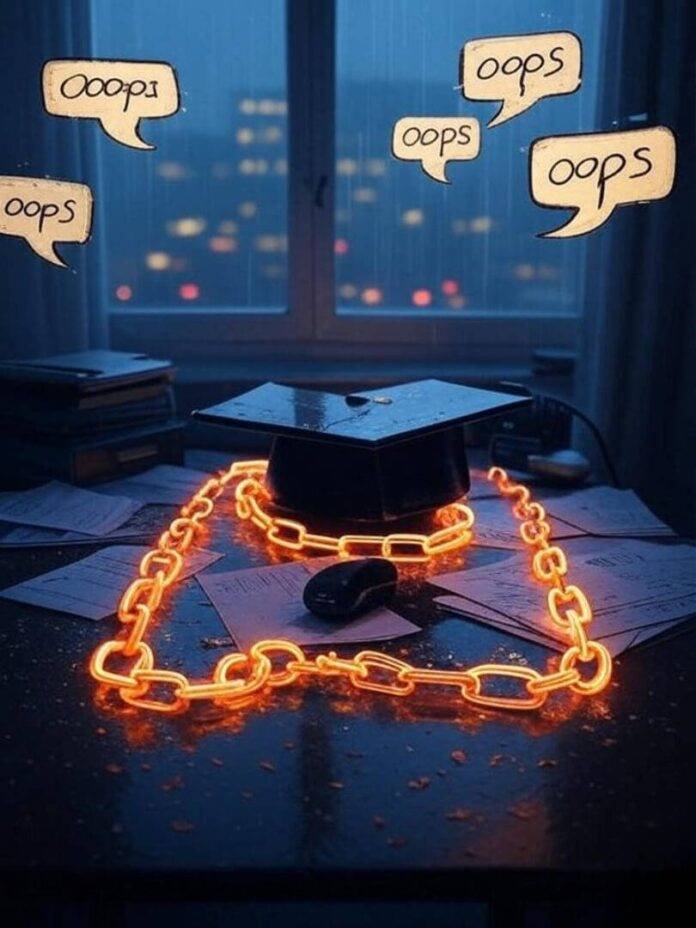

Rebuild a Bad Credit Score takes time and effort, not a quick fix. The writer shares their personal experience of damaging their credit score in 2022 due to impulsive spending during a breakup, which led to a low FICO score in the 500s. Now, after about 18 months of inconsistent work, they have managed to raise their score to around 680. They highlight that the process of credit repair is not straightforward, with ups and downs along the way, including periods of diligent bill payments followed by forgetfulness.

I remember this one embarrassing afternoon last summer, sprawled on my beat-up couch with the fan blasting because Georgia heat is no joke, when I finally pulled my full credit report from AnnualCreditReport.com. The thing was littered with late payments from that freelance gig drought—sensory overload with all those red flags staring back, making my stomach churn like bad gas station food. Anyway, I learned the hard way that rebuilding bad credit involves disputing errors first, which shaved off a couple months for me, but only after I messed up the forms twice and had to resubmit. Contradiction alert: I preach patience now, but back then? I was all “why isn’t this faster?” while munching on chips, crumbs everywhere, ignoring the irony.

Digging Into the Timeline: Factors That Mess With How Long It Takes to Rebuild a Bad Credit Score

So, breaking it down like I’m chatting with you over burgers—factors, right? Payment history is king, accounting for 35% of your score according to Experian, and mine was trash from those missed rent payments during a job switch. It took six months just to see a bump after going auto-pay on everything, but only because I mixed in credit utilization tweaks, keeping cards under 30%—easier said than done when you’re craving that new gadget. Then there’s the age of accounts; closing old cards? Big no-no, I did that once and regretted it instantly, watching my score dip like a bad stock.

- Late payments can haunt you for up to seven years, but their impact fades over time—mine started softening after year one.

- Bankruptcies? Those stick around for 7-10 years, thank god I dodged that bullet.

- Hard inquiries drop off after two years, but I racked up a few from rate-shopping, which slowed my credit rebuilding tips in action.

Weird contradiction: I thought more credit would help, so I applied for a secured card from Capital One, which did boost things, but the initial ding made me second-guess everything. Like, was it worth the temporary hit? Yeah, eventually, but man, the anxiety.

My Go-To Tips: Speeding Up How Long It Takes to Rebuild a Bad Credit Score Without Losing Your Mind

Alright, tips from my flawed playbook—first off, get on top of monitoring with free tools like Credit Karma, which I check obsessively now, even during lunch breaks at my desk job, where the keyboard’s sticky from spilled soda. I set reminders on my phone, but half the time I’d snooze ’em, leading to mini-slips that extended my bad credit recovery by weeks. Pro tip: become an authorized user on a family member’s good card—my sister’s helped me piggyback, but it felt kinda cheating, ya know? Embarrassing to ask at 32, but it shaved months off.

Another gem: pay down debt aggressively. I used the snowball method, tackling small balances first for quick wins, feeling that rush like scoring in a video game, but then I’d splurge on dumb stuff and backslide. Seriously, balance transfers saved my butt once, moving high-interest crap to a 0% promo card from Chase, but watch those fees—they bit me hard. And don’t forget building positive history; I got a credit-builder loan from Self, paying myself back essentially, which felt weirdly therapeutic.

Common Pitfalls: What Stretched Out My Time to Rebuild a Bad Credit Score

Pitfalls? Oh boy, where do I start? Ignoring small debts—had a $50 medical bill go to collections, and bam, it tanked progress for three months while I disputed it via CFPB. I was in denial, munching takeout in my living room, Netflix blaring, thinking it’d vanish. Nope. Also, applying for too much credit at once; did that during a car hunt, and inquiries piled up, making lenders side-eye me.

- Avoid closing accounts prematurely—it shortens your credit history.

- Don’t max out cards; I did post-holidays once, score dropped 50 points overnight.

- Watch for scams; almost fell for a shady credit repair service promising quick fixes.

Contradiction: I know consistency is key for improving FICO score, but life’s chaotic—job stress, family drama—and I’d lapse, then beat myself up. Human stuff, right?

Wrapping This Up: Your Turn on How Long It Takes to Rebuild a Bad Credit Score

Man, reflecting on how long it takes to rebuild a bad credit score from my spot here, with the sun setting over the city skyline and my cat knocking over my water glass—again—it’s a marathon with detours, but doable if you’re real with yourself. My journey’s full of slip-ups, but those taught me more than any perfect plan. If you’re in the dumps like I was, start small, track progress, and forgive the mess-ups. Anyway, what’s your credit story? Hit up the comments or check your score today—might surprise ya. Seriously, give it a shot; what’s the worst that happens?