Man, DIY credit repair has been this wild rollercoaster in my life lately, like seriously, I dove headfirst into it last winter when my score tanked after some dumb impulse buys on that online sale—y’know, the kind where you’re scrolling at 2 AM in your freezing Chicago apartment, wrapped in a blanket that smells like yesterday’s pizza, and suddenly you’ve got regrets stacking up faster than the snow outside my window. I’m sitting here right now, staring at the same laptop screen in my cluttered living room, with the hum of the L train rattling by every few minutes, reminding me how real this stuff gets in the US grind. Anyway, I figured I’d spill the beans on whether fixing your credit yourself is actually worth the sweat, based on my own messy attempts. I’ve got scars from it, folks—metaphorical ones, mostly, but hey, that one time I argued with a credit bureau rep on the phone while burning my toast? That left a literal char mark on my counter.

My Epic Fail with DIY Credit Repair

Okay, so picture this: I’m in my tiny kitchen, the one with the flickering fluorescent light that buzzes like an angry bee, trying to pull my free credit reports from AnnualCreditReport.com [https://www.annualcreditreport.com/]. I thought, “Pfft, DIY credit repair? Easy peasy, I’ll just dispute those old medical bills myself.” But nope, I ended up spending hours uploading docs, only to get rejection emails that made no sense. Like, why does the system hate PDFs from my phone scanner app? It was embarrassing—I even vented to my buddy over beers at the local dive bar, admitting how I fat-fingered my social security number once and freaked out about identity theft. Contradiction alert: I started out all gung-ho, thinking it’d save me bucks compared to hiring pros from sites like CreditRepair.com [https://www.creditrepair.com/], but halfway through, I was questioning if my sanity was worth the potential score boost.

That fail taught me a ton, though. I realized self credit improvement isn’t just about firing off disputes; it’s digging into why your score sucks in the first place. Mine? Mix of late payments from forgetting autopay during a job switch—yeah, adulting fail—and some mystery inquiries that turned out to be from a car loan I never took. Raw honesty: I felt like a total idiot, but hey, that’s the American dream, right? Stumbling through financial pitfalls while chugging coffee that’s way too strong.

The Surprising Wins in Fixing Credit Yourself

But wait, it wasn’t all doom. After that initial flop, I buckled down and actually saw my score creep up by 50 points in three months. How? By obsessively checking Credit Karma [https://www.creditkarma.com/] every morning with my cereal—crunchy flakes getting soggy while I refreshed the app. DIY credit repair clicked when I focused on small wins, like negotiating with creditors directly. One time, I called up an old utility company, voice shaking from nerves, and got them to remove a late fee just by explaining my layoff story. It’s empowering, y’know? Like taking control in a system that feels stacked against regular folks like me, sitting here in sweatpants amid the chaos of unpaid bills on my coffee table.

