Look, if you’re googling the best credit cards for bad credit in 2025 like I was six months back, sprawled on my lumpy couch in this sticky Brooklyn walk-up with the AC wheezing like it’s got its own FICO score, you’re not solo in the suck. I mean, seriously? My score dipped to 520 after that freelance gig vanished faster than my last Tinder match—poof, ghosted—and suddenly every coffee run felt like a felony. But hey, from chugging cheap bodega iced tea while doom-scrolling rejection emails, I clawed my way to these picks. No cap, they’re the real MVPs for folks like us, the ones who accidentally Venmo’d rent to the wrong contact (don’t ask). We’re talking secured cards that don’t ghost you, low-deposit lifesavers, and even a sprinkle of cash back to make rebuilding feel less like punishment. Anyway, let’s rank ’em—my flawed, coffee-stained take, pulled from nights glued to NerdWallet and Credit Karma while ignoring the pizza boxes piling up.

Why These Best Credit Cards for Bad Credit in 2025 Hit Different for Me (And Might for You)

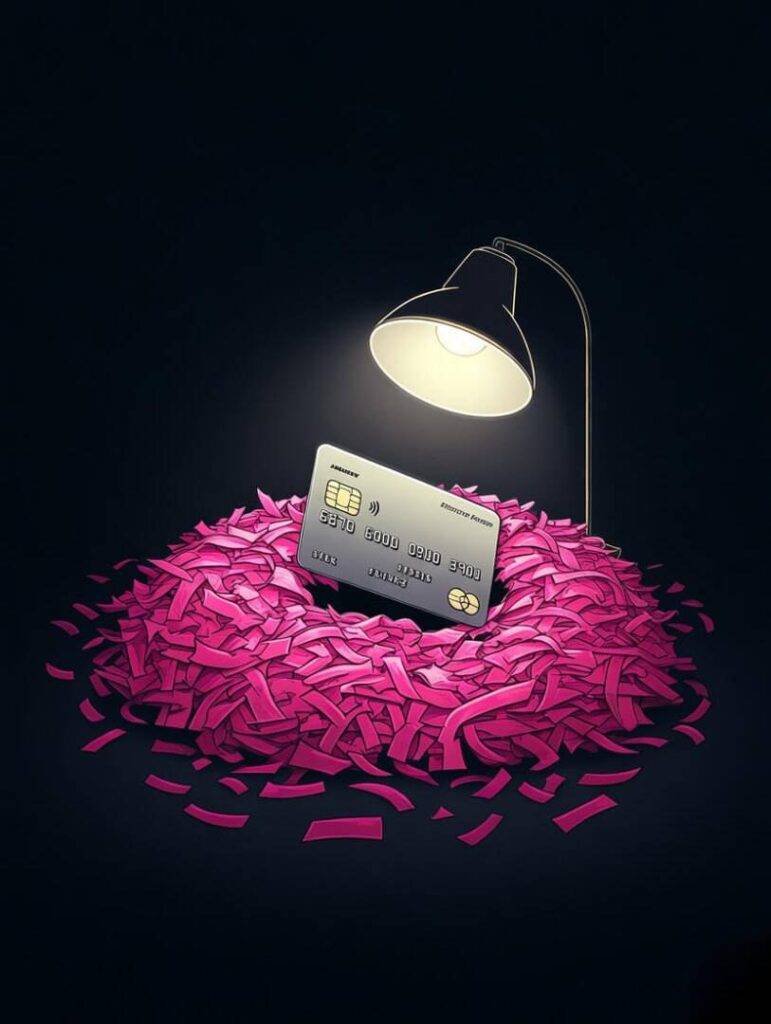

Dude, rebuilding credit? It’s like dating after a bad breakup—you swipe right on anything that doesn’t scream “red flag,” but secretly hope for that spark. I remember applying for my first secured card last winter, fingers frozen on my phone in a snow-dusted Central Park bench (romantic? Nah, desperate), heart pounding like I’d just confessed to maxing out on Ubers during a blackout. These best credit cards for bad credit in 2025? They’re the patient partners that report on-time payments without judging your past dumbassery. Per Experian, secured ones are gold for us sub-600 scorers ’cause they use your own cash as collateral—low risk for banks, high hope for us. But wait, I digress: my score jumped 50 points in three months? Wild. Only hitch? That initial deposit stung like biting into a cold hot dog from a street cart—necessary evil, though.

My Top Ranked Best Credit Cards for Bad Credit in 2025—No Fluff, Just the Goods

Okay, let’s cut the therapy session and rank these bad boys. I vetted ’em based on my own sweat: ease of approval (no hard pulls if possible), fees that don’t murder your wallet, and perks that actually reward not being a total screw-up. Pulled from CNBC’s easiest approvals list and my trial-by-fire apps. Here’s the countdown, like we’re gossiping over late-night ramen.

