Man, I’ve been obsessing over this early retirement checklist lately, like seriously staring at my laptop screen here in my cramped Brooklyn apartment while the subway rumbles outside, making me question if I’m ever gonna escape this hustle. Ya know, the kind where the coffee’s gone cold and I’m scribbling notes on napkins because my printer jammed again—total me move. Anyway, I thought I was hot stuff saving up, but then reality hit like a ton of bricks, reminding me how flawed my planning was. It’s all about that financial readiness, but from my jumbled American perspective, it’s messy as hell.

Kicking Off Your Early Retirement Checklist Basics

So, first things first on any solid early retirement checklist: figure out your freaking expenses, dude. Like, I sat down last week—rain pouring in Seattle where I was visiting family, that damp chill seeping into my bones—and tallied up my monthly bills, only to realize I was lowballing my grocery runs by half because, hello, inflation’s a beast right now. Seriously? I even forgot about those random streaming subscriptions that sneak up on ya. Start by tracking every dime for a month; use apps like Mint or whatever, but don’t beat yourself up if it’s eye-opening—I sure did, laughing at my own denial.

Next up, savings rate is key in the early retirement checklist game. I aimed for 50% of my income, but confessing here, I dipped into takeout way too often during stressful work weeks, blowing that goal. From my couch potato view, calculate yours by dividing savings by total income—easy math, but the discipline? Oof. And don’t forget emergency funds; mine’s at six months now, but I remember panicking during that 2023 layoff scare, sweating bullets in my stuffy home office.

Build that nest egg, folks—aim for 25-30 times your annual expenses, per the 4% rule from sites like NerdWallet. Me? I’m grinding towards it, but admit I splurged on a dumb gadget last month, regretting it instantly while scrolling Reddit in bed at 2 AM.

Crunching Numbers in Your Early Retirement Checklist

Dive into investments next—diversify, ya know? I threw money at index funds, but early on, I chased hot stocks like a fool, losing a chunk during that market dip. Lesson learned the hard way, smelling burnt toast from my kitchen as I freaked out. Check Morningstar for tips on asset allocation. Anyway, factor in inflation; it’s sneaky, eroding your stash like that slow leak in my apartment roof.

The Pitfalls I Tripped Over in My Early Retirement Checklist

Oh boy, healthcare—biggest blind spot in my early retirement checklist. I figured, hey, I’m healthy, but then a random doc visit cost me an arm and a leg, literally wincing at the bill while chugging cheap coffee. In the US, pre-Medicare? Brutal. Plan for COBRA or marketplace options; I shopped around on Healthcare.gov and it was a headache, but necessary. Don’t be me, ignoring it till panic sets in.

Taxes, too—withdrawals can bite ya. I daydreamed about Roth conversions while stuck in traffic on the 405 in LA last summer, AC blasting but still sweating. Optimize that stuff early; chat with a tax pro, or read up on Kiplinger for checklists. And lifestyle inflation? Guilty as charged—I upgraded my phone unnecessarily, then felt dumb.

Boredom’s another trap; I quit a side gig once and binged Netflix for days, feeling empty in my quiet living room. Plan hobbies—Reddit threads on FIRE have great ideas, like picking up guitar or volunteering.

