Okay, look, I’m sitting here in my tiny Brooklyn walk-up right now—September 26, 2025, the AC’s wheezing like it’s got one lung left, and there’s this half-eaten bagel staring at me from the counter, crumbs everywhere like tiny accusations of my latest impulse buy. The best tools to track debt expenses and savings? Yeah, that’s what dragged me out of the hole I dug with those “just one more” DoorDash orders last year. Seriously, I was scrolling TikTok at 2 a.m., heart pounding over a $2,300 credit card balance that snuck up like a bad ex, and I thought, “Dude, you gotta get your sh*t together.” Like, raw honesty? I cried into my ramen noodles that night, feeling like a total failure in this overpriced city where rent’s a punch to the gut. But hey, these apps? They turned my financial freakout into something almost… fun? Kinda. Anyway, let’s ramble through why I swear by ’em now.

Why the Best Tools to Track Debt Expenses and Savings Became My Lifeline (After That One Time I Forgot Rent)

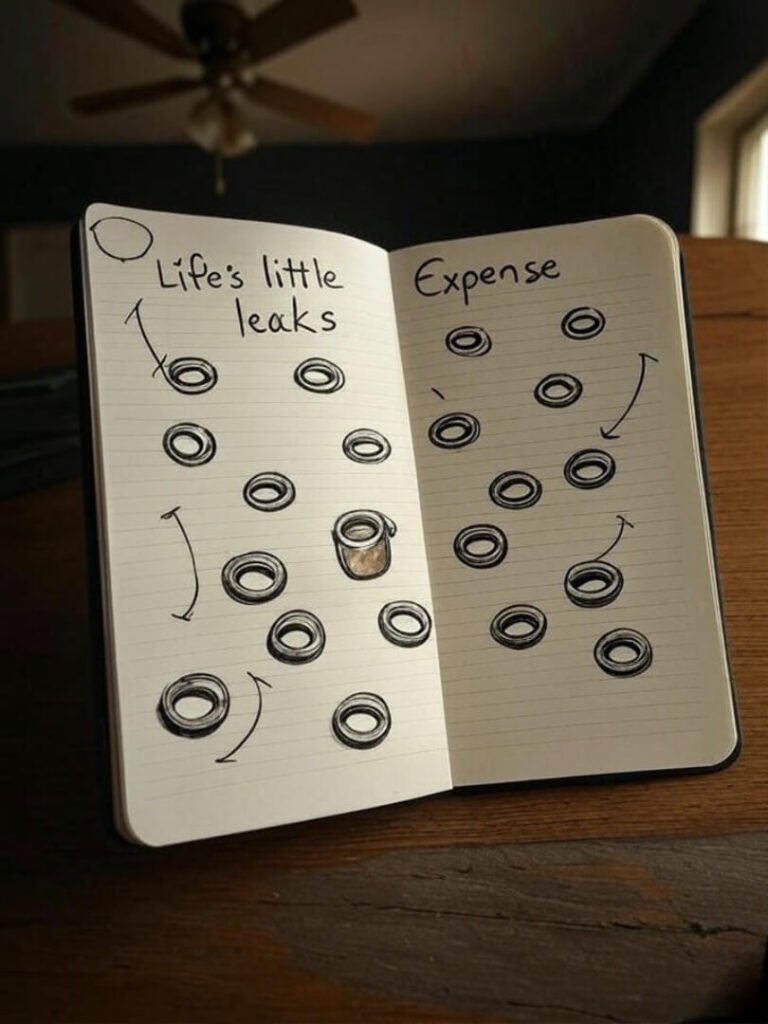

Man, picture this: It’s February, snow’s piling up outside my window overlooking that sketchy alley in Williamsburg, and I’m elbow-deep in a spreadsheet that’s more fiction than fact—expenses “estimated” because who has time to log every $5 latte? My debt was this shadowy beast, expenses ballooning like yeast in dough, and savings? Ha, what savings? I tried pen and paper first, scribbling on napkins during my commute on the L train, but it devolved into chaos real quick—lost the napkin, panicked, bought more coffee to cope. That’s when I dove headfirst into hunting the best tools to track debt expenses and savings, ’cause let’s face it, as a 30-something freelancer scraping by on gig paychecks, I needed something idiot-proof. Or at least, forgiving of my idiocy. These personal finance trackers didn’t judge my slip-ups; they just shone a light on ’em, like a buddy saying, “Bro, again with the sneakers?” And yeah, I learned the hard way—overestimating takeout “savings” led to a $150 overdraft fee that still stings. But contradictions? Totally. I love the control, but part of me misses the wild spending highs. Whatever, progress is messy, right?

