I’m sitting in my tiny Seattle apartment, rain smacking the window like it’s got a personal vendetta, and I’m thinking about how a weekly spend plan pulled me out of my own financial dumpster fire. Like, no joke, I was the dude dropping $15 on lattes without a second thought until my budgeting app pinged me last week—September 18th, I think—and I actually stopped myself. Felt like a damn superhero for a second. But real talk? I only got into this weekly spend plan thing after a late-night Amazon binge left me $200 lighter and my bank account laughing at me. It’s messy, I screw it up plenty, but this realistic spending budget thing keeps me from going full broke. If you’re drowning in bills in this wild US economy where a burger costs as much as a car payment, a weekly money management plan might just save your ass.

Why Even Mess with a Weekly Spend Plan?

Okay, monthly budgets? Total scam for someone like me. They sound smart, but they crash harder than my old laptop. A weekly spend plan lets me pivot fast—like when gas prices jumped last Monday and I had to ditch Uber for my bike. It’s about those little financial planning tips that hit every week, keeping things real instead of letting screw-ups stack up till I’m eating instant noodles for a month. I’ve tried both, and monthly plans leave me lost, while weekly ones are like a quick chat with my wallet over Sunday leftovers.

Monthly vs. Weekly: My Hot Take

Monthly budgets feel like signing a contract with your future self, who’s apparently a genius. Spoiler: I’m not. Weekly spend plans are more my speed—short, messy, adjustable. I can see where my budgeting weekly expenses go wrong by Wednesday and fix it before Friday’s happy hour tempts me. Plus, it’s less overwhelming than staring at a whole month’s worth of numbers.

My Messy Steps for a Weekly Spend Plan That Kinda Works

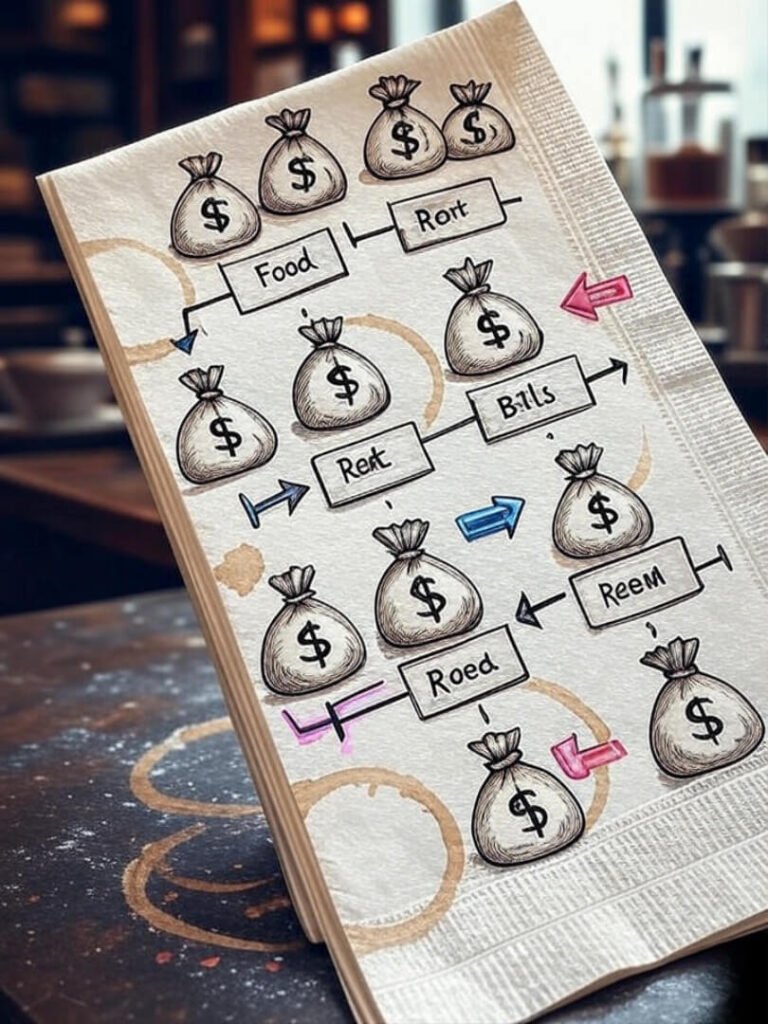

Here’s how I cobble together a weekly spend plan without losing my mind. First, I grab my ratty notebook—yeah, I’m old-school, apps crash, and I forget passwords like it’s my side hustle. I scribble last week’s fails, like dropping $60 on tacos because “friends were in town” when really I was just bored. Start with fixed stuff: rent split weekly, that gym membership I swear I’ll use someday. Then, set a fun money cap—mine’s $100 for food and random crap, which sounds lame but keeps my impulse buy control in check.

- Figure out your weekly cash flow: I freelance, so my income’s all over the place. I lowball it to avoid getting cocky.

- Sort your spending: Essentials (groceries, bills), wants (Netflix, that new game I don’t need), and oopsies (like my car’s $250 repair last month—ouch).

- Use tools, but don’t overdo it: I lean on Mint for expense tracking habits, plus a Google Sheet for my weird quirks. Check out NerdWallet’s budget app rundown for ideas.

Mid-week, I check in. If I’ve already blown half my food budget on DoorDash by Wednesday (yep, been there), I switch to cooking. It’s about saving money weekly without feeling like a monk—though I’ll admit, I sometimes sneak a splurge and hate myself later. Messy? Sure, but that’s me.

Apps and Tools That Don’t Make Me Wanna Scream

I’ve flopped hard with fancy apps before. YNAB? Great, but it fried my brain at first. Now I stick to freebies like PocketGuard for quick peeks at my budgeting weekly expenses. Pro tip from my dumb moments: Set alerts for when you’re close to overspending. Saved me from a $45 bar tab last Friday in Seattle, where drinks cost more than my dignity. For more app ideas, Investopedia’s budgeting basics are solid.

Where Weekly Spend Plans Go Wrong (aka My Greatest Hits)

Oh, dude, I’ve tanked my weekly spend plan so many ways. Like forgetting those sneaky subscriptions—Spotify’s $9.99 sneaking in mid-week always screws my personal finance tracking. Or getting smug after a good week and buying “essential” $70 sneakers because “sale.” Really, self? Underestimating random costs—like my cat eating a sock and racking up a $200 vet bill—can nuke everything. The trick is keeping your realistic spending budget loose enough to roll with life’s punches, ‘cause rigid plans make me wanna rebel and buy all the snacks.

- Emotional spending traps: I stress-bought $75 in candy after a bad Zoom call. Now I keep a small “oops” fund.

- Skipping daily checks: Miss this, and by Thursday, your weekly money management’s toast.

- Overcomplicating crap: Tried 15 categories once, quit in a week. Stick to 5-7 for sanity.

Some weeks, the plan just… poof, gone. Like when I traveled to Cali last month and my budget imploded. Life happens—adjust and move on.

Fixing Your Weekly Spend Plan Before It’s a Total Disaster

From my many, many flubs, the fix is often just chilling for a sec. I set a 10-minute timer before big buys—helps with impulse buy control. Talking to friends about financial planning tips over group chat helps too. If you’re stuck, Forbes’ personal finance section’s got good stuff.

Alright, wrapping this like we’re splitting the tab at a dive bar: A weekly spend plan ain’t about being perfect—it’s about not crying over your bank app every Monday. Mine’s gone from trainwreck to semi-decent, flaws and all. Try it this week, make it yours, and drop your biggest budget fail in the comments—I need to know I’m not the only hot mess out there. What’s your story?