Man, taking out a personal loan this year was like this total rollercoaster for me, you know? I’m sitting here in my tiny Brooklyn apartment, the kind where the radiator hisses like it’s judging you, staring at my bank app on this rainy September afternoon in 2025, and I’m thinking back to how I almost screwed it all up last spring. Like, I needed cash quick for this dumb vet bill when my cat decided to eat a sock—seriously, why do they do that?—and I jumped into a personal loan without really getting the deets. It was embarrassing, me pacing around with coffee breath, muttering to myself about interest rates while my neighbor’s dog barked nonstop. Anyway, here’s my unfiltered spill on what to know before taking out a personal loan this year, straight from my flawed American ass.

My Epic Fail with Interest Rates When Taking Out a Personal Loan This Year

Interest rates on personal loans in 2025 vary widely, ranging from 6. 74% for those with excellent credit to as high as 36% for those with poor scores. The average rate is between 8-18%, and inflation can push these rates higher. It’s important to check your credit score before applying, as a lower score can lead to much higher rates, resulting in painful monthly payments. Shopping around for better rates can save significant money.

From my experience, if you’re taking out a personal loan this year for stuff like debt consolidation, aim for fixed rates to avoid surprises. I once went variable thinking it’d drop, but nope, it ticked up and I was scrambling, eating ramen for a week straight—embarrassing, right? Like, the smell of cheap noodles still haunts my microwave. Anyway, Wells Fargo’s got some as low as 6.74% APR for good credit folks, but LendingClub goes up to 35.99% if you’re riskier. Don’t be me; calculate that total cost with an online tool before signing.

Credit Score Drama Before Taking Out a Personal Loan This Year

Dude, your credit score is like the bouncer at the personal loan club—if it’s under 580, you might get turned away or slapped with crazy fees. I learned this the hard way last year when I applied impulsively; my score dipped temporarily from the hard inquiry, and I was sitting on my worn-out couch in this humid East Coast heatwave, sweating not just from the weather but from rejection emails. Experian says you need at least a fair score, around 580-669, but for better terms, shoot for 700+. Like, I boosted mine by paying off a small card balance—nothing fancy, just chipping away while binge-watching shows to distract from the anxiety.

Taking out a personal loan this year? Prequalify first to avoid dings on your report. I didn’t, and it felt like a self-inflicted wound, you know? Contradiction alert: I tell everyone to build credit slowly, but there I was, rushing in like an idiot. Oh, and income matters too—lenders want proof you make enough, say at least $25k a year, but I scraped by on freelance gigs and still got one after begging a bit. Embarrassing confession: I once listed my side hustle selling old comics online as “stable income”—cringe.

Shopping Around for Lenders When Taking Out a Personal Loan This Year

Don’t just grab the first personal loan offer that pops up, folks—compare like your wallet depends on it, because it does. I’m here in the US, dealing with this wild economy where rates fluctuate weekly, and I wish I’d known to check credit unions too; they’re often cheaper than big banks. Like, Navy Federal has rates from 8.99% to 18%, way better than some online lenders. My story? I went with a flashy app lender first, seduced by no-fee promises, but hidden origination fees ate 5% of my loan—boom, $500 gone while I was munching on takeout I couldn’t afford.

Tips from my mess-ups: Look at APR, not just interest, because it includes fees. Secured vs. unsecured? I went unsecured since I had no collateral, but if you do, rates drop. And shop around—U.S. Bank suggests prequalifying without impact. I compared five lenders, pacing my apartment with the AC blasting, and saved 2% on rates. Seriously, do it.