Pros and Cons from My Flawed Lens on DIY Credit Repair

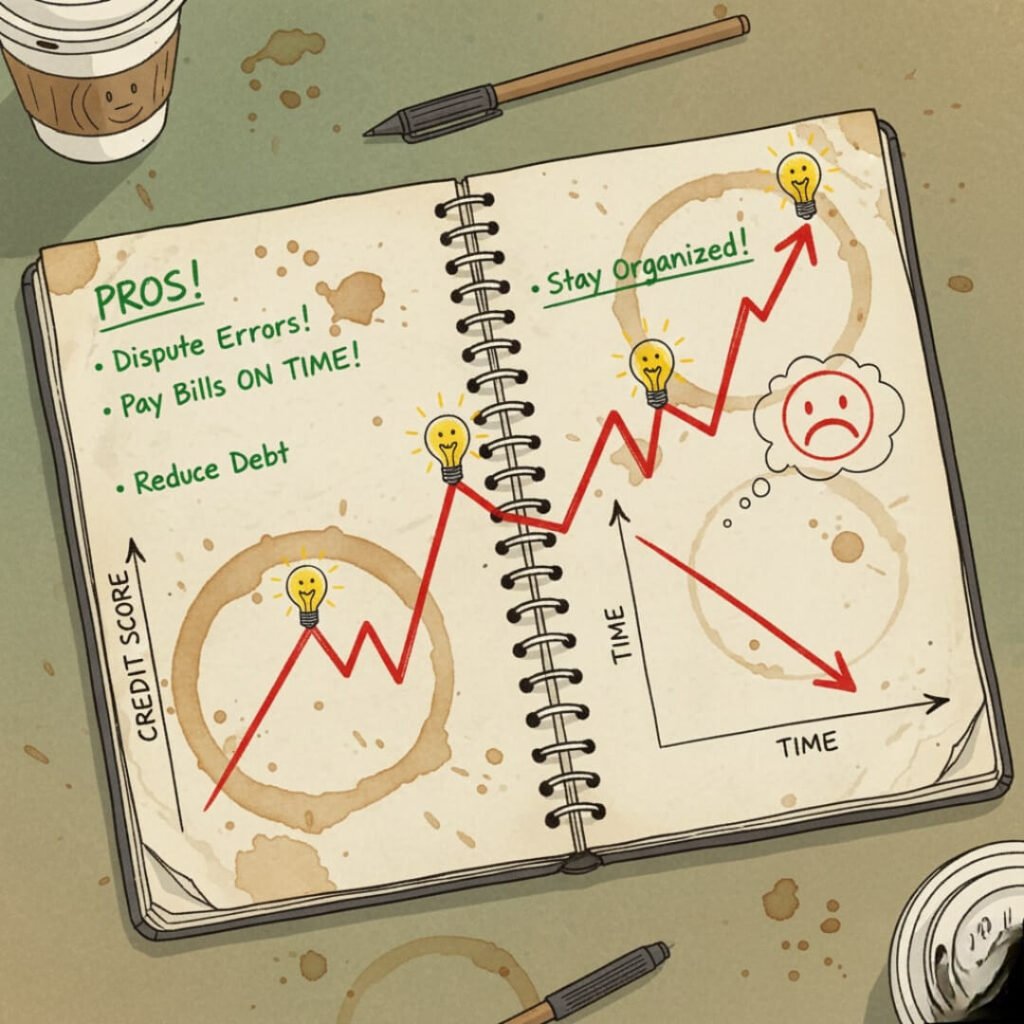

Let’s break it down, ’cause I love a good list when my brain’s fried from staring at FICO scores. Pros first, since I’m trying to stay positive amid the rain pattering on my window right now.

- Cost savings, duh: No shelling out hundreds to services—my wallet thanked me, especially with gas prices skyrocketing in the US lately.

- Learning curve that’s kinda addictive: I geeked out on blogs from NerdWallet [https://www.nerdwallet.com/article/finance/diy-credit-repair], picking up credit repair tips that stuck.

- Flexibility on your terms: Do it from your couch, like I did during a Netflix binge, pausing to file a dispute mid-episode.

Cons? Oh boy, they’re real.

- Time suck: Weeks lost to paperwork, making me miss out on hikes in the nearby park—fresh air I desperately needed.

- Emotional rollercoaster: One day you’re up, next you’re down when disputes fail. I cried—yeah, embarrassing admission—over a denied claim while the microwave dinged my sad frozen dinner.

- Risk of screwing up worse: Like, if you mess up the dispute letter, it could backfire. Happened to me once; score dipped temporarily, and I panicked scrolling forums at 3 AM.

Overall, from my jaded but hopeful view, the pros edge out if you’re patient. But contradictions abound—I still sometimes wish I’d hired help during my busiest months.

Myths Busted in My DIY Credit Repair Saga

People say stuff like “DIY credit repair is a scam” or “It’ll fix everything overnight.” Nah, from my experience, it’s legit but slow. I busted that myth when I waited patiently for Equifax [https://www.equifax.com/personal/credit-report-services/] to update—took 45 days, during which I paced my apartment, dodging laundry piles. Another myth: You need perfect knowledge. Wrong; I started clueless, learning from mistakes like disputing valid debts (oops, that was dumb).

Tips I’ve Learned the Hard Way for DIY Credit Repair

Alright, spilling my guts here with some credit score boost advice, straight from my trial-by-fire.

- Start with your reports: Pull ’em free weekly now, thanks to pandemic rules still in play—check Experian [https://www.experian.com/], too.

- Dispute smartly: Use templates from the FTC site [https://www.ftc.gov/business-guidance/resources/sample-letters-dispute-credit-debit-charges], but personalize ’em. I added my sob story; worked sometimes.

- Track everything obsessively: I used a Google Sheet, updating while sipping tea that stained my mug ring by ring.

- Build good habits parallel: Pay on time, lower utilization—my score jumped when I cut card spending during a no-spend challenge.

- Know when to bail: If it’s overwhelming, pros might be worth it. I almost did after a marathon call session left me hoarse.

These credit repair myths and tips? All from my flawed playbook—take ’em with a grain of salt, since I’m no expert, just a guy fumbling through.

Wrapping Up My Take on DIY Credit Repair

So yeah, is DIY credit repair worth it? From where I’m sitting, with the city lights twinkling outside and my cat knocking over yet another stack of papers, I’d say yes—if you’ve got the grit and time. It’s saved me money, taught me loads, but man, the headaches were real. Contradictory as hell, but that’s life, right? Anyway, if you’re staring down your own credit mess, give it a shot, but don’t beat yourself up if it doesn’t pan out perfectly. Hit me up in the comments with your stories—misery loves company, or whatever. Or, y’know, check your score today and start small; you might surprise yourself like I did.