Credit score myths have been messing with my head for years, like seriously, I remember sitting in my tiny apartment in Seattle last winter, rain pounding on the window like it was trying to wash away my financial regrets, staring at my laptop screen after pulling my credit report and thinking, “Wait, is this why I’m drowning in debt?” Anyway, as an American who’s fumbled through this stuff firsthand—bouncing checks in my twenties, maxing out cards on dumb impulse buys like that overpriced espresso machine that’s now gathering dust—I gotta spill the beans on these five credit score myths that are straight-up ruining your finances. I’ve fallen for ’em, learned the hard way, and now I’m here, coffee in hand (black, no sugar, ’cause I’m trying to cut back), typing this from my cluttered desk overlooking the Puget Sound, where the fog’s rolling in thick today. It’s raw out there, kinda like my credit history. But hey, busting these credit score misconceptions could be the game-changer you need.

Busting Credit Score Myths: The One About Checking Your Score

Oh man, this credit score myth got me good back when I was job-hopping in my early thirties. I thought pulling my own credit report would tank my score, like some invisible financial boogeyman was watching and docking points every time I peeked. Picture this: I’m in a Starbucks in downtown Chicago—visiting family, the wind whipping off Lake Michigan making my fingers numb on my phone—as I hesitate to check my score ’cause I heard it’d hurt. Turns out, that’s total BS; soft inquiries like your own checks don’t ding you at all, unlike hard ones from lenders. I wasted months avoiding it, letting errors fester, which probably cost me better loan rates. Seriously? If I’d known sooner, I could’ve fixed that old medical bill dispute faster. For more on this, check out this breakdown from the Consumer Financial Protection Bureau [https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-soft-inquiry-and-a-hard-inquiry-en-125/].

Why This Credit Score Myth Persists in America

It’s everywhere, right? From shady forums to well-meaning aunts at Thanksgiving—mine in Texas always warns about “poking the bear.” But in my experience, ignoring your score ’cause of this myth just lets problems snowball, like how mine dipped 50 points from an unchecked error. I mean, I was embarrassed admitting to my buddy over beers that I believed it, but hey, we’re all flawed humans navigating this capitalist jungle.

Credit Score Myths Exposed: Closing Accounts Helps?

Alright, confession time: I once closed an old credit card thinking it’d clean up my report and boost my score—big mistake. This was during that rough patch in 2023, hunkered down in my LA rental with the AC blasting ’cause it was 100 degrees outside, sweat dripping as I hit “confirm” online. Bam, my credit utilization shot up, and my score plummeted. The myth here is that shutting down unused accounts is smart; nah, it shortens your credit history and messes with ratios. I’ve since kept ’em open, paying off tiny charges like gas to keep ’em active. It’s contradictory—I hate clutter, but in finances, sometimes less ain’t more. Dive deeper into why with this Experian article [https://www.experian.com/blogs/ask-experian/should-i-close-old-credit-card-accounts/].

My Embarrassing Fallout from This Credit Score Misconception

Like, I bragged to my sister about “simplifying” my wallet, only for her to laugh ’cause she’s a banker and knew better. That hit to my ego was worse than the score drop. Anyway, lesson learned: think twice before axing accounts.

Debunking Credit Score Myths: You Gotta Carry a Balance

This one’s sneaky, y’all. I used to leave a little balance on my cards each month, figuring it showed responsibility—ha! Flashback to me in a New York diner last summer, greasy fries in hand, scrolling finance TikToks that pushed this crap. Reality? Carrying a balance racks up interest and doesn’t help your score; paying in full is king. My interest payments added up to hundreds wasted, all while my score stayed meh. Busting this credit score myth freed up cash for better things, like that road trip to the Grand Canyon where the desert heat made me rethink my life choices. For solid advice, peep this from NerdWallet [https://www.nerdwallet.com/article/finance/credit-score-myths].

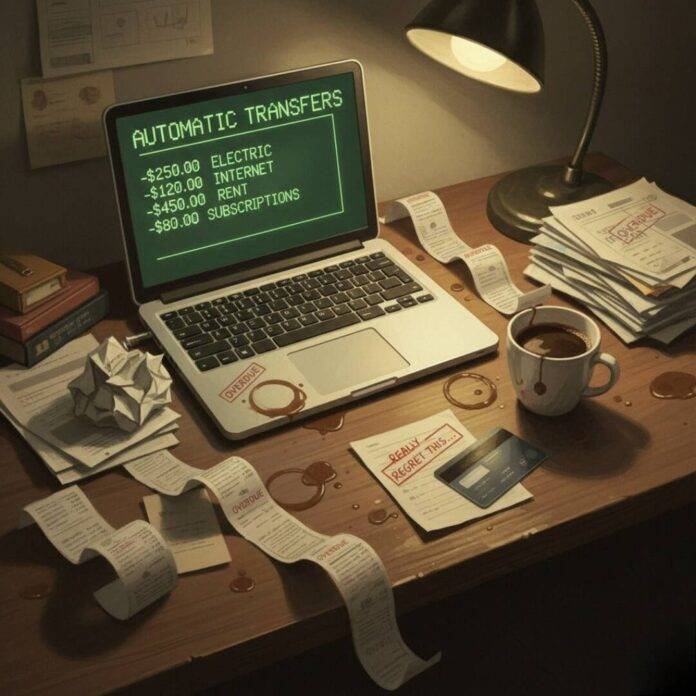

How I Turned This Credit Score Fallacy Around

It took a wake-up call from my bank statement, staring at it over cereal in my kitchen, milk dribbling ’cause I’m a mess. Now I automate payments—game-changer, even if I forget sometimes.

Credit Score Myths That Hit Hard: Income Matters Big Time

Wait, you think your fat salary pumps up your credit score? I did too, back when I landed that decent gig in San Francisco, fog rolling in as I celebrated with overpriced sushi, assuming my pay bump would shine on my report. Nope—credit scores ignore income; it’s all about payment history, utilization, etc. This myth ruined me by making me complacent, ignoring late payments ’cause “I earn enough.” Embarrassing? Totally, especially confessing to my accountant pal. Contradiction: I preach financial smarts but skipped basics. Learn the facts from TransUnion [https://www.transunion.com/blog/credit-advice/what-doesnt-affect-your-credit-scores].

The Real Talk on Busting This Credit Score Myth

In America, where hustle culture’s king, it’s easy to buy in. But my score tanked despite raises—surprising wake-up.

Final Credit Score Myths: All Debt’s Evil

Last one: believing all debt nukes your score. I avoided loans like the plague post-college, scraping by in Austin with that humid heat sticking to my skin, thinking debt-free was holy grail. Truth? Good debt like mortgages builds credit if managed well. I missed out on building history, regretting it when buying my car. This credit score misconception keeps folks stagnant. My take: mix it wisely, but I’m no expert—just a guy who’s tripped up plenty.

Tips from My Messy Journey with Credit Score Myths

- Check your score monthly—free via AnnualCreditReport.com [https://www.annualcreditreport.com/]. I do it now, no fear.

- Pay on time, always. Automated it after too many oops moments.

- Keep utilization under 30%—my rule after that max-out fiasco.

- Dispute errors ASAP; I used the FTC guide [https://www.ftc.gov/business-guidance/resources/disputing-errors-credit-reports-businesses].

Whew, that was a ramble, huh? These credit score myths nearly wrecked me, but sharing my screw-ups feels cathartic, like venting to a friend over tacos. Anyway, if you’re nodding along, hit up your credit report today—don’t wait like I did. What’s one myth that’s bitten you? Drop it in the comments, let’s chat. Stay real out there.