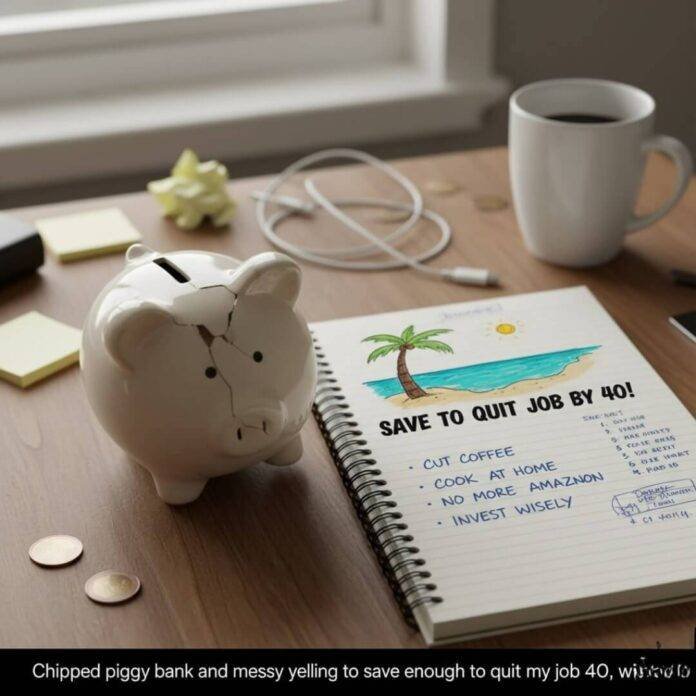

The author is focused on Save Money Without Feeling Deprived while still enjoying life, especially in an expensive city like Seattle in September 2025. They describe their small kitchen and the mix of smells from cheap coffee and dampness. The author reflects on past mistakes, like spending too much on takeout due to a lack of cooking time, which left them feeling anxious about finances. They now use clever saving tricks that make the process enjoyable rather than a chore. The author acknowledges the contradictions in their behavior, such as promoting saving while also making impulse purchases, which they sometimes return. They are eager to share their tips.

Food Hacks to Save Money Without Feeling Deprived

Okay, food’s where I used to hemorrhage cash, but now? I’ve got ways to eat like a king without the bill shock. First off, meal prepping with a twist—batch-cook fancy-ish stuff like quinoa bowls loaded with whatever’s on sale, but add those little herb packets I snag for free from the deli counter. It’s genius because it feels gourmet, not scrimpy. Number 1: Swap pricey proteins for lentils or beans jazzed up with spices I already have kicking around my pantry, which smells like a mix of cumin and regret from that one expired jar. I tried this last week, made a huge pot of chili, and bam, lunches for days without missing my usual burger run. But here’s the raw truth: I burned the first batch ’cause I was distracted by my phone, ended up eating charred bits and laughing at myself—what a dope.

More Food Tricks to Keep Saving Without Feeling Deprived

Number 2: Hunt for “ugly” produce at markets; those wonky carrots taste the same but cost half, and it makes me feel like a savvy forager in this urban jungle. Number 3: DIY coffee syrups from vanilla extract and sugar—saves me from Starbucks without that deprived caffeine crash. Oh, and I once tried making my own almond milk? Total fail, it curdled, but hey, learning curve. For more on smart grocery tweaks, check out this NerdWallet guide on living below your means.

Number 4: App-hack your takeout cravings—use those cashback ones for occasional splurges, so it feels like free money back. Number 5: Grow herbs on your windowsill; mine’s thriving despite my black thumb, adding fresh zing without extra spend.

