Look, I’ve made my fair share of 401(k) mistakes right here in the US, sitting in my cluttered apartment in Austin with the AC blasting against this October heatwave—it’s like 85 degrees out, seriously?—and let me tell you, they stung worse than that time I burned my tongue on overpriced food truck tacos last week. Anyway, I’m no financial guru, just a regular dude who’s been grinding through jobs, watching my retirement savings yo-yo because of dumb slips I could’ve dodged. Like, I thought I was smart stashing cash away, but nope, contradictions abound—I preach saving now but back in my 20s, I was all YOLO with that account. Raw honesty? Some of these blunders cost me thousands, and I’m still kicking myself over ’em while sipping this lukewarm coffee that tastes like regret. But hey, if sharing my messy stories helps you avoid 401(k) mistakes, that’s a win.

Why I Wish I’d Learned to Avoid 401(k) Mistakes Sooner

Dude, picture this: It’s 2019, I’m in Seattle—rain pounding the windows like it’s mad at the world—and I switch jobs without rolling over my old 401k. Boom, it sits there gathering dust, or worse, fees. I didn’t even notice until tax time hit, and suddenly I’m scrambling through paperwork on my beat-up laptop, heart racing like I’d just chugged too much espresso. That retirement savings error? It nibbled away at what could’ve been compound interest magic. Seriously, avoiding 401(k) mistakes starts with basics like this—don’t let inertia win. I learned the hard way, but now I’m all about checking statements monthly, even if it means pausing my Netflix binge.

And yeah, contradictions in my head: Part of me thinks, “Who cares about retirement when rent’s skyrocketing?” But nah, that’s the trap. Weave in some common 401k pitfalls here—stuff like forgetting to update beneficiaries after a breakup. Mine? I had an ex listed for years post-split; embarrassing as hell when I finally fixed it last month, staring at my screen in this Texas humidity that makes everything stickier.

