Man, automatic transfers are my jam now, but lemme tell ya, I stumbled into them like a total noob last summer in my cramped Jersey City apartment, rain smacking the windows, and me staring at my bank app like, “Why am I always broke?” I was surrounded by empty Chipotle bags—guilty—and the smell of my overbrewed coffee was screaming “you’re a mess.” So, I set up automatic transfers, $40 a paycheck, thinking, “This better work, or I’m screwed.” Spoiler: it did, and I’ve got $2,000 saved now, which feels like a freakin’ miracle for someone like me who’s, uh, not exactly a financial guru. Anyway, here’s my chaotic, kinda embarrassing story of how automatic transfers saved my wallet.

Why Automatic Transfers Felt Like a Cheat Code for Saving

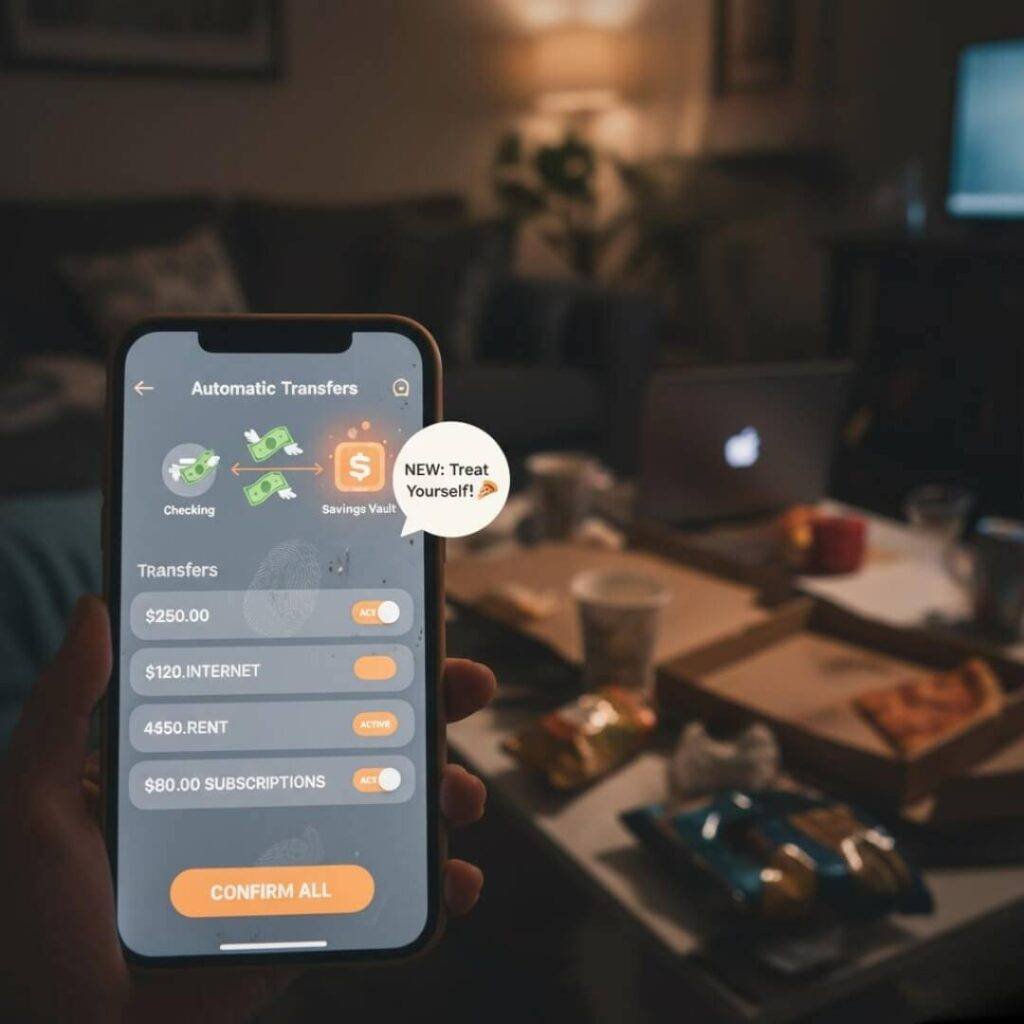

So, I’m chilling in my living room right now, feet propped on a coffee table that’s got mystery stains—don’t ask—and I check my phone. Automatic transfers just yanked $40 into my savings, and I didn’t even blink. When I started, I was like, “Is this just some bank trick to make me feel responsible?” But nah, it’s legit. I used Wells Fargo’s app—check their auto-transfer guide—and set it to pull money every payday. At first, I was annoyed, like, “Yo, that’s my money disappearing!” But then I forgot about it, and my savings started creeping up. It’s like my bank’s doing the adulting for me while I’m out here spilling coffee on my keyboard.

Here’s a cringe moment: last fall, I was at this bodega in Hoboken, grabbing a $15 sandwich I didn’t need, and my card got declined ‘cause automatic transfers had just pulled my last $40. The cashier gave me this “really, dude?” look, and I mumbled something about “tech issues” while bolting out, red-faced. But honestly? That screw-up saved me from another dumb purchase. Automatic transfers are like that friend who stops you from texting your ex at 2 a.m.—annoying but clutch.

My Epic Fails With Automatic Transfers (Yup, I Messed Up)

