Man, I’ve been obsessed with these underrated budget trackers lately, like seriously, they’re the unsung heroes keeping my wallet from imploding while I’m hunkered down in this rainy Seattle apartment, staring at my laptop screen with coffee dribbling down my chin from that overpriced latte I shouldn’t have bought. Anyway, as a regular dude fumbling through adulting in the US right now, I’ve tried a ton of these money tracking tools—some flashy ones everyone raves about, but nah, the underrated budget trackers are where the real magic happens, you know? I mean, I once blew my entire grocery budget on impulse buys at Target, feeling that gut punch of regret while scrolling through my bank app in the parking lot, cars honking around me like judgmental spectators. But these hidden gem finance apps? They’ve pulled me back from the brink, even if I still slip up and order DoorDash way too often. Like, who knew tracking expenses could feel less like a chore and more like a quirky side quest in my chaotic life?

Why These Underrated Budget Trackers Beat the Big Names (From My Messy Experience)

Dude, let’s get real—I’ve bounced between popular budget apps like YNAB and Rocket Money, but they felt too polished, too judgmental with their perfect pie charts staring back at me. Underrated budget trackers, though? They’re like that comfy old hoodie you forgot about but now can’t live without. Take my recent cross-country drive from Seattle to Chicago last month; gas prices were killer, and I was logging every pit stop expense on my phone while munching on gas station jerky that tasted like regret. These lesser-known budgeting software options let me customize without the overwhelm, and honestly, they’ve exposed my dumb habits—like how I spend way too much on craft beer subscriptions. But hey, no shame, right? It’s all part of the flawed American dream, scraping by in this economy.

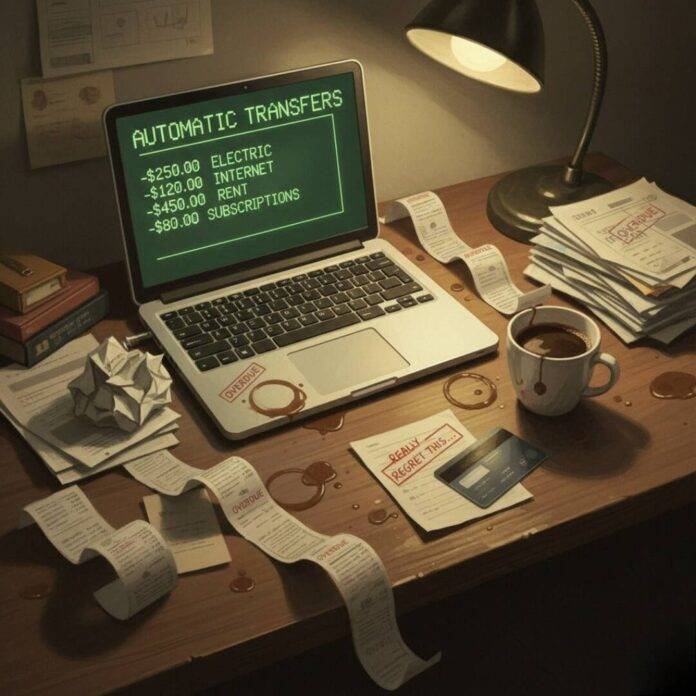

#1: Pocket Guard – The Underrated Budget Tracker That Caught My Sneaky Subscriptions

Okay, so PocketGuard? This underrated budget tracker snuck into my life when I realized I was paying for three streaming services I barely used—talk about a embarrassing wake-up call while binge-watching nothing in my dimly lit living room, rain pattering on the window like it’s mocking my finances. I downloaded it on a whim after seeing a random Reddit thread, and boom, it scans your accounts and highlights those vampire subscriptions sucking your money dry. Like, I canceled two right away and saved $30 a month, which I promptly spent on more coffee—contradictions, am I right? But seriously, its “In My Pocket” feature tells you what’s safe to spend after bills, which saved my butt during a surprise car repair last week. If you’re like me, fumbling with money tracking tools in the US hustle, give PocketGuard a shot—it’s free with premium upgrades, but the basics are solid. Check it out here: PocketGuard.

How This Underrated Budget Tracker Fits My Flawed Routine

PocketGuard’s interface is straightforward, no fancy bells that confuse me further. I remember setting it up while eating leftover pizza, grease on my fingers smudging the screen, thinking, “This better not be another dud.” But it linked my accounts seamlessly, and now I get notifications that feel like a nagging but helpful friend. Sure, it’s not perfect—sometimes it miscategorizes my weird impulse buys, like that late-night Amazon order for novelty socks—but that’s on me, not the app. Underrated budget trackers like this one make me feel less alone in my financial mess-ups.

