Look, weekly saving tips are kinda my lifeline these days, sitting here in my tiny Seattle apartment with the rain pattering against the window like it’s trying to wash away my overdraft fees. I mean, seriously? I used to wake up in a cold sweat at 3 AM, scrolling through my bank app, heart pounding like I’d just chugged three espressos, all because my spending was out of control. But now, incorporating these weekly saving tips into my routine—yeah, the ones that actually work without making me feel like a total failure—has me breathing easier, even if my coffee’s gone cold again. Like, I’m no finance guru, just a regular dude fumbling through adulthood in the US, where everything costs an arm and a leg, but these tips? They’ve dialed down the drama.

My Messy Start with Weekly Saving Tips

Okay, so rewind to last month—I’m at my local grocery store, the fluorescent lights buzzing overhead like angry bees, and I’m staring at a cart full of impulse buys: those fancy artisanal chips that taste like cardboard but cost $7 a bag. Why? Because stress eating, duh. I get home, unpack, and bam, regret hits harder than the credit card bill. That’s when I decided, enough—time for some weekly savings tips that don’t suck the joy out of life. I started small, like setting aside $20 every Sunday while binge-watching Netflix, pretending it’s a game. But honestly? It felt awkward at first, like forcing myself to floss. Now, though, these weekly saving tips have me checking my balance without that pit in my stomach, and yeah, I’ve got contradictions—sometimes I splurge on takeout anyway, but at least it’s planned.

I remember this one time, right here in the States, driving through a McDonald’s drive-thru because “treat yo self,” and next thing I know, I’m $50 lighter for the week. Embarrassing, right? But weaving in weekly saving tips, like tracking those little leaks, turned it around. Anyway, if you’re like me, fumbling with apps that promise miracles, check out this expert-backed habit from Investopedia on regular saving—it eased my anxiety big time [https://www.investopedia.com/reduce-stress-with-these-2-simple-money-habits-backed-by-experts-11794598].

Why Weekly Saving Tips Beat the Big Overhauls

Big resolutions? Forget ’em—they crash and burn. Weekly saving tips, though? They’re bite-sized, like those mini donuts I shouldn’t buy but do. I set a 15-minute “money huddle” every Wednesday, plopped on my couch with the AC humming in the background, reviewing transactions. It’s not perfect; sometimes I zone out and end up doom-scrolling Reddit instead. But it reduces that nagging stress, you know? The kind where your mind races about bills at midnight.

- Track your spends: Jot down everything, even that $4 latte that smells like heaven but adds up.

- Automate saves: I linked my account to auto-transfer $10 weekly—feels like magic, less effort.

- Cut one dumb habit: Mine was subscription boxes; canceled ’em, saved $30/month without missing much.

Seriously, these weekly savings tips keep things real, not some pie-in-the-sky plan.

The Mistakes I’ve Made (And How Weekly Saving Tips Fixed ‘Em)

Oh man, I’ve screwed up plenty—like that time I “invested” in crypto on a whim during a late-night scroll, losing $200 faster than you can say “bubble burst.” Sitting in my living room, the city traffic rumbling outside, I felt like a total idiot, stress levels through the roof. But injecting weekly saving tips turned the tide; now I review risks weekly, no more impulse disasters. It’s raw—I’m still tempted by shiny things, contradicting my “save more” mantra sometimes. Like, why do I eye those Amazon deals when I know better?

NerdWallet has solid advice on tracking spending that mirrored my fixes [https://www.nerdwallet.com/article/finance/how-to-save-money]. Helped me automate and chill out. Another flub: ignoring bills until they pile up, leading to late fees that sting worse than a paper cut. Weekly saving tips? I batch-pay ’em now, every Friday with my morning joe steaming up my glasses. Feels empowering, even if I grumble about it.

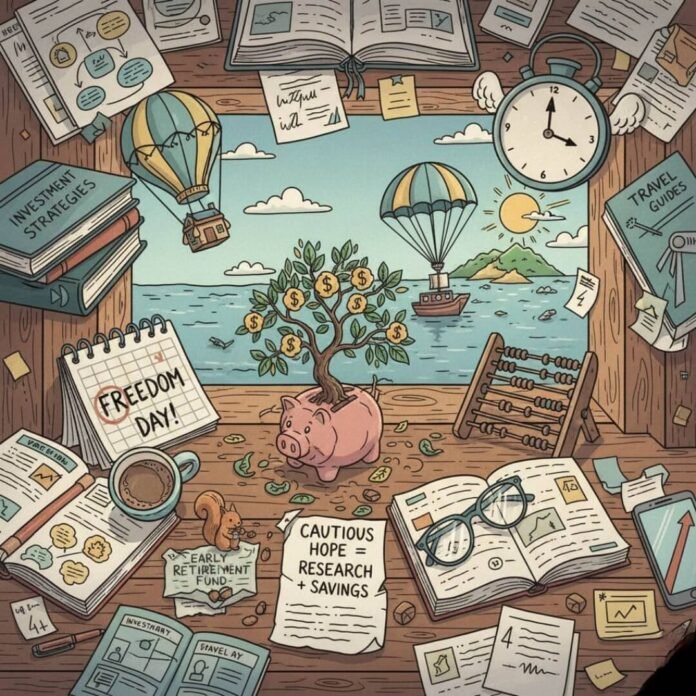

Tweaking Weekly Saving Tips for Real Life Stress

Life’s not linear, right? One week I’m acing these weekly saving tips, next I’m stress-buying concert tickets because YOLO. But that’s human—I’m in the US, where temptations are everywhere, from billboards to ads popping up on my phone. I learned to forgive slips, incorporate mindfulness from BluPeak’s tips [https://www.blupeak.com/blog/mind-over-money-6-tips-to-reduce-financial-stress/], like accepting my flaws while saving. It’s contradictory: I preach weekly saving tips but admit they flex with moods. Anyway, pro tip: pair ’em with a walk in the park, breathing in that crisp fall air, to melt the worry.

Wrapping Up My Rambling on Weekly Saving Tips

So yeah, these weekly saving tips aren’t flawless—I’ve got my share of backslides, like that overpriced brunch last weekend that smelled amazing but dented my savings. But overall, they’ve helped me save more, stress less, right here in my everyday American chaos, with the neighbor’s dog barking non-stop. It’s about progress, not perfection, you feel me? Give ’em a shot; start small, like I did, and watch the shift.