Stick to a spend plan without feeling deprived is tough. The author shares a moment from their cramped Brooklyn apartment, where they realized they were spending too much on unnecessary things like late-night online shopping. They reflected on the financial stress caused by inflation in 2025. Through personal mistakes, they learned that a spending plan doesn’t have to mean sacrificing fun. Instead, it can be about finding ways to enjoy life while managing money better. The author claims to be no financial expert, just someone who has made budgeting mistakes.

Why Sticking to a Spend Plan Without Feeling Deprived Felt Impossible at First

Man, back in my early days trying to stick to a spend plan, I was a hot mess. Picture this: I’m at a Target in the suburbs last month, the fluorescent lights buzzing like they’re mocking me, and I grab this random blender because “smoothies will change my life,” right? Total impulse buy, and boom—my spend plan for the week is toast. I felt so deprived afterward, like I was punishing myself for wanting nice things, y’know? But honestly, that contradiction bugs me; why should managing money feel like a straitjacket? I’ve got this lingering guilt from growing up in a Midwest family where “budget” was code for “no vacations ever,” and it seeps into my adult life here in the States. Sticking to a spend plan without feeling deprived means admitting those old habits die hard, but hey, it’s okay to mess up—I’ve done it plenty.

I remember this one embarrassing moment: I was at a food truck festival in Central Park a couple weeks ago, the smell of greasy tacos wafting everywhere, and my spend plan app pinged “over limit.” Instead of bailing, I sulked on a bench, feeling like a kid denied candy. Like, why me? But that raw honesty helped—I realized deprivation comes from rigid rules, not the spend plan itself. So, I tweaked it, allowing small splurges that fit my vibe. Sticking to a spend plan without that deprived vibe? It’s about flexibility, dude.

My Epic Fail with Impulse Buys and How It Shaped My Spend Plan Approach

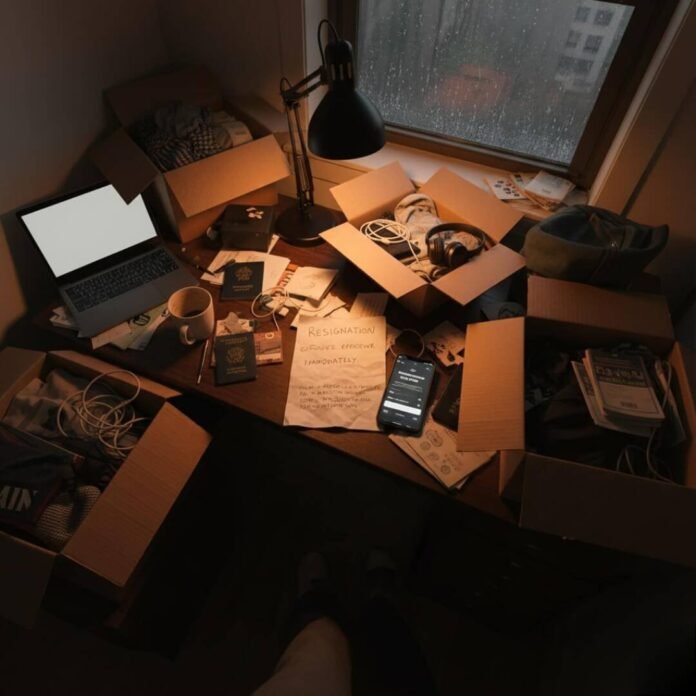

Okay, let’s get real—my biggest fail at Stick to a Spend Plan without feeling deprived was during Prime Day this summer. I’m scrolling on my phone in bed, the AC humming lazily in my stuffy room, and suddenly I’ve carted $200 worth of gadgets I don’t need. Next morning, regret hits like a hangover; I felt so deprived returning half of it, like I was denying my inner shopaholic. But wait, contradiction alert: that spend plan actually saved me from worse debt, y’know? As someone living paycheck to paycheck in this economy, I’ve learned to laugh at my slip-ups—seriously, who hasn’t impulse-bought a weird kitchen tool?

