Credit card denial is the worst, y’all. I’m typing this in my tiny-ass Jersey City apartment, where the radiator’s clanking like it’s got beef with me, and I’m still cringing about that time I got rejected. It was last fall, right after I moved here, thinking I was hot stuff with my new gig and my $6 oat milk lattes. I applied for this fancy Amex card—thought I’d be racking up points for a trip to see my folks in Michigan. Nope! Denied. The email landed like a punch, and I swear I could smell my own flop sweat through my hoodie.

I was at this grungy bar on Newark Ave, the kind with sticky floors and a jukebox that only plays Springsteen. My phone buzzed, and I checked it, half-drunk on a $3 PBR, hoping for good news. Instead, I got a big fat credit card rejection. I felt like such a loser, especially since I’d been hyping myself up to my bestie about “building my credit” like I knew what I was doing. Anyway, here’s the tea on what I learned after that credit card denial kicked my butt, and how you can deal if it happens to you.

Why’d They Say No to My Credit Card?

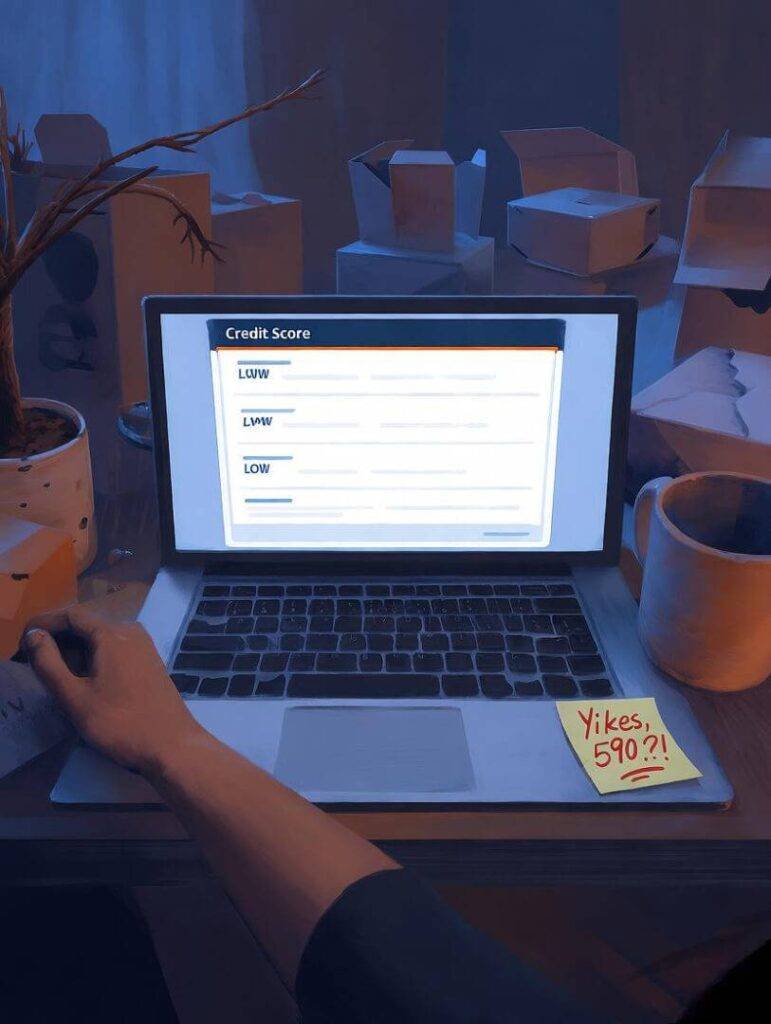

Okay, first thing: you gotta figure out why you got that credit card denial. I didn’t do this right away—I just moped and ate way too many bodega empanadas. But then I actually read the stupid letter (don’t just yeet it to the trash). Most banks, like Amex or Citi, send you a notice explaining the denial. Mine said my credit score was trash—low 600s, oof—and something about “limited credit history.” Like, what even?

Here’s what I found out after some late-night scrolling:

- Crappy Credit Score: If your score’s under 600, good luck getting a decent card. You can check yours free on Credit Karma. Mine was a sad 590.

- No Credit History: This was me. I had, like, one student loan and nothing else. Apparently, that’s not enough for banks to trust you.

- Too Much Debt: If you’re buried in loans or rent (hello, Jersey rent prices), banks get nervous.

- Applying Like Crazy: Applying for a bunch of cards at once? Yeah, that screams “desperate” to lenders.

What I Did After the Credit Card Rejection (It Wasn’t Pretty)

So, I got denied. Big deal, right? I wasn’t about to let some bank ruin my whole vibe. Here’s how I clawed my way out of the credit card denial pit, with a few faceplants along the way.

Don’t Take It Like a Personal Attack

Real talk: a credit card denial feels like getting ghosted after a first date. I was legit embarrassed, like I’d flunked adulthood. I was sitting in that bar, staring at my phone, feeling like everyone could tell I was a credit failure. But it’s not personal—it’s just numbers. I called Amex (number was on the rejection email) and asked what’s up. They said my credit file was “too thin,” which sounds like a bad Tinder bio but means I needed more accounts. Be nice when you call—they’ll spill more tea than the email.

Snoop Through Your Credit Report

I pulled my credit report from AnnualCreditReport.com—it’s free, no cap. I was freaked out, thinking I’d find some random debt from a sketchy dude in Nevada. Turns out, it was just my student loan and a late phone bill from when I was broke. If you see errors, dispute them quick. I didn’t have any, but fixing mistakes can help you avoid another credit card rejection.

Build Credit Like It’s a Slow-Burn Netflix Series

Since my credit history was thinner than my patience in a Trader Joe’s line, I got a secured card from Capital One. You put down a deposit—mine was $200, which hurt my soul—and it works like a real card. I used it for dumb stuff like bodega snacks and Netflix, then paid it off every month. I set phone reminders so I wouldn’t mess it up. After like eight months, my score went up to 650, and I felt like I deserved a parade.

Try Again, But Don’t Be Dumb

After a year of babying my secured card, I applied for a starter card from Discover. Got approved, baby! It’s not glamorous—no fancy rewards—but it felt like I’d won the lottery. Check out sites like Bankrate for cards that vibe with bad or no credit. Don’t go wild applying everywhere—each app dings your score a little.

Dumb Stuff I Did (Learn from My Mess-Ups)

I screwed up a ton, okay? Here’s my cringe list:

- Not Reading the Fine Print: I applied for a card that needed “good credit.” My score was garbage—should’ve known.

- Applying Like a Maniac: I sent out four applications in a week after the first denial. My score tanked harder than my high school GPA.

- Being Too Proud: I didn’t wanna call the bank at first. When I did, they told me stuff I could’ve fixed months earlier.

Wrapping Up My Credit Card Denial Drama

Look, a credit card denial ain’t the apocalypse, even if it feels like it when you’re staring at your phone in a sweaty bar, wondering if you’ll ever get your financial act together. I’m still stumbling through this in my overpriced apartment, but I’ve learned it’s a marathon, not a sprint. Check your report, grab a secured card, and don’t take it personally. You’ll get there. Got your own credit card rejection horror story? Drop it below—I wanna hear the chaos.