Yo, I boosted my credit score by 120 points in just 60 days, sitting in my cramped Queens apartment where the radiator clanks like it’s auditioning for a horror flick. Like, seriously, my FICO score was a dumpster fire before, staring at me from my cracked phone screen while I munched on stale chips. I ain’t no Wall Street bro, just a regular dude in the US dodging late fees and those “you’re pre-approved!” spam emails. Anyway, lemme spill how I pulled off this credit score boost, complete with my dumb mistakes and coffee-fueled rants. It’s messy, it’s real, and yeah, I screwed up plenty.

My Credit Score Disaster Start

Okay, real talk: last summer, I got hit with a big fat rejection trying to lease a new place in Brooklyn. My credit score was, like, 520—yikes. Felt like a punch to the gut, standing in my kitchen with the smell of burnt toast lingering, landlord basically laughing me off. I was pacing, my socks slipping on the hardwood, thinking, “Man, I gotta boost my credit score or I’m stuck in this roach motel forever.” It was humbling, kinda like spilling ketchup on your shirt at a first date—embarrassing but you keep going. That was my kick in the pants to fix it.

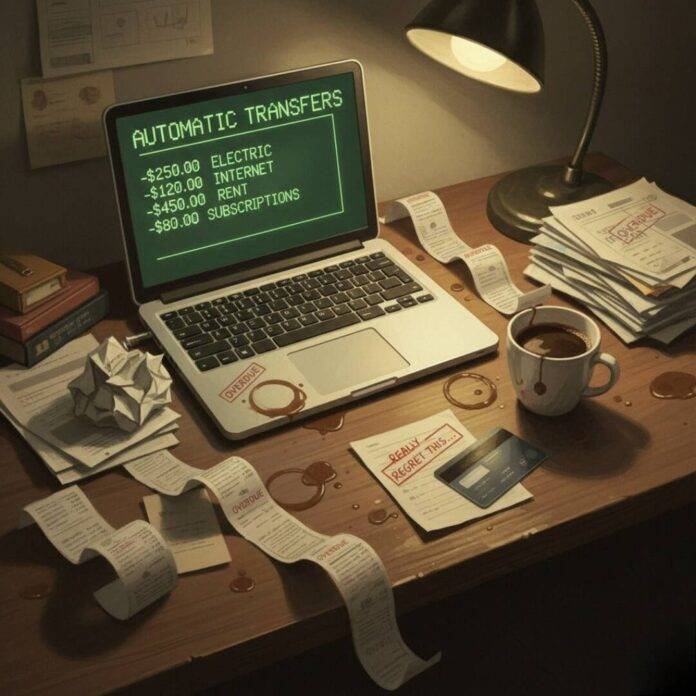

I’d racked up debt from, ugh, dumb stuff—like impulse-buying a fancy coffee maker I never used. Late payments? Guilty. My mailbox was a graveyard of unopened bills, buried under pizza menus.

Why My Credit Was Trash

Here’s the deal: my credit score tanked ‘cause I was sloppy. Late payments from forgetting bills—check. Maxed-out cards from too many takeout orders—check. I was using, like, 85% of my credit limit, which is a big no-no for boosting your credit score. Also, too many inquiries from applying for random loans. I knew this from scrolling Reddit at 2 a.m., but did I act? Nope. It was like ignoring a toothache—keeps getting worse. The vibe was pure chaos, like my apartment’s flickering lights during a storm.