From that mess, I picked up a tip: track sensory triggers. Like, the smell of fresh-baked goods at the mall? That’s my kryptonite for blowing the spend plan. I started noting them in a journal, all scribbly and imperfect, right next to my morning coffee stains. Sticking to a spend plan without feeling deprived means owning those weaknesses—mine include late-night online hauls when I’m bored out of my skull. And hey, for credibility, check out Dave Ramsey’s take on impulse spending—it echoes my chaos but with more polish.

- Admit your triggers: Mine are sales emails at 2 a.m.—delete ’em fast.

- Set a “fun fund” in your Stick to a Spend Plan: $50 a month for guilt-free nonsense.

- Reflect weekly: I do it over cheap diner eggs, jotting what felt depriving vs. empowering.

Hacks That Actually Worked for Me in Sticking to a Spend Plan Without Deprivation

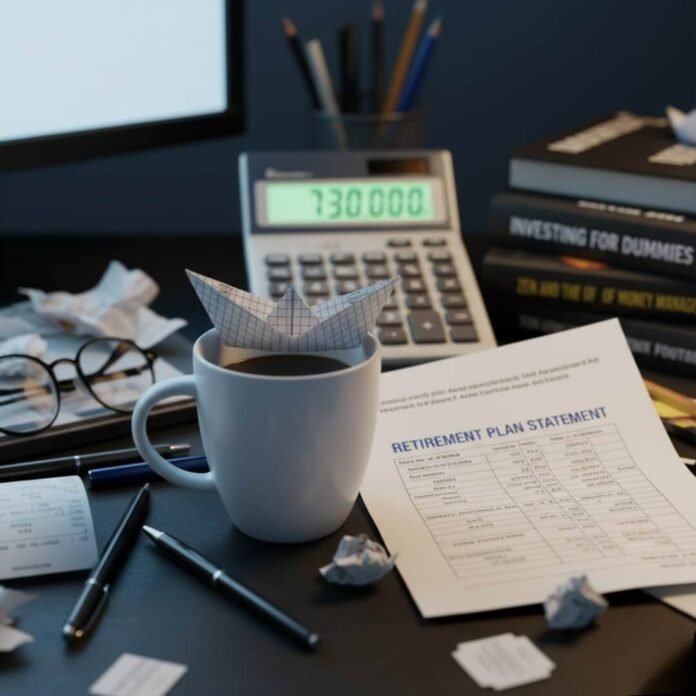

Alright, shifting gears—here’s what clicked for sticking to a spend plan without that deprived funk. First off, I gamified it, like turning my app into a points system where saving extra buys me a treat. Last Tuesday, sitting in a noisy Starbucks with that burnt coffee aroma, I rewarded myself with a fancy latte after nailing my weekly spend plan. Felt empowering, not restrictive, y’know? But honestly, I contradict myself sometimes—I’ll preach this, then overspend on gas station snacks during road trips. As an American dealing with rising costs everywhere, from groceries to gas, it’s a constant juggle.

Another hack: swap-outs. Instead of ditching dining out, I hunt deals on apps—saved $20 last week at a local burger joint in my neighborhood. The surprise? It didn’t feel like skimping; the burger tasted just as juicy. Sticking to a spend plan without feeling deprived is all about those small wins, like finding free park hangs over pricey bars. I’ve messed up plenty, though—once budgeted for “essentials” and ended up with artisanal cheese I didn’t need. Learn from my flops, folks.

For more inspo, peep NerdWallet’s budgeting tools—they’ve got calculators that mirrored my trial-and-error process.

Quick Tips to Hack Your Spend Plan Game

- Prioritize joy: Allocate for hobbies in your Stick to a Spend Plan—mine’s vinyl records, even if it’s quirky.

- Track progress visually: I use sticky notes on my fridge, all colorful and chaotic.

- Forgive slips: One bad day doesn’t wreck sticking to a spend plan without deprivation vibes.

Wrapping Up My Spend Plan Journey—What’s Next for You?

Whew, spilling all this about Stick to a Spend Plan without feeling deprived feels like unloading after a long day—I’m here in my living room now, feet up on the coffee table cluttered with bills, and it hits different. I’ve shared my embarrassing hauls, the contradictions in my head (like wanting luxury but hating debt), and those sensory US moments that make it real. It’s not perfect; I still waver, but that’s the human bit, right? Anyway, the key is treating your spend plan like a flexible friend, not a naggy boss.