Credit repair mistakes have been a big struggle for me. I often find myself in my small Chicago apartment, dealing with the problems on my credit report. Ignoring errors in my credit report last winter led to a significant drop in my score. As an average person facing rising rent and gas prices, I’ve realized that avoiding these mistakes is crucial for my financial survival. I even once claimed to have fixed my credit quickly, only to face trouble when bills came due.

My Biggest Credit Repair Mistakes: Ignoring the Basics

Okay, so first off, one of the top credit repair mistakes I made was straight-up pretending those tiny discrepancies on my report didn’t matter. Picture this: I’m in my kitchen last spring, the fridge humming annoyingly in the background, munching on leftover pizza that’s probably past its prime, and I spot a wrong address listed from like five years ago when I moved cross-country. Did I fix it? Nah, I shrugged it off, thinking, “Who’s gonna care?” Big mistake. That little blunder snowballed into denied loan applications, and suddenly I’m paying higher interest on everything from car insurance to my phone plan. If you’re like me, flawed and forgetful, start by pulling your free annual credit reports—yeah, from AnnualCreditReport.com—and scrutinize every line. It’s not rocket science, but skipping it is a classic credit repair mistake that bites you in the butt.

Why This Credit Repair Mistake Haunts Me Still

Digging deeper, that ignoring-basics thing led to contradictions in my own head—I’d tell myself I was on top of my finances while secretly stressing over late-night Google searches for “quick credit fixes.” Like, one time in 2024, during a heatwave where the AC in my building crapped out, I sweated through calling a bureau to dispute, only to hang up because the hold music was driving me nuts. Unfiltered truth? It felt easier to avoid. But here’s the tip from my messy experience: Use tools like Credit Karma for monitoring—it’s free, and it nags you enough to actually do something. Avoiding this credit repair mistake means embracing the boredom of regular checks; otherwise, you’re just setting yourself up for more headaches.

