I’m trying to maximize employer 401(k) matching contributions while sitting in my tiny [insert US city] apartment, where the air smells like burnt toast and my cat’s glaring at me for no reason. Like, seriously, I’m a mess—my desk’s got old takeout containers and a sticky note that says “SAVE MONEY???” in my terrible handwriting. I’m no Wall Street hotshot, just a guy who’s tripped over his own feet figuring out this 401(k) thing. Here’s my raw, slightly embarrassing story of chasing that sweet employer match, typos and all, with some hard-earned tips from my screw-ups.

Why the 401(k) Match Is Free Money I Almost Ignored

So, picture me last summer, sprawled on my couch, scrolling X with pizza grease on my phone screen, totally oblivious to my company’s 401(k) match. I thought it was, like, some optional perk for nerds who wear ties. Nope. It’s your boss basically handing you free cash for your retirement savings. I read on Fidelity’s site that the average match is like 4.7% of your salary. I was leaving that cash on the table ‘cause I didn’t bother to check. Rookie move.

Here’s the gist:

- Most companies match a chunk of what you put in, like 50% or 100% up to a limit (say, 6% of your pay).

- Some do dollar-for-dollar, which is like finding $20 in your jeans.

- You gotta contribute enough to hit the max match, or you’re just… throwing away money.

I figured this out at an HR meeting, zoning out, when the speaker said “free money” and I dropped my pen. Like, what?!

My Epic Fail: Not Reading the 401(k) Fine Print

Real talk, I didn’t even look at my company’s 401(k) plan ‘til I’d been at my job for, like, eight months. I was too busy stressing over my car payment and forgetting to cancel that gym membership I never use. My kitchen table—littered with bills and a dying succulent—became my “finance zone.” Turns out, my employer matches 100% of my contributions up to 5% of my salary, but there’s a vesting catch. Vesting? Had to look that up on Investopedia. It’s when you actually get to keep the matched money, usually after a few years.

My big goof? I was only putting in 3%, thinking I was slick. Nope, I was missing 2% of free money. I sat there, staring at my cracked phone screen, feeling like I’d just burned a pile of cash.

How I Finally Got a Grip on My 401(k) Match Rules

Here’s what I should’ve done to maximize employer 401(k) matching contributions, instead of flailing:

- Dig into the HR stuff. The benefits packet is dull as dirt, but it’s got the deets. Look for “match rate” or “vesting schedule.”

- Bug HR. I sent a super awkward email to my HR guy (spelled his name wrong, oops) and got a PDF that broke it down.

- Check your pay stub. Mine’s always crumpled in my backpack, but it shows your contribution percentage. Compare it to the match cap.

- Use online tools. I messed around on Bankrate’s 401(k) calculator to see how much I was losing. Eye-opening.

Hacking My Budget to Boost Retirement Savings

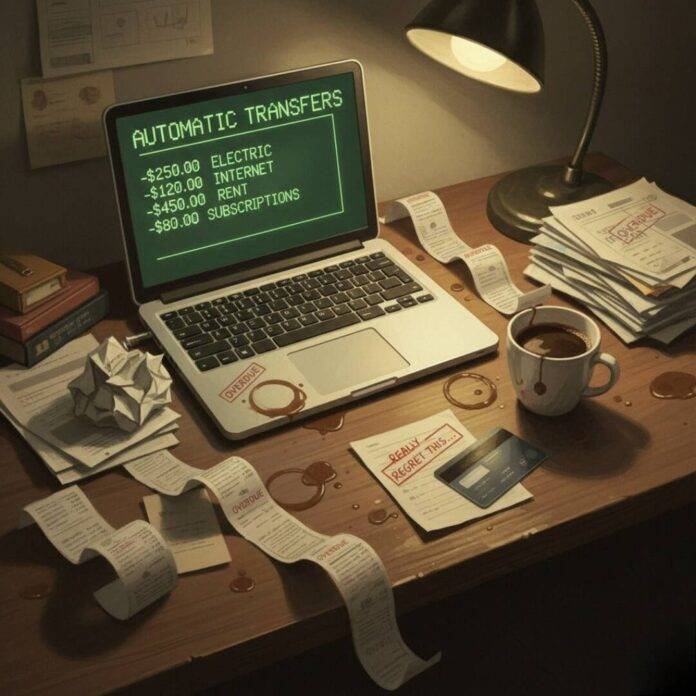

Okay, I’m not exactly swimming in cash—my fridge has ketchup packets and half a yogurt. So how do I maximize employer 401(k) matching contributions without eating ramen for every meal? I started small, bumping my contribution from 3% to 5% to hit the match cap. It’s like $60 less per paycheck, which stung at first. I cut back on streaming subscriptions (sorry, niche anime platform) and set up auto-contributions so I wouldn’t wimp out.

Big tip: when you get a raise, shove that extra money into your 401(k) before you blow it on takeout. I did this after a measly 2% raise last month, and now I’m getting the full match without feeling broke. NerdWallet has some clutch advice on this.

The Weird Headspace of Planning for Retirement

I’m low-key freaked out about this stuff. My mom’s always saying, “Save now, or you’ll regret it,” and I’m like, yeah, but I also need to live? Every time I check my 401(k) balance on my phone—usually while scarfing down cereal at 11 p.m.—it’s like a tiny win. That employer match makes it feel like I’m not totally screwing future me. But I still worry I’m missing something. Like, what if I change jobs and lose some of the match? Anxiety city.

Random 401(k) Stuff That Blew My Mind

Some of this 401(k) match stuff is wild. Like, did you know about “true-up” contributions? I didn’t ‘til I saw a post on X about it. It’s when your company adjusts your match at year-end if you hit the contribution limit early. Mind blown. Also, some plans have “safe harbor” rules that guarantee matches no matter what. The IRS site explains it, but it’s a snooze-fest.

Oh, and get this: if you’re part-time or a contractor, you might not even get a match. I almost took a contract gig last year that would’ve left me with zilch. Dodged that bullet.

My Top Tips for Maximizing Employer 401(k) Matching Contributions

Here’s what I’m doing now to not mess this up (again):

- Automate it. Set your contributions to hit the max match—mine’s 5%. Done and done.

- Know your vesting. I’m two years in, so I’m 40% vested. Gotta stay longer for the full deal.

- Don’t touch it. I was tempted to cash out during a broke phase last year—bad idea. You lose the match and get slammed with taxes.

- Get advice. I ran into a financial planner at a bar (random, I know) who gave me tips for free. Check CFP Board for legit pros.

Okay, Maybe I’m Not Totally Doomed

I’m still a financial disaster sometimes—my sock drawer’s more organized than my budget. But figuring out how to maximize employer 401(k) matching contributions makes me feel like I’ve got a shot at not being broke forever. My balance is creeping up, and seeing that employer match hit is like a little fist bump from the universe. I check it on my phone while avoiding my cat’s judgy stare, and it’s… kinda dope.

Wrapping Up My 401(k) Ramble

So, that’s my hot mess of a journey to maximize employer 401(k) matching contributions. I’m still learning, still spilling coffee on important papers, but I’m not missing out on free money anymore. If I can pull this off while forgetting where I parked my car, you can too. Check your plan, up your contributions, and don’t be me—read the HR stuff sooner. Got your own 401(k) horror stories? Spill ‘em on X or bug your HR rep. What’s the dumbest money mistake you’ve made?