#2: Good budget – Envelope-Style Underrated Budget Tracker for My Scatterbrained Self

Goodbudget takes me back to my grandma’s envelope system, but digital—super underrated budget tracker for folks who need that tactile feel without actual cash envelopes stuffing up your wallet. I tried it after overspending on groceries at Whole Foods, coming home to my fridge full of organic stuff that went bad because, let’s face it, I’m lazy about meal prepping. This app lets you allocate “envelopes” for categories, and I set one for “fun money” which lasted exactly three days before I raided it for concert tickets. Ha, classic me. But it taught me discipline, tracking shared expenses if you’re splitting with roommates like I am here in this cramped US city pad. Free version rocks for basics; premium adds more envelopes. Dive in: Goodbudget.

Surprising Wins (and Fails) with This Underrated Budget Tracker

The syncing across devices is clutch— I check it on my phone while waiting in line at the DMV, sweating over renewal fees. One time, it alerted me I was over on dining out, right as I was about to order burgers; I pivoted to home-cooked ramen instead, feeling smug but hangry. Underrated budget trackers like Goodbudget highlight my contradictions: I love planning but hate sticking to it. Anyway, it’s helped curb my impulse spending, even if I still daydream about splurges.

#3: Honey due – The Underrated Budget Tracker You’ll Love for Shared Chaos

Oh man, Honeydue? This is the underrated budget tracker you’ll love, especially if you’re navigating money with a partner like I am—trying to split bills without awkward convos in our tiny apartment, dishes piling up in the sink. I downloaded it after a fight over who paid for that weekend getaway; it tracks joint expenses, comments on transactions, and even has chat features. Like, I left a note on her coffee run: “Babe, that’s our third this week—love ya tho.” It’s free, focuses on couples without overwhelming features, and honestly, it’s saved us from resentment. My embarrassing anecdote? I once hid a video game purchase, but the app snitched—led to a laugh-cry session over cheap wine. Perfect for US couples juggling rent and dreams. Try it: Honeydue.

Why This Underrated Budget Tracker Feels Personal and Real

Honeydue’s simplicity shines—no ads, just clean tracking. I use it while lounging on the couch, feet up, ignoring the laundry mountain. It exposed my secret snack habits, but also built trust. Underrated budget trackers like this make shared finances less scary, more like a team effort, even when we bicker.

#4: Every Dollar – Ramsey’s Underrated Budget Tracker for Zero-Based Vibes

EveryDollar, from Dave Ramsey’s crew, is this underrated budget tracker that forces zero-based budgeting—every buck assigned a job, which hit hard when I realized my “misc” category was basically a black hole. I started using it post-holidays, hungover from overspending on gifts, sitting in my chilly room with holiday lights still up in February. You manually enter expenses, which sucks at first but keeps me accountable, unlike auto-sync apps that let me ignore reality. Free version is great; premium adds bank sync. I goofed by forgetting to log a bar tab once, woke up to a deficit lesson learned, painfully. Solid for beginners: EveryDollar.

My Raw Thoughts on Mastering This Underrated Budget Tracker

It’s bare-bones, which I dig—no distractions. Tracking on my commute, bumping elbows on the bus, it feels grounded. But I contradict myself; sometimes I cheat and round up numbers. Underrated budget trackers like EveryDollar push growth, even if I’m resistant.

#5: NerdWallet Money Tracker – Free Underrated Budget Tracker with Insights

Wrapping up with NerdWallet’s Money Tracker, an underrated budget tracker that’s totally free and packs insights without premium walls. I stumbled on it while doom-scrolling finance sites, avoiding my own bank balance after a splurge on tech gadgets that now collect dust. It categorizes spending, offers tips, and links to your accounts seamlessly. My self-deprecating story: It showed 40% of my income on “entertainment”—ouch, called out my Netflix marathons and bar hops. But it motivated tweaks, like cutting back for a road trip fund. Ideal for analytical types: NerdWallet Money Tracker.

Final Flubs and Fixes with Underrated Budget Trackers Like This

The visualizations are eye-opening—pie charts that make me cringe but change. I check it daily now, even if I digress into reading articles instead. Underrated budget trackers evolve with you, flaws and all.

Anyway, dude, these underrated budget trackers have been game-changers for my wallet woes, even if I’m still a work in progress—slipping up on budgets while typing this, eyeing that online sale. Give one a try, maybe start with #3 if you’re coupled up. What’s your fave? Drop a comment, let’s chat finances without the judgment. Seriously, it might just save your sanity like it kinda did mine. Oh, and uh, did I mention the rain’s picking up again? Distracting me from, wait, what was I saying? Budgets, right. Yeah.