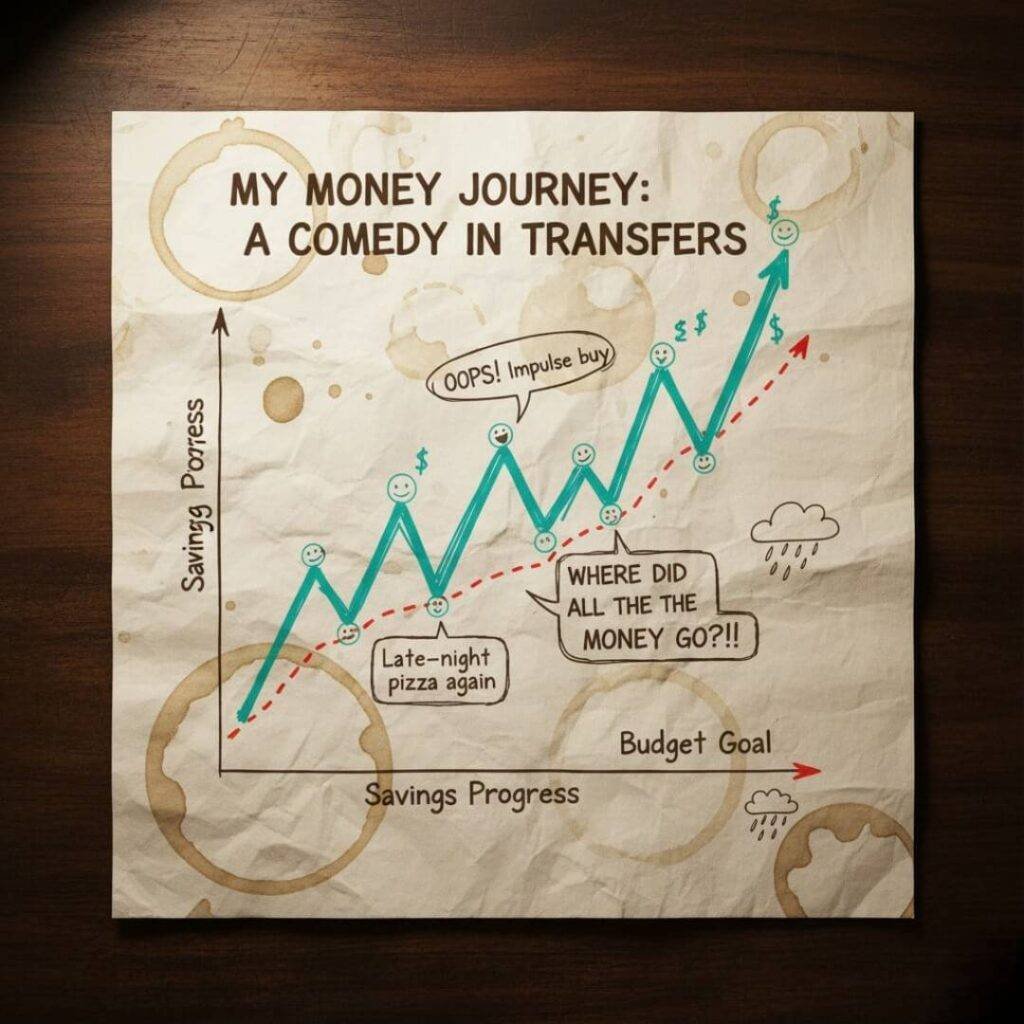

Okay, real talk: I botched this hard at first. I set my automatic transfer to $75 a check, thinking I was some Wall Street hotshot, but then I overdrafted while buying groceries at Trader Joe’s. Standing there, cart full of frozen dumplings, with that “insufficient funds” alert on my phone? Brutal. Smelled like failure and cheap soy sauce. I learned to start small—$20 worked better—and Bankrate’s tips on safe auto-transfers helped me not be an idiot again. Also, I once forgot to update my account after switching jobs, so automatic transfers kept trying to pull from a closed account. Got like 10 error emails while stuck in traffic on I-95, cursing my own dumbness. Lesson? Check your setup every couple months, even if it’s “set it and forget it.”

How I Actually Hit $2,000 With Automatic Transfers

Fast-forward, and automatic transfers have stacked me $2,000. I’m sitting here in my ratty hoodie, sipping coffee that’s honestly kinda stale, staring at my bank app like it’s a trophy. I stuck with $40 bi-weekly, and with a random tax refund thrown in, it added up over 14 months. That money let me fix my car’s busted tire—heard that screeching noise on the Turnpike?—and still have enough for a weekend in the Catskills, where the air smelled like pine and freedom. For someone who used to panic over $50 overdrafts, seeing that $2K feels like I hacked the system.

Here’s what worked for me, flaws and all:

- Go small at first: $10 or $20 if you’re stretched—automatic transfers add up without you noticing.

- Pick a solid account: I switched to a high-yield savings with Ally their auto-savings tools are dope.

- Don’t overcheck: I used to obsess over my balance, but that led to pausing transfers for dumb reasons.

