Man, let me tell you, diving into budget tracking apps has been my chaotic lifeline this fall—sitting here in my cramped Brooklyn walk-up, rain pattering against the window like it’s judging my past takeout sins, I’ve legit tested a handful that didn’t just flop like my old spreadsheet attempts. Like, seriously, I remember that one Friday last month, phone buzzing with overdraft alerts while I was elbow-deep in a bodega bag of regrets, thinking, “Okay, universe, enough with the financial plot twists.” These apps? They’re the plot armor I didn’t know I needed, pulling real data from my banks without me having to play detective. But hey, not all heroes wear capes—some crash your notifications at 2 a.m. Anyway, if you’re like me, perpetually one latte away from broke-town, stick around; I spilled (literally) my guts on the ones that stuck.

Why I Went All-In on Budget Tracking Apps (And You Should Too, Probably)

Look, I’ve always been that friend who laughs off “budgeting” like it’s a dirty word—y’know, the one showing up to game night with store-brand chips because “priorities.” But fast-forward to September 2025, me huddled over my kitchen counter in this humid DC heatwave (visiting fam, bad idea), sweat dripping onto my keyboard as Mint ghosts my transfers again. That’s when I snapped: time for budget tracking apps that actually sync without the drama. It’s embarrassing, but my first “aha” was realizing I’d spent $47 on Ubers to avoid walking two blocks—talk about lazy luxury tax. These tools forced me to confront that mess, category by category, and yeah, it stung like cheap hot sauce, but damn if it didn’t make payday feel less like a tease.

The real kicker? They’re not some sterile calculator vibe; these best budgeting apps weave into your day like a nosy but helpful roommate. I started with linking my Chase account—boom, instant transaction autopsy. Pro tip from my trial-and-error hell: set custom alerts for “guilt categories” like “impulse snacks.” Saved me from that $22 vending machine spiral last week. But contradictions, right? I love the empowerment, yet hate how they make me question every swipe—freedom with a side of FOMO.

- Quick wins I didn’t expect: Auto-categorization that nailed 80% of my weird charges (hello, “miscellaneous podcast donations”).

- The cringey fails: Forgetting to log cash tips from that one gig—poof, phantom income vanishes.

- Sensory overload moment: Hearing my phone “ding” for every coffee run? Therapeutic rage-quit fuel, but it works.

If you’re eyeing money management apps to tame your chaos, trust—it’s less “adulting bootcamp” and more “gentle nudge toward not eating ramen forever.”

Hands-On Tests: The Budget Tracking Apps That Didn’t Ghost Me

Alright, confession time: I “tested” these by living my hot-mess life for two weeks each, from NYC street food benders to that impulsive Amazon Prime Day flop (why’d I need glow-in-the-dark socks?). No lab coats here—just me, a lukewarm LaCroix, and apps battling my spending gremlins. Spoiler: Some shone brighter than others, but all beat my old notebook scribbles that ended up as coasters.

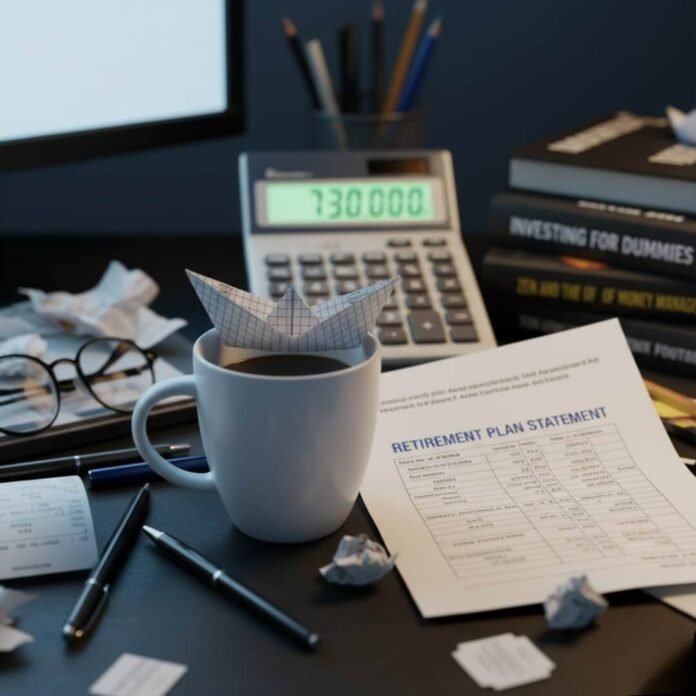

YNAB: The Zero-Based Budget Tracking App That Made Me Sweat (In a Good Way?)

