Man, trying to get a personal loan with bad credit in 2025 is like navigating a minefield blindfolded while your phone’s blowing up with bill reminders—I’ve been there, seriously. Sitting here in my cramped Chicago apartment, the smell of burnt toast from breakfast still lingering ’cause I got distracted scrolling credit forums, I remember how my gut twisted last winter when my score dipped below 600 after some dumb impulse buys. Like, I needed cash for car repairs—tires screeching on icy roads, ya know?—but every bank laughed in my face. Anyway, this ain’t some polished guide; it’s my messy, real-deal ramblings on how I clawed my way to approval, contradictions and all. I mean, I preach caution but then I impulse-apply sometimes, what can I say? I’m just a regular guy fumbling through this American financial circus.

Figuring Out If You Even Qualify for a Personal Loan with Bad Credit

First off, let’s talk basics—do you even stand a chance at snagging a personal loan with bad credit? From my experience, yeah, but it’s not the fairy tale version. I pulled my free credit report from AnnualCreditReport.com (check it out here: https://www.annualcreditreport.com/index.action) and stared at those red flags, coffee mug warming my hands on a chilly morning, feeling like a total failure. Turns out, lenders look at more than just that number—stuff like your income, job stability, and debt-to-income ratio. I had a steady gig at a warehouse, but my DTI was sky-high from student loans, which made me second-guess everything. Weirdly, though, some online spots like Upstart or LendingClub (peek at their bad credit options: https://www.lendingclub.com/loans/personal-loans) use AI to peek beyond the score, which surprised me ’cause I thought it was all doom and gloom.

Checking Your Credit Score Before Chasing a Personal Loan with Bad Credit

Don’t skip this, folks—it’s the gut-check moment. I used Credit Karma (free tool, highly recommend: https://www.creditkarma.com/) on my phone while pacing my living room, the city traffic humming outside, and bam, there it was: 550. Ouch. But hey, it showed errors I disputed, like an old utility bill that wasn’t mine. Pro tip from my screw-ups: Fix those inaccuracies first; it bumped my score 30 points in a month. If you’re like me and hate numbers, just treat it like ripping off a Band-Aid—quick and painful but necessary for landing that personal loan with bad credit.

Hunting Down Lenders Who’ll Give You a Personal Loan with Bad Credit

Okay, so where do you even start looking for lenders okay with bad credit? I dove into this rabbit hole late at night, my laptop fan whirring like it’s judging me, rain pattering on the window in this Midwest downpour. Traditional banks? Forget it—they want pristine scores. But fintech apps? Game-changers. I tried Avant (solid for bad credit: https://www.avant.com/personal-loans/) and got pre-qualified without a hard pull, which didn’t tank my score further. Contradiction alert: I tell myself to shop around, but I panic-applied to three at once and regretted the inquiries. Seriously, compare rates—use sites like NerdWallet (great breakdowns: https://www.nerdwallet.com/best/loans/personal-loans/bad-credit-loans) to avoid my mistakes.

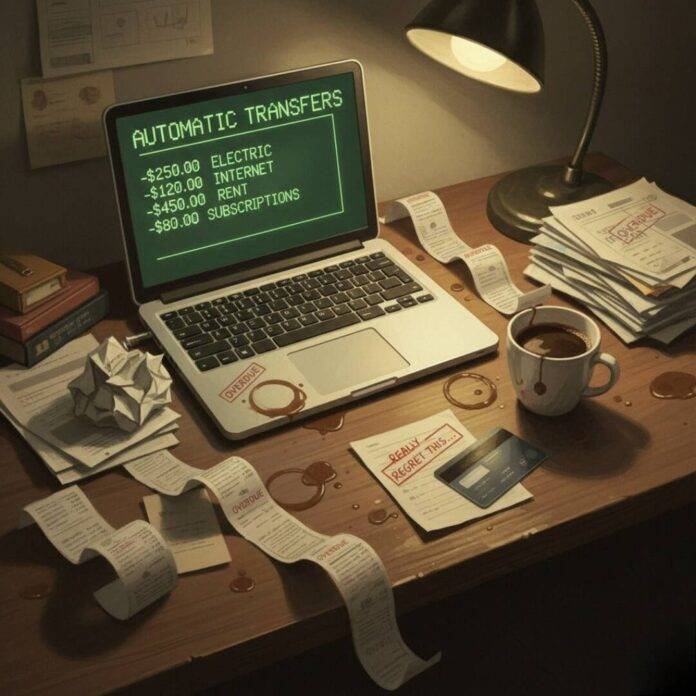

Comparing Rates and Terms for Your Personal Loan with Bad Credit Hunt

Rates can be brutal, like 20-36% APR, which hit me hard when I crunched numbers on a calculator app, my forehead sweating under the desk lamp. Aim for unsecured loans if you got no collateral— that’s what I did, no car to risk. Bullet points ’cause my brain’s scattered:

- Check for origination fees; mine snuck up and ate 5% of the loan.

- Look at repayment terms—shorter means higher payments but less interest, which I chose ’cause I’m impatient.

- Co-signers? I begged a buddy, but it strained our friendship—proceed with caution. Anyway, tools like Bankrate helped me sort this (try it: https://www.bankrate.com/loans/personal-loans/bad-credit/). Getting a personal loan with bad credit ain’t cheap, but it’s doable if you’re stubborn like me.

My Step-by-Step Mess of Applying for a Personal Loan with Bad Credit

Alright, here’s the nitty-gritty—my flawed playbook. Step one: Gather docs. I rummaged through drawers, dust bunnies everywhere, for pay stubs and ID while my cat judged me from the couch. Upload ’em fast; delays kill momentum. Two: Pre-qualify everywhere—saved my score hits. Three: Apply, but read the fine print; I missed a balloon payment clause once and freaked. Four: If denied, ask why—Equifax taught me that (info here: https://www.equifax.com/personal/education/credit/report/credit-report-denials/). Surprising twist: I got approved at OneMain Financial (they cater to bad credit: https://www.onemainfinancial.com/personal-loans) despite my doubts, and the funds hit my account in days. Felt like winning the lottery, but with interest.

Avoiding Pitfalls When Grabbing That Personal Loan with Bad Credit

Biggest oops? Not budgeting for payments—I skipped lunches to make ’em, stomach growling during shifts. Watch for scams too; sketchy lenders promising no-credit-check miracles are red flags. I almost fell for one via email, heart racing as I double-checked with BBB (useful: https://www.bbb.org/). And build credit post-loan— I started with secured cards from Capital One (start here: https://www.capitalone.com/credit-cards/secured-mastercard/). It’s a grind, but getting a personal loan with bad credit taught me resilience, even if I still cringe at my score.

Whew, that’s my unfiltered spill on snagging a personal loan with bad credit in 2025—flaws, wins, and all. If you’re staring at your own financial mess right now, like I was with that burnt toast smell still in the air, give it a shot but be smart about it. Seriously, hit up those sites I mentioned, check your score, and maybe chat with a financial advisor if you’re as clueless as I felt. What’s your story—drop it in the comments if ya want. Take care out there.