- Life happens: When my rent spiked, I lowered my automatic transfers to $15 for a bit—be flexible.

I still mess up, don’t get me wrong. Last month, I dipped into savings for a new phone case on Amazon—shiny, useless, $30. Classic me. Automatic transfers keep me on track, but I’m still, like, human and impulsive.

The Weird Side Effects of Automatic Transfers

Here’s the wild part: automatic transfer made me kinda lazy about budgeting, but in a good way? I stopped stressing over every dollar ‘cause the auto-pull handled the big stuff. But then I’d splurge on dumb things, like $60 on wings and beers at a dive bar, thinking, “Eh, my savings are fine!” Regretted that one—grease stains on my shirt and a lighter wallet. Automatic transfers don’t fix your bad habits; they just give you a cushion while you figure it out.

They also made me weirdly cocky. Over tacos with friends in a noisy diner, fryer oil in the air, I’d brag about my $2,000 from automatic transfer, like I’m some finance bro. They’d roll their eyes but ask for tips, and I’d ramble about starting small. It’s cool to share, even if I’m no expert—just a dude in the US trying not to blow it.

Wrapping Up My Messy Automatic Transfers Adventure

So yeah, automatic transfers got me to $2,000, and I’m still shocked it worked for someone as scatterbrained as me. I’m writing this from my couch, surrounded by laundry I swore I’d fold, and I’m like, “Wow, I did something right?” It wasn’t perfect—I overdrafted, forgot updates, and still buy dumb stuff—but automatic transfers were my safety net. If you’re reading this, drowning in bills or just curious, try setting up automatic transfers. Start with $5, see what happens. Hit me up in the comments with your own money stories—I’m nosy and wanna know!