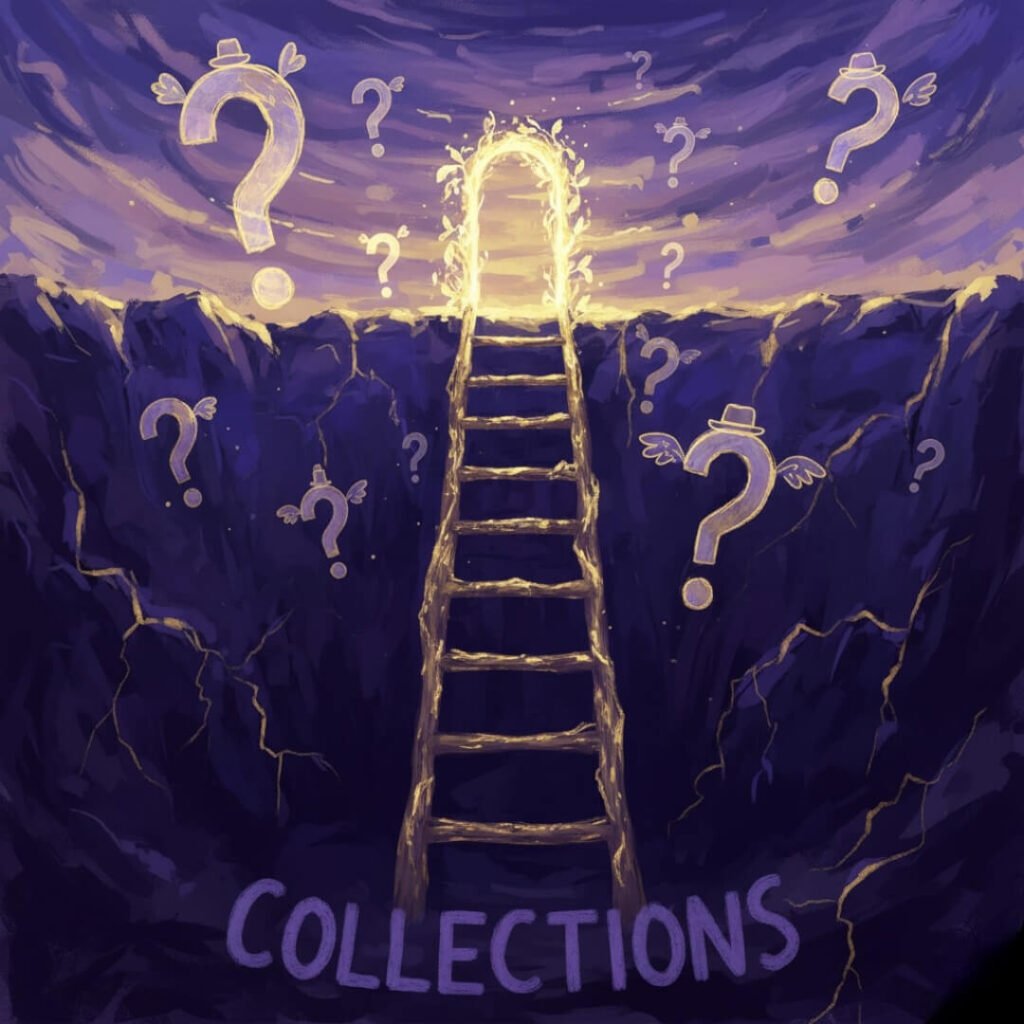

I gotta tell ya, trying to fix your credit after collections is like waking up from a financial nightmare and realizing your wallet’s still haunted. Here I am, chilling in my tiny Brooklyn walk-up—sirens blaring outside, that classic New York hum—sipping on this lukewarm coffee that’s probably my third today, thinking back to when my score tanked because of some old medical bills that went to collections. Seriously? It was embarrassing, man, like admitting to your buddies you still can’t parallel park after years in the city. I remember staring at my Experian app on my phone, heart pounding like I just ran up five flights, seeing that big red flag. But hey, I’m no expert, just a regular dude who’s been through the wringer and came out kinda wiser. Anyway, let’s dive into this mess—I mean, guide.

My Messy Start: How Collections Wrecked My Credit and How I Began to Fix It

Look, collections hit me out of nowhere last summer. I was dealing with this lingering hospital bill from a dumb skateboarding wipeout in Central Park—yeah, at my age, what was I thinking? The pain was bad, but seeing “collections” pop up on my credit report? That stung worse, like salt in the wound. My score dropped faster than a bad TikTok trend, from a decent 720 down to the low 600s. I felt like a total loser, scrolling through Reddit threads at 2 a.m., my room lit only by the screen, wondering if I’d ever fix my credit after collections without going bankrupt or something drastic.

