Hey, so yeah, figuring out how to use tax refund wisely is something I’ve been obsessing over lately, especially since I’m sitting here in my cramped apartment in Seattle, rain pattering on the window like it’s judging my bank account. Like, last April, I got this decent chunk back from Uncle Sam—nothing life-changing, but enough to make me feel rich for a hot minute—and boom, I almost blew it on a shiny new gaming setup I didn’t need. Seriously? The smell of fresh cardboard from unboxing that crap still haunts me, mixed with the stale coffee from my all-nighter regretting it. Anyway, as a regular dude scraping by in the US, I’ve learned the hard way that treating your tax return like free money is a trap, but man, it’s tempting.

Why I Screwed Up Using My Tax Refund Wisely (And You Might Too)

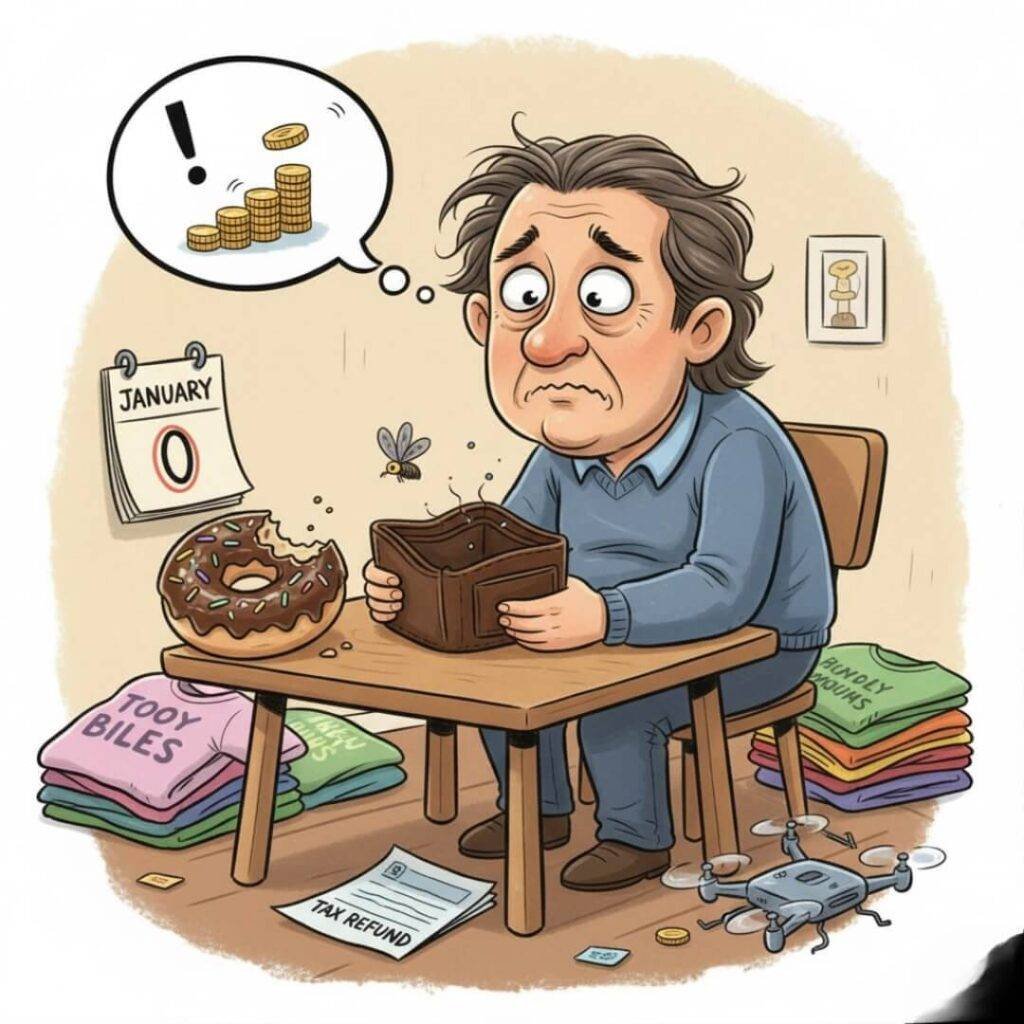

Okay, let’s get real—my first big tax refund a couple years back, right after moving to this rainy city for a tech gig, I treated it like winning the lottery. I remember the buzz in my chest, heart pounding as I hit “add to cart” on Amazon for stuff like overpriced sneakers that pinched my feet and a drone that I crashed into a tree on day one. The crunch of leaves underfoot that fall day, wind whipping my face as the thing spiraled down—embarrassing as hell. But here’s the contradiction: part of me knew I should use tax refund wisely, stash it away or something, yet the impulse won because, dude, adulting is exhausting. I’ve talked to buddies here in the States who did the same, splurging on trips or gadgets, only to face credit card bills later. It’s like our brains short-circuit on that “found money” vibe.

The Emotional Pull That Messes With Using Tax Refund Wisely

And don’t get me started on the guilt trip afterward. Like, I’d lie awake in my lumpy bed, staring at the ceiling fan whirring lazily, thinking, “Why didn’t I manage tax return smartly instead?” It’s this weird mix of excitement and shame—excited because hey, extra cash in a country where everything costs an arm and a leg, shameful because I know better now. My mom back in Ohio would call and nag, “Son, invest tax refund or pay down debt,” and I’d brush it off with a laugh, but deep down, it stung. Raw honesty? I’ve got this habit of contradicting myself—preach financial smarts to friends over burgers at the local joint, grease dripping on my shirt, then go home and online shop. It’s flawed, it’s human, it’s me.