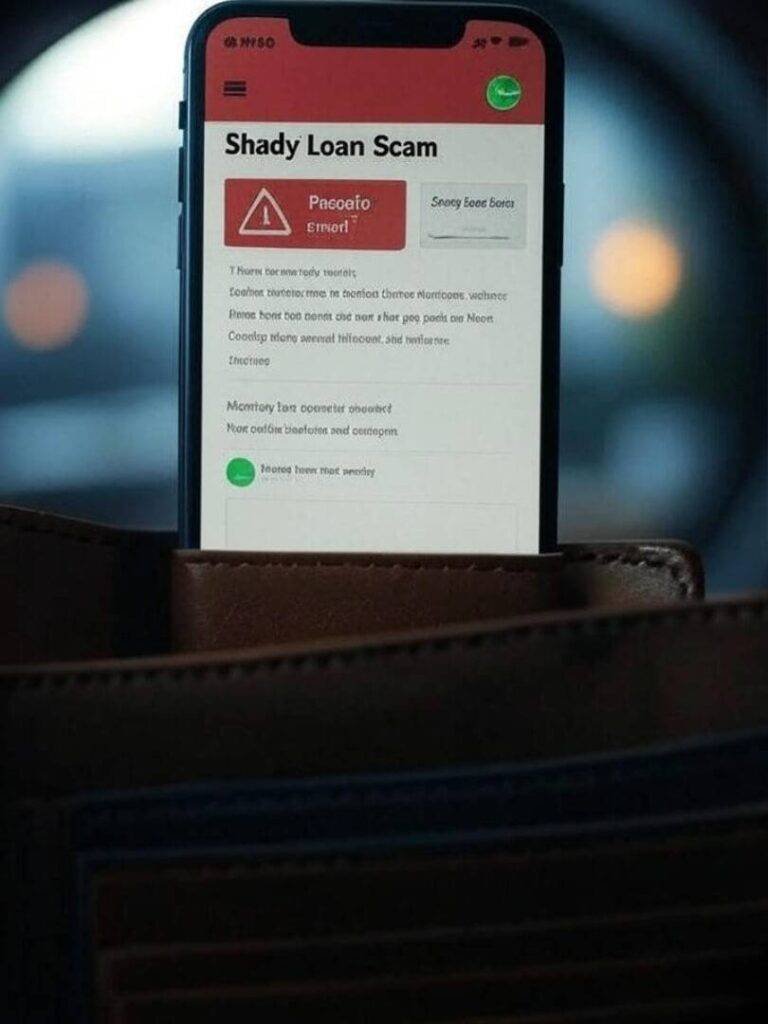

Watch Out for Scams While Taking Out a Personal Loan This Year

Oh man, scams are everywhere in 2025—Equifax warns about lenders guaranteeing approval without checks or demanding upfront money. I almost fell for one; got this sketchy email promising instant cash, and I clicked while half-asleep on my lumpy bed, heart racing like I’d won the lottery. Thank god I double-checked—turned out it was phishing. Like, my palms were sweaty just thinking about losing my info.

When taking out a personal loan this year, stick to legit spots like Credit Karma or direct bank sites. Red flags? Upfront fees, pressure to act fast. I now verify with the Better Business Bureau, something I learned after that near-miss that left me paranoid, checking my accounts obsessively. Contradiction: I preach caution but still get tempted by “easy” offers—human, right?

Repayment Terms and Long-Term Vibes for Taking Out a Personal Loan This Year

Long-term personal loans, like 5-10 years, sound chill with lower monthly payments, but total interest kills you—National Debt Relief says higher costs overall. I took a 3-year one and it was tight, but better than dragging it out. Sitting here with my morning joe, steam fogging my glasses, I recall budgeting apps helping me track—missed one payment once, fees piled on, embarrassing call from the lender while at a BBQ.

Advice: Know your terms, use for essentials like medical bills, not impulse buys. I consolidated debt and it helped, but surprised how discipline it took—contradictory, since I’m lazy with finances sometimes.

Anyway, wrapping this up like our chat’s running long—taking out a personal loan this year can be a lifesaver if done right, but learn from my goofs, okay? Check everything twice, boost that credit, and compare til your eyes cross. If you’re eyeing one, maybe start by prequalifying on Bankrate or Experian—saved my bacon. What’s your take? Hit me up if you got stories. Seriously, don’t rush it like I did, or you’ll end up with regrets and extra interets—wait, interest, ha, typos happen when I’m ranting. Anyway, chaos ensues if you ignore the fine print, like my budget exploding last month over a miscalcuated payment, rambling now but yeah, be smart out there.