It all started when I ignored those nagging calls—y’know, the ones with the robotic voices that make you wanna chuck your phone. Big mistake. Turns out, collections agencies are like that ex who won’t let go; they report to the bureaus and bam, your credit’s toast. But I learned, painfully, that you can dispute ’em. I pulled my free reports from AnnualCreditReport.com (check it out here: https://www.annualcreditreport.com), sitting on my lumpy couch with crumbs everywhere, and spotted errors. Like, one bill was double-reported—how does that even happen? Anyway, that was my wake-up call to start repairing my credit post-collections.

From there, I dove into the basics. First off, understand what collections mean for your credit—it’s like a black mark that sticks around for seven years unless you fix it. But don’t panic; I didn’t, mostly because I was too exhausted. I started by paying off what I could, even if it meant skipping that fancy brunch with friends. Repairing credit after debt collections isn’t quick, but it’s doable if you’re stubborn like me.

The Emotional Rollercoaster of Trying to Fix Your Credit After Collections

Oh man, the feels. One day I’m pumped, thinking I’ve got this credit repair after collections thing down, the next I’m doubting everything because my score barely budged. Like, I disputed a charge online via the FTC’s site (pro tip: use their dispute tools at https://www.consumer.ftc.gov), and waited weeks, pacing my apartment like a caged animal. The waiting game’s brutal—nails bitten, endless refreshing. And get this, when it finally got removed, I celebrated with cheap takeout, but then another collection popped up from years ago. Contradictions much? I preach patience now, but back then I was a hot mess.

Step-by-Step to Fix Your Credit After Collections: My Flawed But Real Plan

Alright, let’s break this down like I’m explaining it over beers—’cause that’s how I’d do it in real life. Fixing your credit after collections ain’t rocket science, but it takes grit. Step one: Pull your reports. I did it annually, but now I check quarterly ’cause paranoia, y’know? Use that AnnualCreditReport link I mentioned; it’s legit and free.

Step two: Dispute inaccuracies. I wrote letters—old-school, yeah—to the bureaus like Equifax (their dispute page is here: https://www.equifax.com/personal/credit-report-disputes/). Included proof, like paid receipts scanned on my phone. One time, I misspelled my own address in the letter—embarrassing, but they still fixed it. Improving your credit score post-collections means being thorough, even if you flub sometimes.

- Pay or settle debts: Negotiate with collectors; I haggled one down 40% via phone, sweating bullets.

- Build positive history: Get a secured card—I used Capital One’s (check ’em at https://www.capitalone.com)—and paid on time, religiously.

- Monitor progress: Apps like Credit Karma (free monitoring: https://www.creditkarma.com) became my obsession.

Step three: Avoid new debt. Easier said than done; I slipped once on impulse buys, tanking my progress briefly. But rebounding taught me resilience in this credit rebuilding after collections game.

Tools and Resources I Swear By for Repairing Credit Post-Collections

Don’t go it alone; I tried and failed spectacularly. Credit counseling from nonprofits like NFCC (visit https://www.nfcc.org) saved my butt—they’re not pushy like for-profits. Also, budgeting apps helped me track spending, preventing more slips into collections territory.

Common Pitfalls When You Try to Fix Your Credit After Collections (And How I Screwed Up)

Here’s where it gets real: Pitfalls galore. Ignoring small debts? I did that, and they ballooned. Thinking paying collections auto-removes ’em? Nope, gotta request goodwill deletions—sometimes works, sometimes not. I emailed one agency begging, felt pathetic, but hey, it vanished.

Another trap: Applying for too much credit. I got denied twice, dinging my score more. Lesson? Patience in boosting FICO after collections. And scams—dodgy “credit repair” services promising miracles. Stick to legit ones via BBB ( https://www.bbb.org ).

Man, the contradictions: I advise caution but I’m impulsive. Anyway, learn from my goofs.

Wrapping Up: Keep Grinding to Fix Your Credit After Collections

So yeah, that’s my take—flawed, honest, from this noisy US perch. Fixing your credit after collections changed how I handle money; less stress, more control. It’s ongoing, like life. If you’re in the trenches, start small, forgive your mess-ups. Hey, why not pull your report today? Share your story in comments—misery loves company, right? Let’s chat.