Alright, so smart 401(k) investment strategies in your 30s and 40s? Man, it’s like trying to herd cats while riding a unicycle in my tiny Ohio apartment, the radiator clanking like it’s mocking me. I’m sitting here, my desk a warzone of sticky notes and an empty Red Bull can, thinking about how I totally botched my first 401(k) moves. Like, at 31, I thought dumping my bonus into some hyped-up stock I read about on X was gonna make me a millionaire. Spoiler: it crashed harder than my attempt at keto last year. The smell of my neighbor’s BBQ drifting through the window still reminds me of that burnt cash. Anyway, here’s my raw, slightly messy take on getting this right, flaws and all.

My 30s Were a Wild Ride for Smart 401(k) Investment Strategies

Back in my early 30s, I was all about “living my best life,” which apparently meant ignoring my 401(k) like it was junk mail. I barely tossed in enough to snag the employer match—free money, people, don’t sleep on it! But then I got cocky, threw it all into tech stocks because some dude at a bar said they were “the future.” Cue the 2023 market wobble, and I’m pacing my apartment, stress-eating Doritos, watching my balance tank. The crunch of those chips? Basically my dreams. Learned my lesson: go for 70% stocks, 30% bonds, heavy on low-cost index funds for diversification. Keeps the smart 401(k) investment strategies in your 30s and 40s from feeling like a rollercoaster with no brakes.

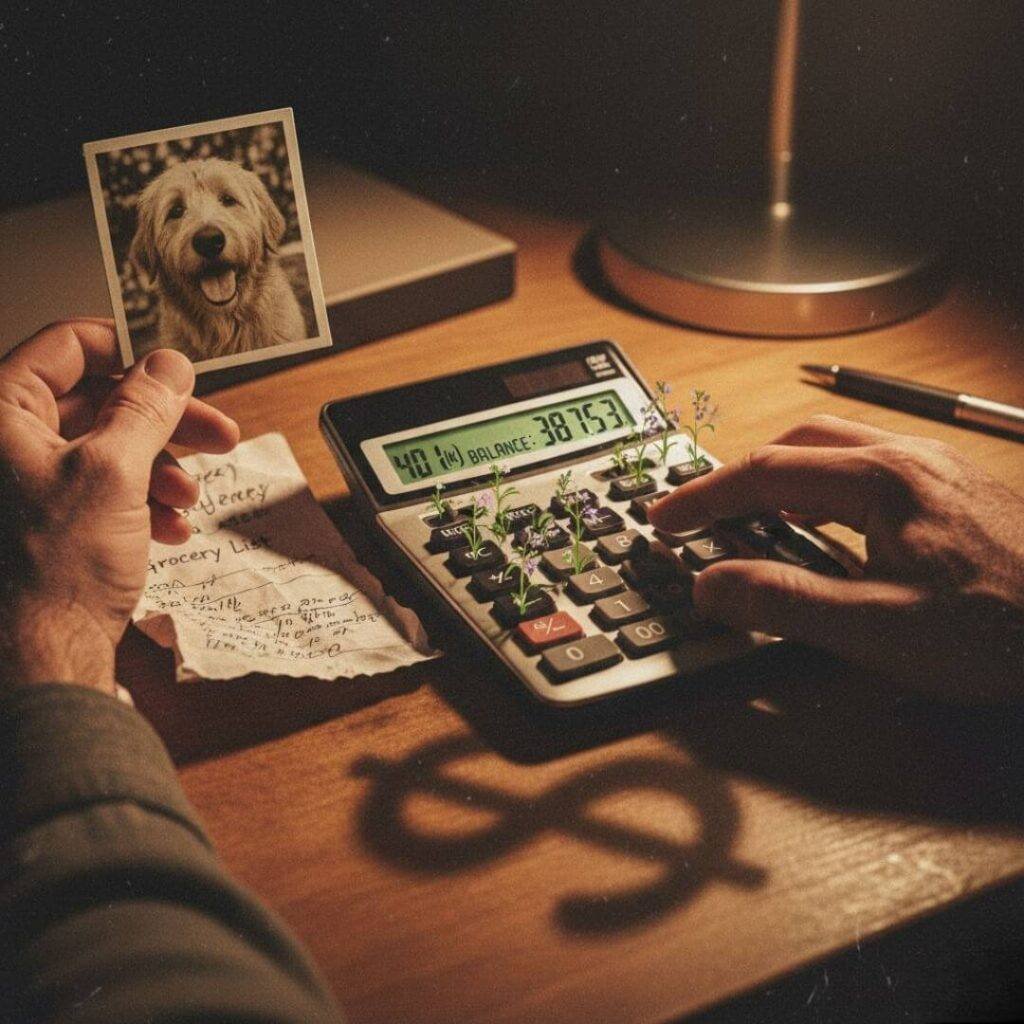

Here’s the deal: target-date funds are my lazy-but-smart hack now, auto-adjusting as I age. But, ugh, I screwed up by not having an emergency fund first. When my dog needed emergency surgery (love you, Max), I had to pause contributions, which sucked. Build that safety net—3-6 months’ expenses—before going hard on smart 401(k) investment strategies in your 30s and 40s. And yo, pay off those credit cards; mine from a “spontaneous” Miami trip haunted me forever.

- Always grab the full employer match. It’s like finding $20 in your jeans.

- Diversify like your life depends on it—stocks, bonds, maybe some global funds.

- Don’t check your balance daily; I did, and it was like watching a horror flick.

Hitting 40s: Smart 401(k) Investment Strategies Get Real

Now I’m 40-ish—okay, fine, 41—and smart 401(k) investment strategies in your 30s and 40s feel like a race against time. Last weekend, I was mowing my lawn, grass clippings everywhere, stressing about my kids’ college funds while my portfolio’s still leaning too hard into stocks. I’m all about growth, but man, I’m contradicting myself here—I crave safety now too. Shifted to 60% stocks, 40% bonds, tossing in some Treasury notes for stability. It’s like, I’m hopeful, but my creaky knees remind me time’s ticking. That moment when I burned my toast this morning? Same vibe as realizing I need to plan smarter.

I messed up by leaving an old 401(k) with a job I quit years ago; fees ate it alive. Now I’m all about consolidating and automating contributions—every raise, I bump it up. Also, don’t count on Social Security being your golden ticket; I read some stats on Social Security’s future and, yeah, treat it like a cherry on top, not the sundae. Oh, and IRAs? Look into ‘em if your 401(k) plan’s fees are high.

My Dumb Mistakes with Smart 401(k) Investment Strategies in My 30s and 40s

Oh boy, where do I start? Took a 401(k) loan for a “quick” bathroom remodel that turned into a plumbing nightmare—lost growth and paid penalties. Then there was that time I followed some X post about a “sure thing” biotech stock while chugging an IPA at a Cleveland dive bar. Tanked. My gut still twists thinking about it. Stick to boring index funds, trust me, and check out sites like Vanguard for low-fee options. I still peek at X for ideas, but now I verify with advisors, not my buzzed self.

Wrapping Up My Messy Take on Smart 401(k) Investment Strategies in Your 30s & 40s

Phew, spilling my guts about smart 401(k) investment strategies in your 30s and 40s feels like confessing to a priest, only with more coffee stains and less incense. I’m no guru—my dog’s chewed tennis ball on the floor proves I’m a mess—but starting now beats procrastinating. Check your 401(k) today, maybe call a fiduciary advisor, or hit up Fidelity’s planning tools for a start. What’s your worst 401(k) flub? Spill it below—I need to know I’m not alone.