Not Maxing Out That Match My Biggest Avoid 401(k) Mistakes Regret

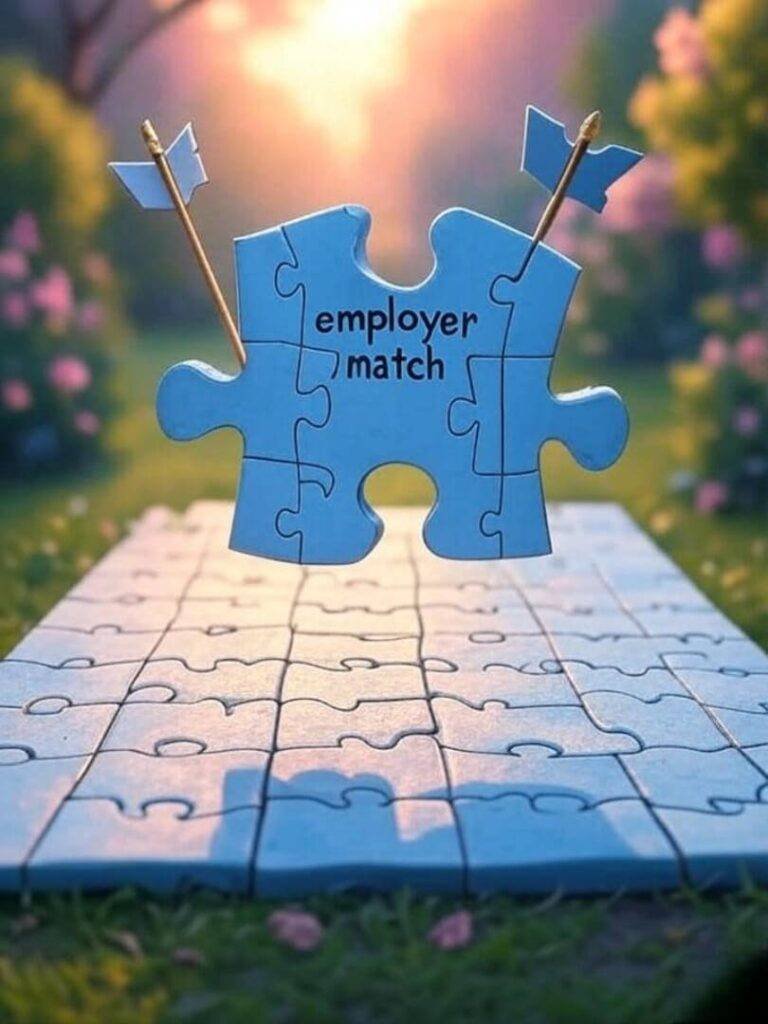

Okay, real talk—my dumbest retirement planning blunder was ignoring the employer match for like two years straight. Like, free money? And I left it on the table because I was too broke—or thought I was—paying off student loans. Cut to me in 2022, crunching numbers in a Chicago diner, grease from the fries on my fingers, realizing I’d pissed away thousands in matching contributions. To avoid 401(k) mistakes like this, bump up your percentage to at least snag the full match; it’s like your boss handing you cash, dude. I ramped mine up gradually, even when it hurt the paycheck, and now it’s paying off—sort of. But honestly? Sometimes I still second-guess if I should’ve splurged on that road trip instead. Flawed human here, what can I say?

- Always calculate the match percentage—mine was 50% up to 6%, goldmine I missed.

- Set auto-increases yearly; I did that post-mistake, feels automatic now.

- Check IRS guidelines on 401(k) contributions for current limits— they’re up in 2025, FYI.

Ignoring Those Sneaky Fees in My Quest to Avoid 401(k) Mistakes

Fees, man—they’re like those hidden charges on your phone bill that add up. I remember poring over my 401k statement in a New York subway last year—train rattling, strangers bumping me—and spotting expense ratios over 1%. Oof, that high 401k fees blunder shaved off growth I didn’t even see coming. To dodge these common 401k pitfalls, switch to low-cost index funds; I did, and it felt liberating, like decluttering my closet. But get this: I contradict myself sometimes, thinking maybe pricier funds perform better—nope, data says otherwise, per sites like Investopedia’s fee breakdown. Anyway, audit your plan yearly; mine revealed a fund charging 1.5%, swapped it out pronto.

Diversification Dodges to Help Avoid 401(k) Mistakes Like Mine

Oh, and don’t get me started on not diversifying—another retirement savings error I pulled. All eggs in tech stocks during the 2020 boom? Yeah, when it dipped, my balance tanked, and I was stress-eating pizza in my LA rental, cheese strings everywhere, wondering why I didn’t spread it out. Advice from my flawed experience: Mix stocks, bonds, internationals—aim for that 401k investment diversification sweet spot. I use tools like Vanguard’s portfolio analyzer now, but back then? Pure hubris. It’s okay to admit you’re not Warren Buffett; I sure ain’t.

Pulling Cash Out Too Early—A Classic Way Not to Avoid 401(k) Mistakes

This one’s embarrassing: In 2018, I tapped my 401k for a car down payment—taxes and penalties hit like a freight train, leaving me short thousands. Sitting in that dealership lot in Florida, palms sweaty from the heat, I regretted it instantly. Early retirement mistakes like withdrawals before 59½? Avoid ’em unless it’s dire; loans are better if available. I learned via Fidelity’s penalty guide, but hindsight’s 20/20. Contradiction? Yeah, it funded a needed move, so bittersweet win, but financially? Dumb. Build an emergency fund instead—mine’s now six months’ worth, stashed separately.

Wrapping this up like we’re finishing beers at a bar—avoiding 401(k) mistakes isn’t rocket science, but it takes vigilance, dude. I’ve shared my screw-ups from coast to coast, hoping you skip ’em and build that nest egg. Seriously, review your 401k today; maybe chat with a advisor if you’re as clueless as I was. What’s one 401(k) mistake you’ve dodged or fallen into? Spill in the comments—let’s commiserate.