Man, lemme tell you, this tax refund timeline thing has been my personal nemesis for years now—like, I just filed my 2024 taxes back in April, sitting here in my cramped apartment in Seattle, rain pattering on the window like it’s mocking my impatience, and I’m still refreshing that IRS app every damn morning with my burnt coffee in hand. Seriously? I thought it’d be quick this time, but nope, delays hit because of some dumb mistake I made on my deductions, and I ended up waiting an extra three weeks, feeling like a total idiot. Anyway, as an average Joe fumbling through this American tax mess, I’ve got stories that’ll make you nod or cringe. Like, last year, I e-filed super early, hyped up on that promise of cash back for a road trip, but the tax refund timeline stretched out because I forgot to update my address after moving—ended up with a paper check lost in the mail for days, me pacing the living room in my ratty slippers, cursing under my breath.

My Latest Tax Refund Timeline Debacle

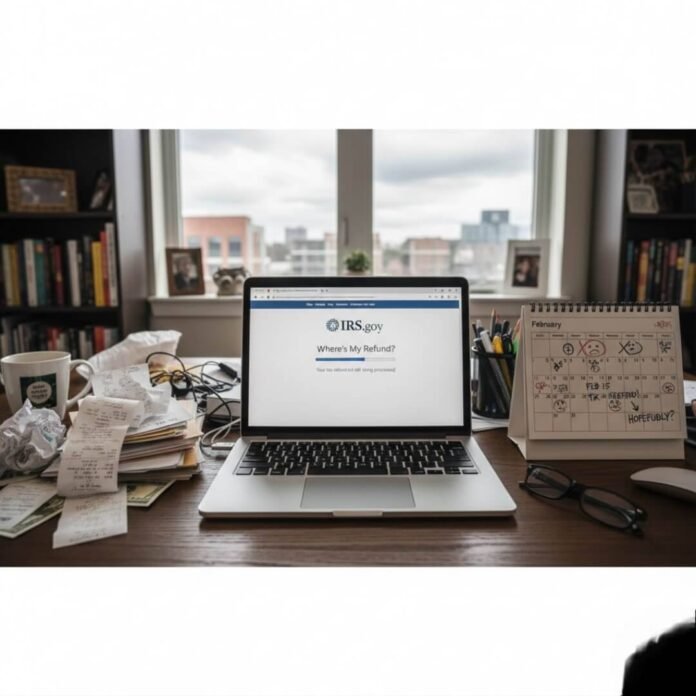

Okay, so picture this: It’s early 2025 now, but flashing back to my most recent screw-up. I filed electronically on TurboTax—love how it feels all slick and modern, right?—expecting my refund in 21 days as the IRS promises for most folks. But ha, joke’s on me; it took 28 days because I claimed some home office stuff that flagged a review, and I was left staring at my phone, the screen glow reflecting off my foggy glasses, heart sinking each time it said “processing.” I even called the IRS hotline once, waited on hold for an hour listening to that godawful muzak, only to get a rep who sounded as bored as I was frustrated. Contradiction alert: I preach patience to my buddies, but internally? I’m a wreck, binge-watching shows to distract from the anxiety. If you’re in the same boat, check out the official IRS guidelines on their site for real-time updates—here’s a link to the IRS Where’s My Refund tool—it saved my sanity, sorta.

Why My Tax Refund Timeline Felt Like Eternity

Digging deeper, the tax refund timeline varies wild based on how you file. Me? I went digital, but if you’re old-school with paper, forget it—could be six to eight weeks, like my grandma still does, bless her. I learned the hard way that errors, like misspelling my own freaking name (yeah, embarrassing, happened in 2022 after a late-night filing session), add weeks. And don’t get me started on identity theft flags—happened to a friend, stretched his to months. From my flawed view, it’s all about that initial submission; get it right, or pay in wait time.

Typical Tax Refund Timeline Breakdown

Alright, let’s break this tax refund timeline down like I’m explaining it over beers—most e-filers get it in under 21 days if no issues, per the IRS stats. But if you claimed earned income tax credit or child tax credit, bam, delays till mid-February at earliest, even if you filed in January. I remember claiming that EITC once, thinking it’d boost my refund big time, but the wait? Killed my vibe for a spontaneous Vegas trip. Paper filers, you’re looking at four weeks minimum, often more—why bother when apps make it easy? Oh, and direct deposit shaves off days compared to checks; I switched to that after losing one in the mail, felt like a genius… until the bank glitch held it up anyway. For solid deets, peek at this breakdown from Taxpayer Advocate Service—link to their refund cycle chart—eye-opening stuff.

Factors Messing With Your Tax Refund Timeline

Complexity kills speed—amendments? Add months. Audits? Nightmare fuel. I got a minor audit notice in 2023 over freelance gigs, sweated bullets in my stuffy home office, papers everywhere, and it pushed my tax refund timeline back by six weeks. Weather or holidays can slow mail too; living in the PNW, storms delayed my check once. Pro tip from my mistakes: Verify everything twice.

Pro Tips to Hack Your Tax Refund Timeline

Wanna speed up that tax refund timeline? File early, like January if you can— I did that this year, beat the rush, got mine faster despite the hiccups. Use free tools like IRS Free File if you’re under 72k income; saved me bucks and time. Track with the app obsessively, but don’t call unless over 21 days—wasted my time there. Avoid loans against your refund; I considered one once, dumb idea, high fees ate into it. And hey, if delayed, breathe—mine always came eventually. For more hacks, this Forbes article nails it—link to Forbes tax tips.

Common Pitfalls in the Tax Refund Timeline

Biggest oops? Not updating banking info—I did that, refund bounced back, added two weeks. Or filing late; penalties suck. I procrastinated in college, regretted it hard.

Whew, that’s my raw take on the tax refund timeline—flawed, yeah, but real from this American grinding through it. If you’re waiting, hang in there; share your story in comments or hit up that IRS tool. Seriously, file smart next time? You’ll thank yourself.