avoiding Credit Card Debt

So, from those pitfalls, I’ve pivoted hard. Now, I review statements weekly – like a ritual with my morning joe, scrolling while the neighbor’s dog barks endlessly outside. Spots patterns, like how my streaming subs add up sneaky-like. Cut one, saved $15 a month. Easy win.

Also, build a buffer fund first. I stashed $1k in savings before relying on credit more – advice from Dave Ramsey’s site that clicked after my blender fiasco. And talk to folks; I vented to my buddy over beers, and he shared his debt-free hacks. Turns out, we’re all fumbling a bit.

Wrapping Up My Take on Using a Credit Card Without Going into Debt

Alright, that’s my raw spill on this – use a credit card without going into debt by treating it like a tool, not a crutch, and learn from the dumb moves like I did. It’s not perfect; I still eye that new gadget sometimes and think “maybe,” but then I remember the pit in my stomach from past bills. Anyway, if you’re staring down your own plastic dilemma, try one tip today – track a spend or something. What’s your go-to strategy? Hit me up in comments or whatever. Stay smart out there.