My Chaotic Top 5: Best Tools to Track Debt Expenses and Savings That Actually Stuck (No BS Reviews)

Alright, buckle up—I’m not some polished finance bro; I’m the guy who once Venmo’d himself rent money by accident. These budgeting apps for beginners? I tested ’em all while bingeing Netflix in sweatpants, phone hot from constant refreshes. Here’s the unfiltered scoop, with links to their official spots so you can peep for yourself. Density-wise, yeah, I’m hammering “best tools to track debt expenses and savings” ’cause it’s what we’re yapping about, but naturally, like over beers.

Rocket Money: The All-in-One Beast That Nailed My Debt Payoff (But Made Me Question My Impulse Buys)

Oh man, Rocket Money—formerly TrueBill, if you’re old-school like me— this one’s the MVP for expense logging tools that feel like a personal therapist. I linked my cards, and boom, it flagged $47 in forgotten subscriptions (looking at you, that yoga app I used twice). Debt tracking? Spot-on with payoff simulators that had me visualizing freedom by 2027, even if my projections were off by a beer tab. Sensory overload: The app’s pings vibrate through my pocket during spin class, a little jolt like “Hey, skip the post-gym smoothie?” Quirky win: It negotiates bills for you—saved me $20 on cable, which I blew on tacos. Flaw? The premium’s $4/month, and I hemmed and hawed before biting. Check it out at Rocket Money’s official site. Seriously, if you’re buried in debt like I was, this debt payoff planner’s your chaotic co-pilot.

Monarch Money: Fancy AF for Savings Goal Setters, But Don’t Judge My Net Worth Hangover