1. Discover it® Secured Credit Card: The Underdog Hero I Wish I’d Met Sooner

Top spot goes to this gem—$0 annual fee, and get this, they match your cash back at year-end? I earned like $27 on gas station slushies alone, which bought me emotional therapy in blue raspberry form. APR’s around 28.24% variable, deposit starts at $200 (refundable, obvs), and no credit check drama. Pros: Reports to all three bureaus, auto-review for unsecured upgrade after 7 months. Cons: Rewards cap at 2% on rotating categories—fine for basics, but don’t go wild. My story? Applied during a rain-soaked subway delay, got approved in minutes. Score up 40 points by spring. If you’re eyeing secured credit cards for rebuilding credit, this one’s your chaotic neutral bestie.

2. Capital One Platinum Secured Credit Card: Low Deposit, High “I Got This” Vibes

Second place ’cause that $49 deposit option? Game-changer when you’re scraping quarters from couch cushions like I was after forgetting my wallet at a dive bar quiz night (team name: Broke But Woke). $0 fee, 29.74% APR, no rewards but straight-up credit building—limit starts at $200, reviews every 6 months. Pros: Installment payments on deposit, pre-approval tool online. Cons: No cash back, so it’s pure grind mode. I snagged this mid-panic attack in a Duane Reade aisle, buying antacids with loose change. Now? It’s my “responsible adult” badge, even if I still eye impulse buys like a hawk.

3. Chime Credit Builder Secured Visa: No Check, All Chill—My Lazy Rebuild Hack

No credit check? Sold. This one’s for when you’re too burnt from job hunting to adult properly—like me, bingeing true crime pods while my score sulked at 510. Backed by your savings (no deposit lock-in), $0 fee, no APR ’cause it’s charge-only. Rewards? Spotty 1.5% on rotates if you direct deposit. Pros: Auto-pays from your Chime account, builds habits without debt fear. Cons: Needs a Chime checking setup, and rewards ain’t fireworks. Applied from bed at 2 a.m., woke up to “welcome”—pure serotonin. Easiest credit cards no credit check 2025? This screams “yes” if you’re over the interrogation vibes.

4. OpenSky® Plus Secured Visa® Credit Card: The “I Don’t Even Have a Bank” Savior

Fourth ’cause 89% approval rate, no bank account needed—lifesaver when I was couch-surfing cousins in Queens, dodging bill collectors like bad exes. $0 fee first year (then $35), 25.64% APR, deposit $200-$3k for matching limit, up to 10% cash back on gas. Pros: No check, flexible deposits via money order. Cons: Higher APR bites if you carry balance (don’t, dummy). My embarrassing tale: Funded it with gig app payouts, felt like a boss paying bodega tabs. Low deposit credit cards bad score? OpenSky’s your quirky sidekick.

5. Petal® 2 “Cash Back, No Fees” Visa® Credit Card: Unsecured Hope for the Almost-There

Rounding out at five—unsecured, no deposit, but they peek at your banking deets instead of score. $0 fee, 28.99%-30.99% APR, 1%-1.5% cash back scaling with on-time pays. Pros: Builds to 10% at partners, no hard pull initially. Cons: Not for rock-bottom scores (mine was borderline). I applied post-gym sweat, high on endorphins, and boom—first unsecured win. Cash back cards poor credit? Petal’s the sneaky glow-up.

Quick Tips from My Hot-Mess Credit Journey with These Best Credit Cards for Bad Credit in 2025

- Start Small, Stay Consistent: I set alerts for payments—saved me from that one “oops” late fee that dropped my score 20 points. Like, duh, but brain fog is real.

- Pair with Free Tools: Track via Credit Karma—it’s my nightly ritual, wine optional.

- Avoid the Traps: No, don’t chase sign-up bonuses if fees lurk. Learned that chasing a “free” card that charged $99 upfront—facepalm city.

- Mix It Up: Got Chime for basics, Capital One for growth. Diversify like your weird aunt’s essential oils shelf.

Whew, typing this out, I’m smelling the faint must of my old mail stack wafting from the corner—reminder we’re all just one bad month from the pit. But these best credit cards for bad credit in 2025? They turned my “why me” spirals into “watch me” struts. Flawed? Hell yeah—I’m still eyeing that overpriced latte. Surprising? My score’s at 680 now, and I cried ugly tears over Thai takeout celebrating. If you’re in the weeds, pick one, apply today (links above, no excuses), and hit reply—tell me your war stories. What’s your first move? Let’s rebuild messy together.