Smart Moves to Actually Use Tax Refund Wisely This Time

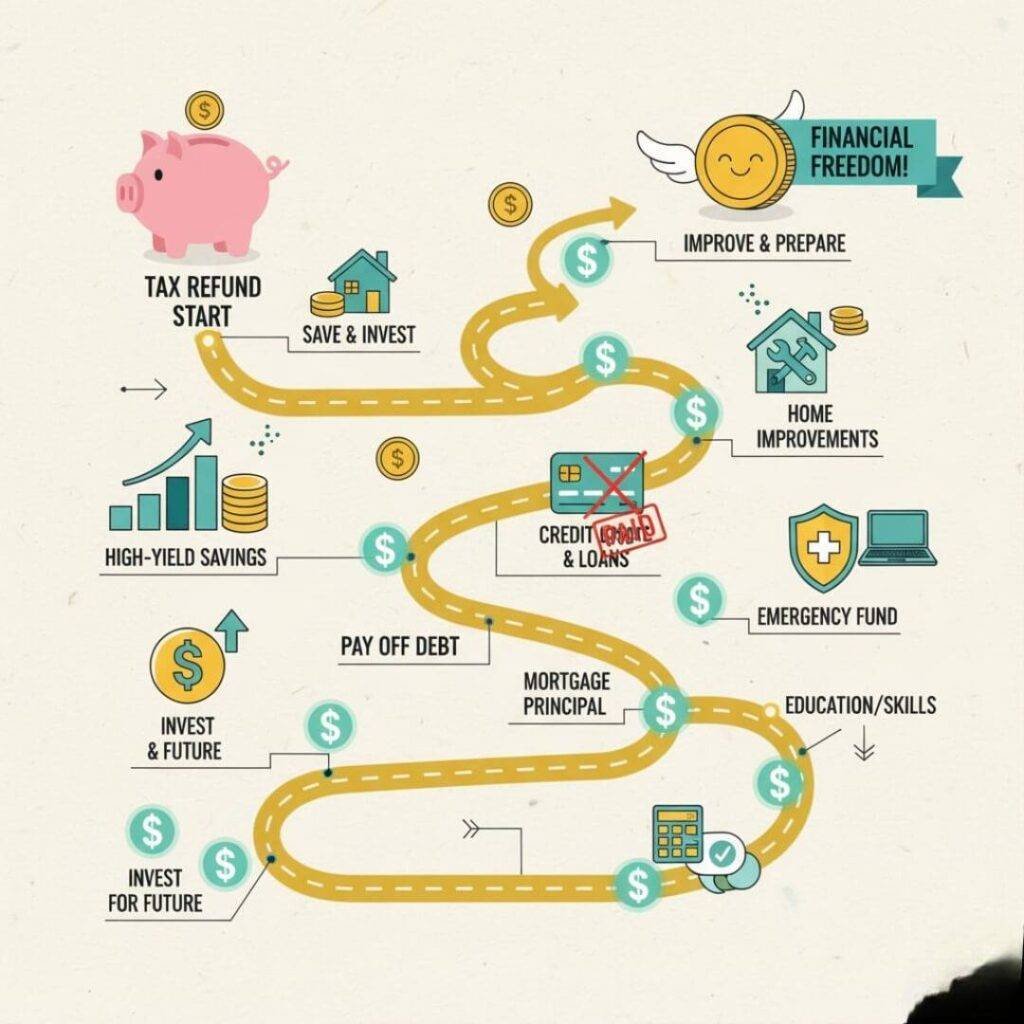

Alright, shifting gears—after that drone disaster, I swore I’d get better at using tax refund wisely. First off, I sat down with a notebook in my favorite coffee shop, the aroma of espresso hitting me like a wake-up call, and mapped out priorities. Build an emergency fund, y’know? That thing financial gurus rave about. I threw half my last refund into a high-yield savings account—check out sites like Ally or Capital One for decent rates (https://www.ally.com/ or https://www.capitalone.com/). Felt boring at first, no instant gratification, but now? It’s grown a bit, and that security blanket eases the knot in my stomach during tough months.

- Pay off nagging debts: Dude, if you’ve got credit cards charging insane interest, use tax refund wisely by knocking those down. I paid off a chunk of mine, and the relief? Like finally scratching an itch you’ve ignored forever.

- Boost your retirement: Toss some into a Roth IRA—sites like Vanguard make it easy. I did, and yeah, it’s not sexy, but future me will thank present me.

- Home improvements that save money: Living in the US, energy bills suck. I spent on LED bulbs and insulation—small stuff, but it cut my electric bill noticeably.

Surprising Wins From Using Tax Refund Wisely

But here’s a twist—I also allowed a tiny splurge, like 10% rule, to keep it fun. Bought a used bike for commuting, wind in my hair on Seattle trails, muscles burning but in a good way. Contradiction alert: I preach no-splurge, yet a controlled one kept me motivated. Learned that from trial and error—my first attempt at budgeting flopped because it was too rigid, left me cranky and rebound-splurging on takeout. Now? It’s about balance, weaving in smart tax refund spending without going overboard.