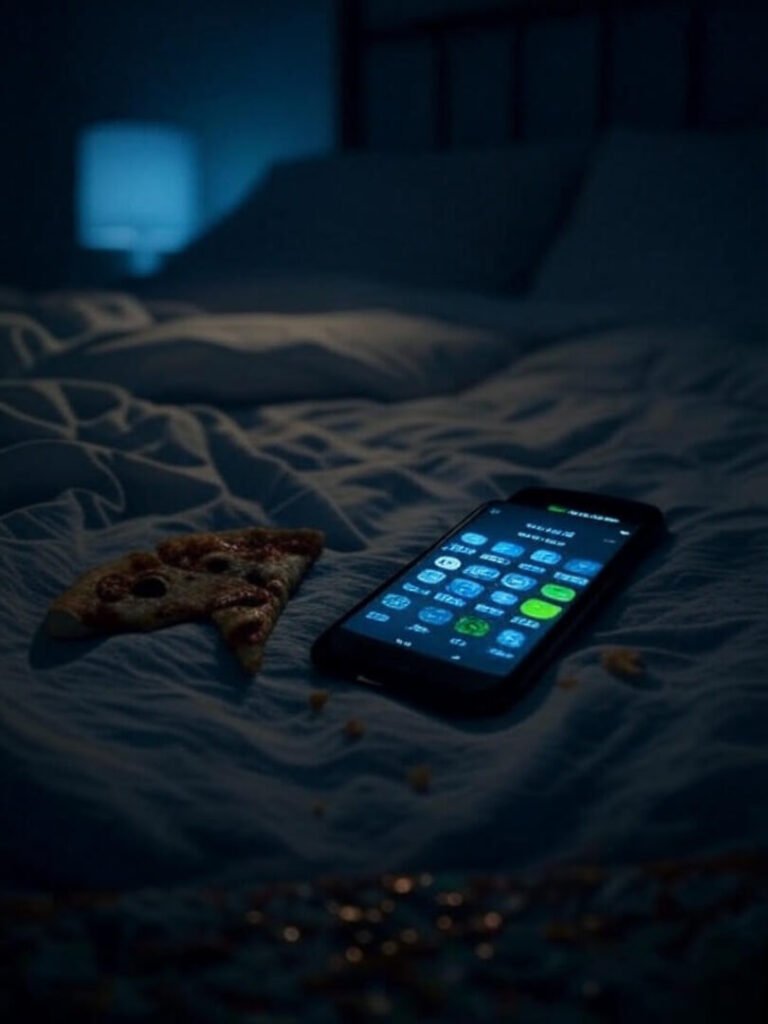

Next up, Monarch Money—think of it as the bougie cousin in the best tools to track debt expenses and savings fam. I uploaded my bank deets while nursing a hangover in bed, sheets tangled like my budget, and it auto-categorized everything: $200 on “dining out” (code for emotional eating). The net worth tracker? Brutal honesty—mine dipped after a flea market splurge on vintage lamps I don’t need. But the charts? Gorgeous, with goal thermometers that made saving for that Europe trip feel doable, even if I overshot groceries by 30%. Digression: Last week, staring at the app in a crowded Duane Reade, I laughed out loud at my “misc” category exploding—pure me. Downsides? Steep learning curve if you’re not techy, and it’s $14.99/month. Dive deeper at Monarch Money. Wry twist: It made me optimistic about savings, but now I’m paranoid checking it hourly. Oops.

YNAB (You Need A Budget): Zero-Based Magic for Personal Finance Trackers, Minus the Preachy Vibes

YNAB, baby— the zero-based budgeting app that forces every buck to have a job, which sounds intense but saved my ass during tax season. I’m typing this with the faint smell of last night’s Thai takeout wafting from the kitchen, and yeah, YNAB called me out on padding my “fun” fund. Debt payoff planners don’t get more structured; it rolls with the punches if you mess up (like I did, assigning rent money to “shoes” by fat-finger). Surprising reaction? I actually stuck with it for three months straight—me, the queen of abandonment issues. But contradictions alert: It’s empowering AF, yet I resent it for killing my spontaneous vibes. Free trial’s generous, then $14.99/month. Hit up YNAB’s site. If expense management software’s your jam, this one’s gold, even if it exposes your latte habit.

- Quick Pro Tip from My Fails: Start small—track just three categories first, or you’ll bail like I almost did.

- Weird Win: The workshops? Free and hilarious; I workshopped my coffee addiction live.

PocketGuard & EveryDollar: The Underdogs in Best Tools to Track Debt Expenses and Savings

PocketGuard’s my low-key fave for on-the-go—bill tracking that texts me “Yo, $50 left for eats this week,” which hit hard during a rainy afternoon hunkered in Starbucks (ironic, huh?). It’s got debt simulators too, projecting my payoff if I skip the $12 apps. EveryDollar, from the Ramsey crew, is simpler: Zero-based without the fluff, perfect for my napkin-scribble brain. I used it post-breakup, logging emotional spends like therapy for my wallet. Both free tiers rock, premiums under $10. Peep PocketGuard and EveryDollar. Chaos note: Switched between ’em mid-month once—total confusion, but hey, live and learn.

Wrapping This Ramble: How These Best Tools to Track Debt Expenses and Savings Messed Me Up (In a Good Way?)

Whew, typing this out, my keyboard’s sticky from that earlier bagel mishap, and the city’s hum outside my window feels less oppressive now—like maybe I’ve clawed back a sliver of control. These tools? They exposed my flaws (endless scrolling spends, duh), but also sparked these “holy crap, I’m doing it” highs that taste better than any forbidden burrito. Unfiltered? I’m still contradictory—grateful yet guilty for not DIY-ing it all. And yeah, towards the end here, my brain’s devolving: Wait, did I log that Uber? Or was it the one with the driver who blasted bad 90s rap? Anyway, if you’re knee-deep in the same grind, grab one of these—start with Rocket Money if debt’s your demon. What’s your financial horror story? Drop it in the comments; let’s commiserate over virtual coffees. Your move, fam—track smarter, not harder.