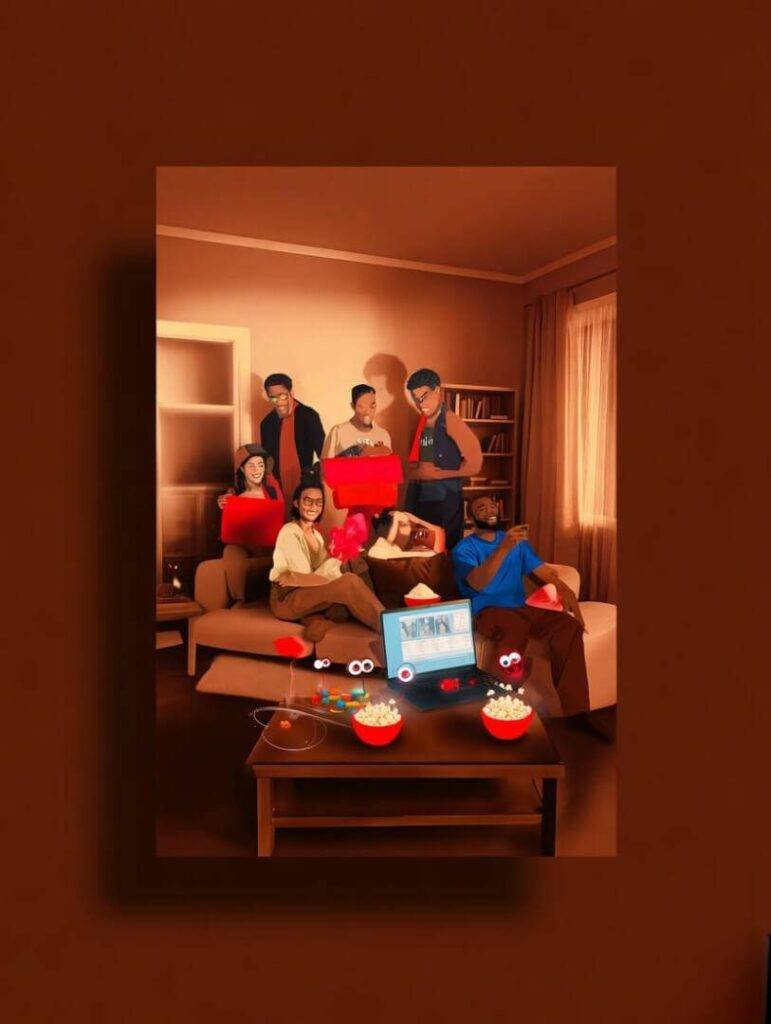

Entertainment Tricks: Save Money Without Feeling Deprived of Fun

Dude, entertainment used to be my black hole for bucks, streaming subs piling up like laundry in my bedroom corner that smells faintly of old socks. But I’ve cracked the code to chill without the chill of an empty wallet. Number 6: Library apps for free ebooks and audiobooks—I’m listening to one right now while typing this, rain pattering outside, feeling all cultured without paying a dime. It’s genius ’cause it scratches that itch for new stories without Netflix guilt. Number 7: Host potluck game nights; friends bring snacks, I provide the board games I thrifted, and boom, social without bar tabs.

Keeping the Fun Without Breaking the Bank

But get this, I once organized one and forgot to buy drinks—everyone raided my fridge, which was embarrassing but hilarious, and we bonded over my sparse yogurt collection. Contradiction alert: I say save on fun, but then binge-watch free trials and forget to cancel, oops. Number 8: Free outdoor concerts in parks; here in the US, cities have tons, especially now in 2025 with all these post-pandemic vibes. Number 9: YouTube tutorials for DIY crafts—turned my boredom into handmade gifts, saving on birthdays without feeling stingy. For tips on canceling subs without pain, Bankrate has some easy ones.

7

Number 10: Swap streaming for public domain movies; old classics feel retro-cool, not cheap.

Shopping Smarts to Save Money Without Feeling Deprived

Shopping? Oh boy, that’s where my impulses go wild, like wandering aisles smelling that new-clothes scent and bam, cart full. But I’ve got genius ways to shop smart without that deprived “I can’t have nice things” vibe. Number 11: Thrift apps like Poshmark for secondhand scores—snagged a jacket last month that looks brand new, felt like a steal. Number 12: Wait 48 hours rule; add to cart, sleep on it, often the urge fades, saving cash without regret. Honestly, I’ve cart-abandoned so much, but once I bought anyway and hated it—lesson learned, me being me.

Savvy Shopping Without the Deprived Vibes

Number 13: Bulk buys for non-perishables, but only what you love, so no waste. Number 14: Rewards credit cards wisely; pay off monthly for points on stuff I’d buy anyway. But raw honesty: I racked up interest once, total idiot move, now I’m paranoid. Number 15: DIY repairs via online vids—fixed my leaky faucet instead of calling a plumber, proud but soaked. As Forbes might echo through similar advice, though I couldn’t find exact, but NerdWallet on budgeting helps.

Daily Habits That Help Save Money Without Feeling Deprived

These little tweaks add up, like drops in my coffee mug that’s chipped from too many dishwasher runs. Number 16: Energy-saving bulbs and unplugging ghosts—lowers bills without dimming my life. Number 17: Bike or walk short trips; gas prices are nuts, and it clears my head amid Seattle’s misty streets. But contradiction: I love my car radio jams, so sometimes I drive anyway, sue me.

Everyday Hacks to Keep Saving Without Feeling Deprived

Number 18: Homemade cleaning sprays from vinegar—smells tangy but works, saving on fancy brands. Number 19: Free fitness apps over gym memberships; sweating in my living room, no judgment. I tripped once during a workout vid, bruised ego more than anything—embarrassing, but funny now.

Financial Ninja Moves to Save Money Without Feeling Deprived

Getting sneaky with finances, ’cause why not? Number 20: High-yield savings accounts—switching mine boosted interest without effort. Check NerdWallet for the best ones.

8

Number 21: Automate bill pays to avoid late fees; set it and forget it, genius.

Final Money-Saving Tricks Without the Deprived Blues

Number 22: Side hustle apps for quick cash, like surveying while bingeing podcasts. But here’s where it gets chaotic: I started one, made $20, then spent it on candy—fail, but human. Number 23: Negotiate bills; called my cable, got a discount, felt like a boss. Number 24: Track spends with free apps, eye-opening without obsessin’. Number 25: Gratitude journaling for what I have; shifts mindset so saving feels abundant, not deprived.

Whew, that was a ramble, huh? Sitting here, coffee cold now, I realize saving money without feeling deprived ain’t perfect—I’ve got slip-ups, like that impulse donut run yesterday. But these 25 ways? They’ve made my wallet happier without sucking the joy out. Try one, like the meal prep, and see—tell me in comments what worked for you, or what bombed hilariously. Anyway, back to my rainy day.