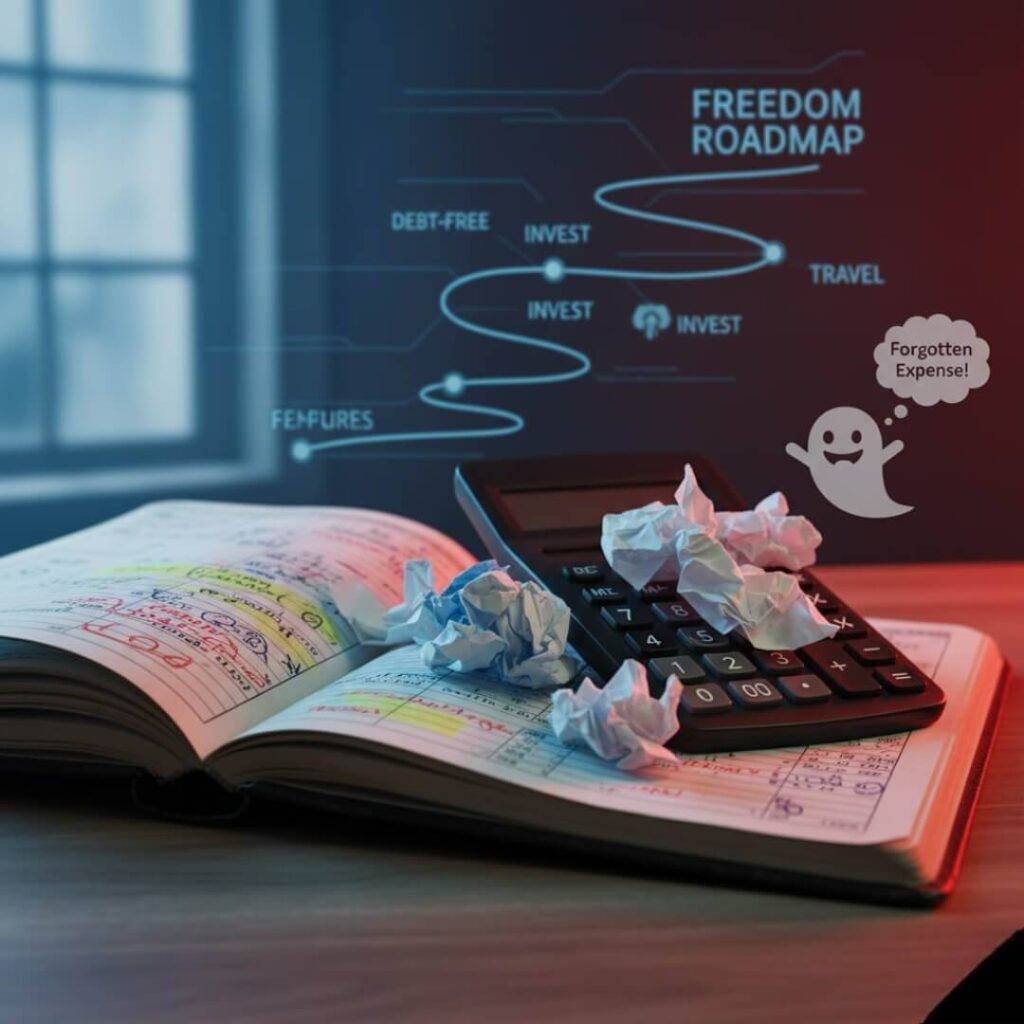

Dodging Common Early Retirement Checklist Mistakes

Overestimating returns? Yeah, I did that, assuming 7% forever—ha, markets laugh at plans. Adjust for realism, per CalPERS guides. And family dynamics; my folks questioned my early out dreams over Thanksgiving turkey, gravy dripping everywhere, making me doubt but also motivate.

My Top Tips for Nailing the Early Retirement Checklist

Start small—build habits like auto-savings. I set mine up while munching cereal at breakfast, milk dribbling—simple but game-changing. Track net worth monthly; mine’s up, but dips happen, keeping me humble.

Seek community—join forums or local meetups. I lurked on financial independence subs, then shared my screw-ups, feeling less alone. And revisit your early retirement checklist yearly; life changes, like my recent move cross-country, shaking things up.

Personal Hacks to Boost Your Early Retirement Checklist

Side hustles helped me—gig economy stuff, though I burned out once, crashing on the couch exhausted. Balance is key. And mindset: embrace frugality without misery; I cook more now, savoring that homey kitchen smell.

Anyway, wrapping this up like ending a late-night chat over beers—early retirement checklist ain’t perfect, but it’s my roadmap outta the rat race, flaws and all. If you’re pondering yours, grab a pen, jot down your numbers, and maybe check Social Security’s guide for starters. Seriously, what’s stopping ya? Drop a comment if you’ve got your own messy stories—let’s commiserate.