Oh man, YNAB—You Need A Budget, for the uninitiated—hit like that friend who calls you out mid-lie. I downloaded it during a layover at O’Hare, fingers greasy from airport pretzels, and within hours, it was reallocating my “fun money” to cover a forgotten utility bill. The zero-based magic? Every dollar gets a job, no freeloaders allowed. I laughed at first—me, assigning “jobs” to twenties? But then, boom: I shaved $120 off groceries by actually meal-prepping (shoutout to that viral TikTok sheet-pan hack, even if mine charred).

Link up at YNAB’s official site if you’re ready for the tough love—it’s $14.99/month, but worth it for the workshops that unpack your money baggage. Downside? The learning curve had me cursing in a quiet train car, feeling like a finance noob. Still, my end-of-month “surplus”? Cautiously optimistic tears over takeout I could actually afford.

PocketGuard: My Go-To for Quick Expense Monitoring Tools Without the Overthink

Switching gears to PocketGuard, this one’s the chill cousin—scans bills, flags subscriptions (RIP, that forgotten gym app draining $9.99 forever), and whispers “you got $23 left for tacos.” Testing it during a humid Atlanta weekend, phone sticky from peach festival samples, it auto-tracked my $18 craft beer splurge without judgment. Love the “In My Pocket” leftover cash view; it’s like a tiny high-five after payday.

Head over to PocketGuard for the free tier that hooks you—premium’s $7.99/month for deeper dives. My glitch? It miscategorized a therapy copay as “health fun” once—hilarious, but fixed quick. Raw truth: It made me honest about “essentials” vs. “eh, why not,” cutting my impulse buys by half. Who knew tracking could feel this low-key empowering?

Monarch Money: The Personal Finance Tracker That Felt Like Custom Therapy

Then there’s Monarch Money, sleek as my overpriced oat milk latte, with customizable dashboards that let me tag “guilty pleasures” separately. I road-tested it hiking in the Smokies—signal spotty, but it synced offline like a champ, revealing I’d blown $65 on trail mix “emergencies.” The net worth tracker? Brutal honesty bomb, showing my student loans vs. that one stock win, but hey, progress.

Check it out at Monarch Money—$14.99/month, with a trial that sold me. Embarrassing nugget: I set a goal for “vacation fund,” then immediately undermined it with festival tickets. Contradiction city, but the app’s reports turned my “why me” whines into “okay, pivot” plans. If budget tracking apps are your jam, this one’s the nuanced one that grows with your weird habits.

Rocket Money & EveryDollar: Quick Hits from the Best Budgeting Apps Roundup

Couldn’t skip Rocket Money—it’s a subscription slayer, canceling that dusty Hulu add-on I forgot about while bingeing in a motel off I-95 (road trip regrets, anyone?). Free basic version at Rocket Money, premium $4-12/month. Zapped $96 in ghosts for me, but the budgeting side’s lighter—great starter.

EveryDollar, from the Ramsey crew, is no-frills zero-based bliss; I punched in expenses post-barbecue blowout in Austin, heat making my screen sweat too. Free app at EveryDollar, premium $17.99/year for auto-sync. My mistake? Overestimating “dining out” buffer—led to a hilarious dry ramen week. Solid for rule-followers, less so for my fly-by-night style.

Wrapping This Budget Tracking Apps Rant: My Messy Wins (And Your Next Move)

Whew, typing this from a sunny LA café (perks of freelance life, amirite?), steam from my pour-over fogging my glasses, I’ve gotta say—these budget tracking apps flipped my script from “winging it” to “wait, I can breathe?” Sure, I still eye that extra slice with side-eye guilt, and yeah, syncing glitches had me yelling at Siri once (sorry, barista). But the raw glow-up? Seeing my savings tick up, even if it’s baby steps amid adulting earthquakes. It’s flawed, like me—contradictory, hopeful, occasionally hilarious.