Man, zero-based spend plan stuff hit me like a truck last month when I was staring at my bank app in this dingy coffee shop in downtown Chicago—rain pounding the windows, that bitter black coffee taste lingering, and me realizing I’d blown through my paycheck on dumb takeout again. Like, seriously? I’m a 32-year-old dude living in the US, supposed to have my act together, but here I am, scrolling through transactions feeling that pit in my stomach, the kind where your palms get sweaty just thinking about rent. Anyway, I dove into this zero-based budgeting thing—wait, zero-based spend plan, same vibe—because my buddy swore it fixed his finances, and honestly, I was desperate. It’s all about assigning every dollar a job before the month starts, no leftovers floating around tempting you. I mean, I tried it, and it was a mess at first, but dang, it works when you stick to it.

What the Heck is a Zero-Based Spend Plan Anyway?

Okay, so picture this: I’m sitting on my lumpy couch in my tiny apartment, the AC humming too loud ’cause it’s that humid Midwest summer, and I’m Googling “how to stop being broke.” That’s when zero-based spend plan popped up—basically, it’s budgeting where income minus expenses equals zero. Every buck gets a category, like rent, groceries, that Netflix sub you forget about. It’s not about starving yourself; it’s making sure your money does what you tell it to. I remember thinking, “This sounds too rigid for my scatterbrained self,” but then I recalled that time I “accidentally” spent $200 on sneakers ’cause they were on sale—yeah, zero-based spend plan forces you to plan that crap out.

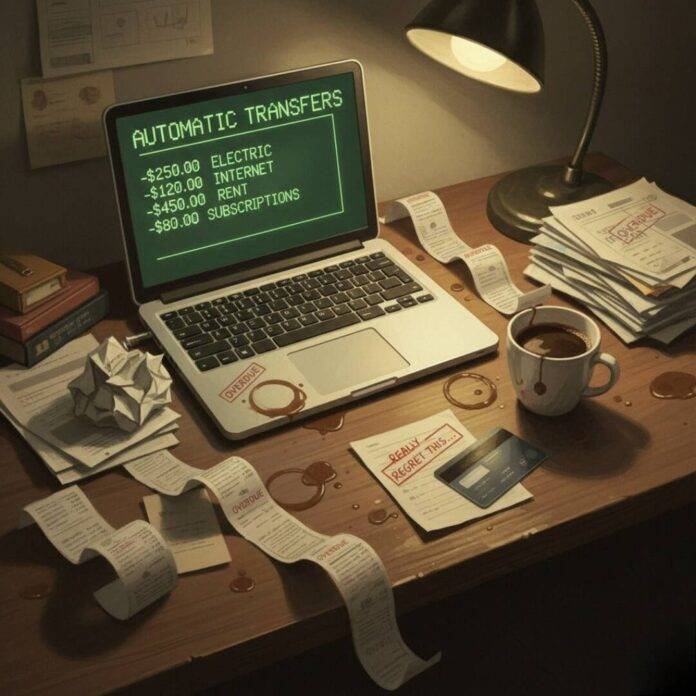

Unlike those fluffy budgets where you guess and hope, zero-based spend plan is zero-sum—your paycheck is the pie, and you slice it all up. I love how it highlights waste; like, I found out I was dumping $50 a month on unused apps. Pro tip from my fails: Track variable stuff like gas prices fluctuating here in the States. For more deets, check out this solid guide from NerdWallet on zero-based budgeting basics—they break it down without the fluff.

Why Zero-Based Spend Plans Beat Other Budgeting Methods for Beginners

Dude, I’ve tried envelope systems—stuffing cash into actual envelopes felt archaic, like something my grandma did during the Depression. But zero-based spend plan? It’s digital-friendly, fits right into apps like YNAB (You Need A Budget), which I downloaded while munching on cold pizza leftovers. It’s flexible for us Americans with weird tax stuff and random bills. Sure, it contradicts my lazy side that wants to wing it, but that’s the point—it reins in the chaos. I mean, 50/30/20 budgeting is cool for basics, but zero-based spend plan digs deeper, making you question every coffee run.

My First Stab at Building a Zero-Based Spend Plan

Alright, confession time: My initial zero-based spend plan was a hot mess. I was at my desk, the one with coffee rings from too many late nights, typing up categories while the neighbor’s dog barked nonstop—typical suburban US noise. Started with income: My freelance gig pays erratic, so I averaged it out, which was my first mistake ’cause one slow week tanked everything. Then expenses: Fixed like $1,200 rent (ouch, city living), variable like groceries where I lowballed at $300 but reality hit $450 ’cause impulse chips. I assigned every dollar, even socked away $50 for “fun”—ha, that vanished quick.

Steps I took, flawed as they were:

- List all income sources—don’t forget side hustles like that Uber shift I did once.

- Tally must-haves: Bills, food, transport—be brutally honest, I underrated my gas guzzling SUV.

- Allocate the rest to savings or debt—mine went to credit card payoff, felt empowering but scary.

- Adjust as you go; life’s unpredictable, like that surprise vet bill for my cat.

I screwed up by not buffering for emergencies, so when my tire blew on the highway—wind whipping, heart racing—I had to reshuffle. Learn from me: Build in a small “oops” fund. For app recs, Mint’s free tool helped me track, though it’s got ads that annoy.

Tools I Used (and Hated) for My Zero-Based Spend Plan

Apps, spreadsheets—I’ve tried ’em all. Google Sheets was my starter, free and simple, but clunky on mobile when I’m out grabbing tacos. YNAB? Game-changer, but the subscription fee made me hesitate—ironic for a budgeting tool. It syncs everything, shows where your zero-based spend plan leaks. Excel’s okay if you’re old-school, but I kept fat-fingering formulas. Anyway, pick what fits your vibe; for me, mixing app and paper notes worked, even if it looked chaotic.

Common Screw-Ups in Zero-Based Spend Plans and How I Fixed Mine

Oh boy, where do I start? Forgetting irregular expenses—bam, car insurance quarterly bill sneaks up, and your zero-based spend plan crumbles. I did that, ended up borrowing from savings, felt like a failure with that knot in my gut. Solution: Annualize ’em, divide by 12, tuck away monthly. Another: Over-optimism on spending— I thought $100 on eating out was fine, but hello, DoorDash addiction. Track for a week first, eyes wide open.

Underestimating fun money leads to rebellion; I cheated my zero-based spend plan with a sneaky bar tab, then felt guilty chugging that overpriced beer. Fix: Be realistic, maybe cut elsewhere. And rigidity—life happens, like friends visiting and you splurge on tickets. Adjust without quitting. Check Dave Ramsey‘s take for tough love—he’s blunt, matches my no-BS mood.

Tweaking Your Zero-Based Spend Plan When Life Throws Curveballs

Inflation hitting hard these days, gas prices yo-yoing—my zero-based spend plan needed monthly reviews. Last week, grocery costs spiked, so I swapped brands, saved $20. Job change? Recalculate income pronto. It’s not set in stone; that’s the beauty and frustration.

Whew, wrapping this up—zero-based spend plan ain’t perfect, and neither am I; still slip up, like that impulse Amazon buy yesterday. But it’s kept me afloat, less stress staring at bills. Give it a whirl, tweak as needed. What’s your biggest money fail? Share in comments, let’s commiserate. Seriously, start your own zero-based spend plan today—it might just save your sanity. Oh, and if you’re deep in debt, peep Credit Karma for free advice. Peace out. Wait, did I mention how my cat knocked over my budget notebook last night? Total chaos, receipts everywhere—figures, right? Anyway, yeah, try it.