Invest It: Leveling Up How You Use Tax Refund Wisely

Investing? Yeah, I dipped my toes in after reading up—nothing fancy, just index funds via apps like Robinhood. Remember that buzzing excitement from splurging? Redirected it here, watching my tiny portfolio tick up on my phone screen during lunch breaks at work. Sensory overload: the ping of app notifications, the taste of my cheap office coffee turning sweeter with each gain. But honesty time—I lost a bit at first on a dumb stock pick, heart sinking like a stone. Lesson? Diversify, don’t chase hype. For newbies, start small to use tax refund wisely without panic.

Mistakes I Made Investing to Use Tax Refund Wisely

Oh man, my biggest flub? Timing the market like an idiot, buying high on meme stocks during a hype wave. Screen glowing late at night, eyes bleary, clicking buy—regret city. Now I stick to boring, steady stuff, and it’s paid off slowly. If you’re like me, flawed and impulsive, talk to a advisor or use free tools from Fidelity. It’s not perfect, but it’s progress.

Wrapping this up like we’re finishing a beer at the bar—using tax refund wisely isn’t about being a finance robot; it’s about owning your messes and tweaking ‘them. I’ve shared my screw-ups and small wins because, hey, we’re all winging it in this crazy economy. Give one of these tips a shot next refund season, maybe start with that emergency fund. What’s your plan—hit me up in the comments if you’ve got stories. Let’s not splurge ourselves into regret, yeah?