Hacks That Kicked My Credit Score Up

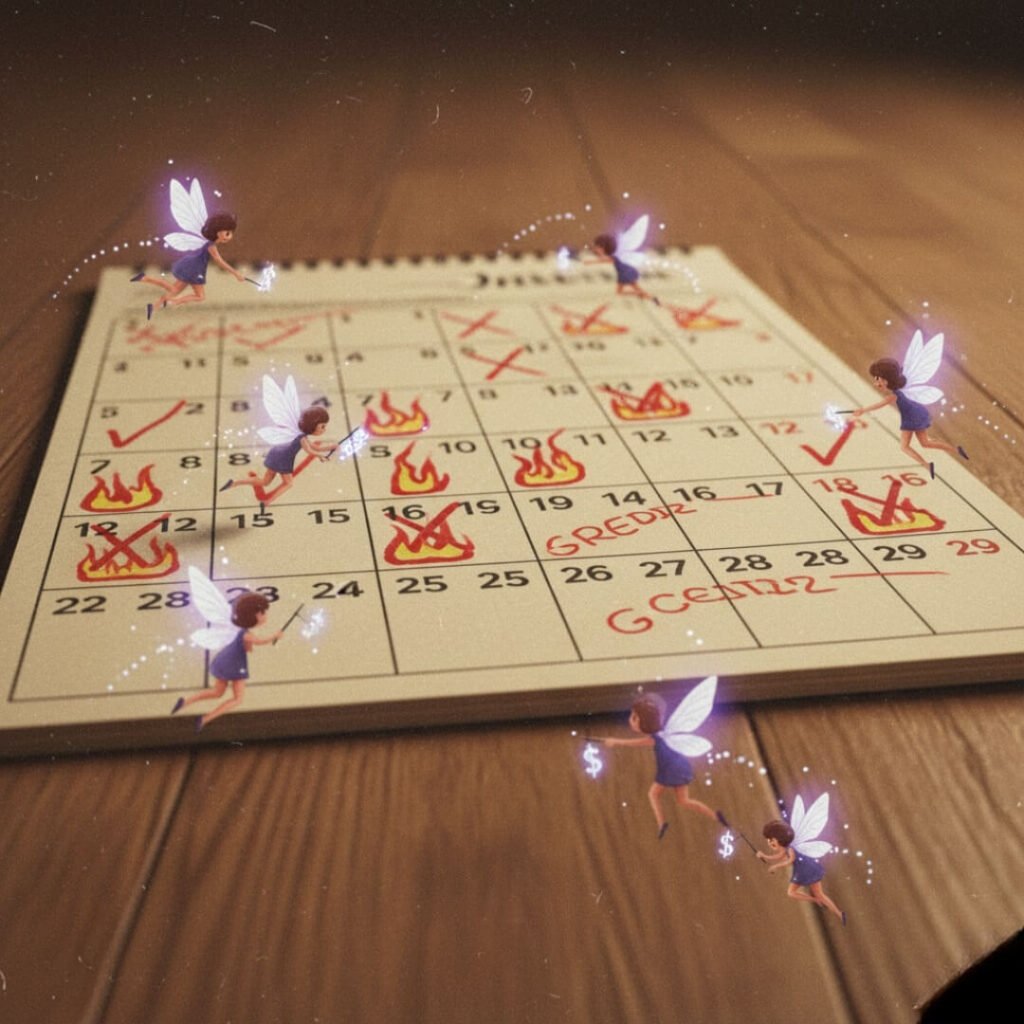

So, I got to work, sprawled on my saggy couch with my laptop heating my thighs. Boosting my credit score wasn’t some fairy-tale fix; it was me fumbling through, learning as I went. I didn’t follow a shiny guru plan—just patched together what worked from my own trial and error. Here’s what clicked:

- Checked My Reports: Grabbed free reports from AnnualCreditReport.com (link: https://www.annualcreditreport.com). Found errors, like an old phone bill that wasn’t mine. Disputed it online—felt like I was on CSI.

- Paid Down Debt: Used the snowball method, hitting smallest debts first. Paid minimums plus extra, but man, I ate cereal for dinner too many nights. Helped boost my credit score fast.

- Secured Card Trick: Got a secured card from Capital One (link: https://www.capitalone.com). Dropped $200, used it for small stuff like gas, paid it off monthly. Easy win.

Screwed up once, though—missed a payment when I got distracted binge-watching some true crime doc. Score dipped, heart sank. But bounced back.

Weird Tricks That Actually Helped Boost My Credit Score

Here’s where it gets kinda wild. I hopped on my sister’s credit card as an authorized user—her score’s pristine. Felt like mooching off her at 32, super awkward, but it gave my credit score a boost by linking to her good history. Also, I stopped applying for every shiny card offer—fewer inquiries, better score. Oh, and I used Experian Boost (link: https://www.experian.com/boost) to report my phone bill payments. Added points for stuff I was already paying, which was dope.

Weird thing: I hated budget apps at first, felt like they were judging me. Now I’m glued to ‘em, notifications pinging like a needy ex. Go figure.

Dumb Stuff I Wish I Knew About Boosting My Credit Score

If I’d known checking my score weekly on Credit Karma (link: https://www.creditkarma.com) would’ve kept me sane, I’d have done it sooner. Those random dips freaked me out—turns out, scores wiggle like a bad Wi-Fi signal. Also, don’t close old accounts; keeps your credit history long, helps boost your credit score. Who knew?

Mistakes? Oh yeah. I consolidated debt but forgot about the fee—dumb move. Felt like stepping on a Lego. And I almost fell for a sketchy “credit repair” ad—dodged it thanks to FTC tips (link: https://www.ftc.gov/business-guidance/resources/credit-repair-scams). Learning was like tripping up stairs in front of a crowd.

What Almost Tanked My Credit Score Boost

Got cocky halfway through. Score jumped 60 points in 30 days, so I splurged on some overpriced headphones—utilization spiked, score wobbled. Lesson learned: chill, dude. Also, I mixed up accounts once, paid the wrong card—ugh, rookie error. My apartment’s chaos didn’t help; bills got lost under laundry piles.

It got messy near the end—thought I was done, but a late fee snuck in. Fixed it, though, and that 120-point boost? Legit.

Wrapping Up My Messy Credit Score Boost

So yeah, boosting my credit score 120 points in 60 days was no fairy tale—just me, a flawed American fumbling through in my noisy Queens pad. Loved the wins, hated the discipline, but now I’m getting approvals without sweating. If your score’s in the gutter, try these hacks—they’re not perfect, but neither am I. Got a credit horror story? Drop it below. Or, like, check your score now—don’t wait for a landlord to roast ya.