I remember sitting here in my tiny Chicago apartment last night, rain pattering against the window like it’s mocking my bills, deciding to finally refinance student loans without hurting credit because, dude, those interest rates were eating me alive. Like, I’d just grabbed a greasy slice from the corner joint—deep dish, obviously, since I’m in the Windy City—and I’m scrolling through my statements, heart pounding from the caffeine and the numbers staring back. Seriously, why did no one tell me in college that this debt monster would follow me into my 30s? Anyway, I’ve been through the wringer with this, made some dumb moves that dinged my score a tad before I figured it out, and now I’m spilling it all because if I can help you avoid my pitfalls, that’s a win.

Why I Decided to Refinance Student Loans Without Hurting Credit in the First Place

Okay, so picture this: I’m lounging on my worn-out couch, the one with the mystery stain from last week’s takeout spill, and I’m staring at my phone where my credit app shows this decent score I’ve been babying. But my student loans? They’re from like a decade ago, high-interest federal and private mishmash that felt like chains. I wanted lower payments without tanking that score I’d built up after some rough patches—like that time I maxed cards on a cross-country move that went sideways. Refinancing student loans without hurting credit seemed like a no-brainer, but honestly, I waffled for months because I heard horror stories about hard inquiries dropping scores by 20 points. Turns out, it’s doable if you’re smart about it, and yeah, I learned that the hard way after applying willy-nilly to a few lenders.

What pushed me over the edge was chatting with my buddy over beers at this dive bar downtown—neon lights flickering, sticky floors underfoot—and he bragged about slashing his rates. Made me jealous, but also fired up. So, if you’re in that boat, weighing the pros like better terms against the fear of credit dips, know that refinancing student loans without hurting credit can actually boost your financial vibe long-term. Just don’t rush like I did initially.

My Step-by-Step Mess on How to Refinance Student Loans Without Hurting Credit

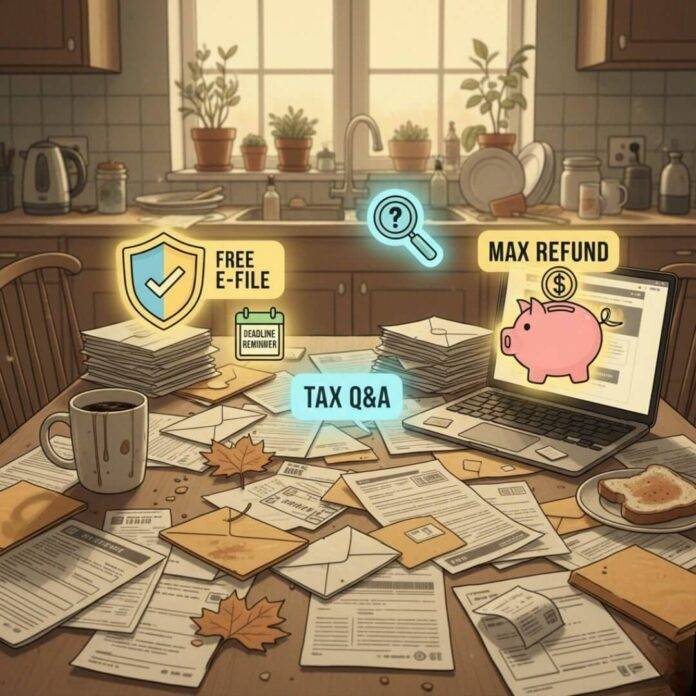

First off, check your credit score for free— I use sites like Credit Karma because it’s quick and doesn’t hit your report. Mine was hovering around 720, which ain’t bad, but I panicked when I saw it dip after my first app. Lesson one: prequalify, folks. Most lenders like SoFi or Earnest let you do a soft pull that doesn’t affect your score. I skipped that once, applied hard to three places in a week, and boom, inquiries piled up like dirty laundry.

Next, shop around for rates. I compared on NerdWallet, which has these handy calculators—saved me from blindly picking the first shiny offer. Gather your docs: pay stubs, loan statements, ID. I remember fumbling through my junk drawer at 2 a.m., papers everywhere, cursing under my breath. Then, apply strategically—space ’em out if needed. And if you’re federal, think twice; refinancing to private loses perks like forgiveness, which I almost regretted but didn’t qualify anyway.

- Prequalify with multiple lenders to see rates without dings.

- Calculate your debt-to-income—mine was iffy after a freelance dry spell.

- Choose fixed or variable? I went fixed for peace of mind, even if variable tempted with lower starts.

- Submit and wait; my approval came with a slight temp drop, but it rebounded in a month.

Honestly, the waiting sucked—nerves frayed, checking email every five minutes like a addict.

The Dumb Mistakes I Made While Trying to Refinance Student Loans Without Hurting Credit

Oh man, where do I start? I ignored the fine print on one lender’s site, thinking all refinances were the same. Nope, some bundle fees that jack up costs. My credit took a small hit because I didn’t know inquiries stay on your report for two years, even if temporary. Like, I applied during a busy month when my utilization was high from holiday spending—bad timing, self. And get this, I forgot to freeze my credit after a data breach scare, so extra paranoia there.

Another flop: not boosting my score first. I could’ve paid down a card or two, but nah, impatient me jumped in. Surprisingly, though, once approved, my new lower payments actually helped my score over time by improving utilization. Contradictory, right? Refinancing student loans without hurting credit long-term is the goal, but short-term blips happen. Learn from my chaos—do your homework on Experian for real talk on impacts.

Surprising Wins from Refinancing Student Loans Without Hurting Credit

Despite my screw-ups, the payoff was huge. My monthly hit dropped $150, freeing cash for actual life stuff—like that spontaneous road trip to the lakes last summer, windows down, wind whipping my hair, feeling free for once. Credit-wise, after the initial dip, it climbed because consistent payments shine. I even got a better rate than expected, around 4%, which felt like winning the lottery after years at 7%.

But here’s the raw truth: it wasn’t all roses. I missed federal protections, and when rates dipped later, I kicked myself for not waiting. Still, for private loans especially, refinancing student loans without hurting credit transformed my budget. If you’re buried like I was, it might for you too—just be real about your situation.

Wrapping Up My Rant on Refinancing Student Loans Without Hurting Credit

Anyway, that’s my take, flaws and all, from this coffee-fueled spot in my living room where the AC is humming too loud. Refinancing student loans without hurting credit isn’t magic, but with prequals and patience, it’s doable without major drama. I mean, my score’s better now than before, go figure. If anything, sharing this makes me feel less like a financial flop.

Hey, if you’re ready, hit up Federal Student Aid to simulate options or chat with a advisor. What’s your story—drop it in comments if you want, or nah, your call.