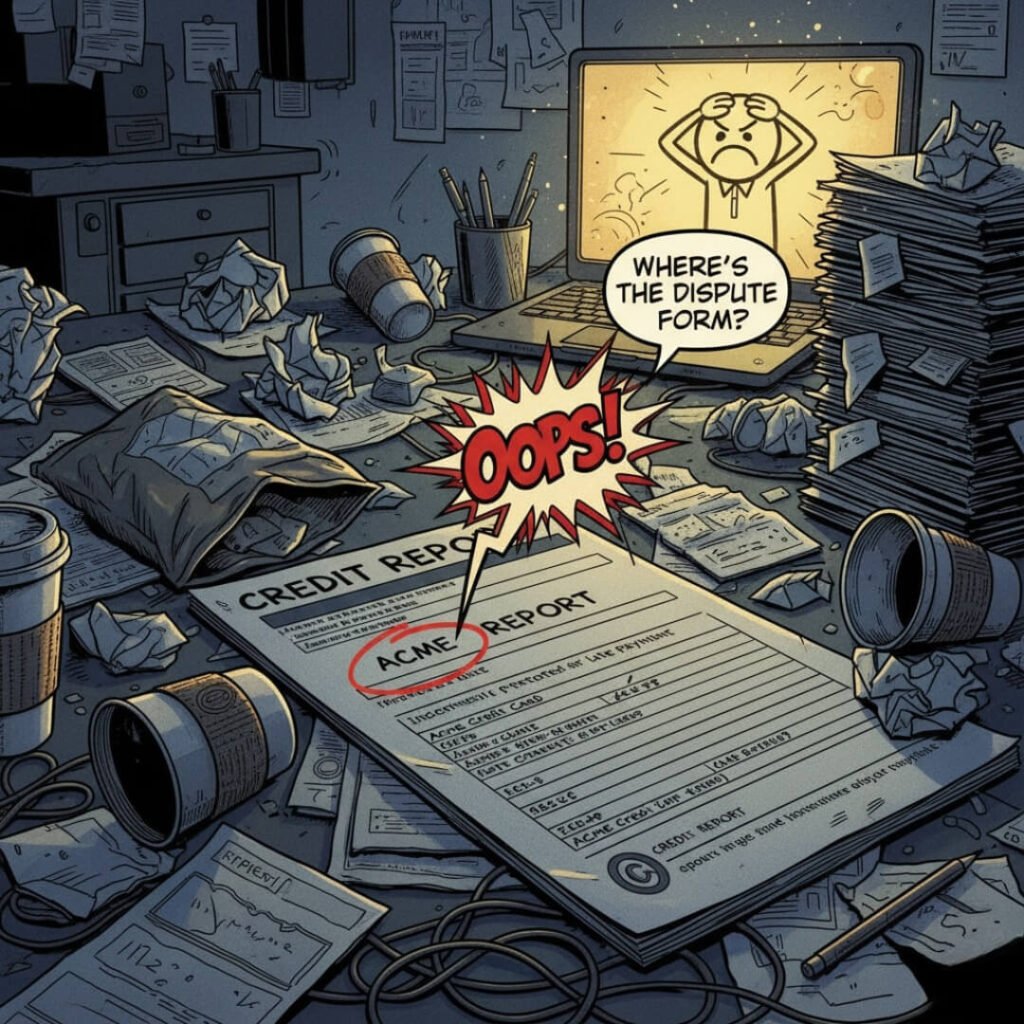

Credit Repair Mistakes Involving Quick-Fix Scams

Man, falling for those shady “guaranteed” services? That’s another huge credit repair mistake I’ve owned up to, and it still makes me cringe. I was at a bar in the Loop district last summer, the clink of glasses and laughter all around, chatting with a stranger who swore by this online company promising to wipe my slate clean for a “small fee.” Sounded legit over a couple beers, right? Wrong. I forked over cash from my checking account—poof, gone—and my score didn’t budge; worse, they messed with disputes I could’ve handled myself. As an American who’s seen too many infomercials late at night while doom-scrolling on my phone, I now know better: Stick to reputable non-profits like the National Foundation for Credit Counseling. These credit repair mistakes thrive on desperation, and yeah, I was desperate after a job layoff that left me eating ramen for weeks.

Spotting Red Flags in Credit Repair Mistakes Like This

Red flags? Promises of overnight miracles or asking for upfront payments—huge no-nos under the Credit Repair Organizations Act, which I only learned after the fact, sitting in my stuffy living room with the fan blasting warm air. Contradiction alert: I hate bureaucracy, but following FTC guidelines saved my skin later. If you’re dodging credit repair mistakes, quiz any service: Are they licensed? Do they explain the process? My advice, raw and real: DIY where you can, like filing disputes directly with Equifax, Experian, or TransUnion. It takes time, but it’s free and empowering—unlike my scam detour that left me broker and bitter.

Overlooking Payment Histories: A Sneaky Credit Repair Mistake

Alright, third on my list of credit repair mistakes is blowing off payment histories, thinking one late bill won’t kill you. Ha! I did that during the holidays in 2023, snow piling up outside my window while I prioritized gifts over that utility payment—next thing, it’s dinging my report for years. Sensory overload: The guilt hit me like the cold draft sneaking under the door as I checked my score app, heart sinking. As a flawed human in the US, where everything from apartments to jobs checks your credit, this mistake amplified my anxiety. Tip: Set up autopay, folks—it’s a lifesaver. And if you’re late, negotiate with creditors; sometimes they remove it if you’re polite and persistent.

Fixing This Credit Repair Mistake the Hard Way

My learning curve? Steep and slippery. I contradicted myself by preaching budgeting to friends while secretly juggling due dates like a bad circus act. Surprising reaction: When I finally tackled it head-on last month, my score jumped 50 points—mind-blown emoji here. Weave in secondary stuff like building positive history with secured cards from places like Capital One. Avoiding this credit repair mistake means consistency; slip once, and it’s a chain reaction.

Credit Repair Mistakes with Too Many Inquiries

Number four: Racking up hard inquiries like they’re free candy—that’s a credit repair mistake that sneaks up on you. I went nuts applying for store cards during a shopping spree at the mall last Black Friday, the crowds buzzing and holiday music blaring, figuring more credit meant better options. Nope. Each inquiry shaved points off my score, and suddenly lenders saw me as risky. From my American perspective, where consumerism is king, it’s tempting, but resist. Space out applications, and monitor with Mint or something similar.

The Aftermath of This Particular Credit Repair Mistake

Embarrassing anecdote: I got denied for a car loan right after, sitting in the dealership with that new-car smell taunting me, feeling like a total loser. Unfiltered: I raged internally, then laughed it off with self-deprecating jokes to my sister over the phone. Advice? Soft inquiries don’t hurt—use them to shop rates. Dodging credit repair mistakes like this keeps your score stable.

Mixing Personal and Business Credit: My Dumbest Credit Repair Mistake

Finally, blending personal and biz credit? Epic credit repair mistake, especially as a freelancer hustling from home. Last year, I charged work stuff on my personal card during a cross-country drive through the Midwest, cornfields whizzing by and truck stops smelling of diesel, thinking it’d build rewards. Instead, it maxed my utilization and tanked everything. Lesson: Separate ’em—get a business card from Chase if you’re legit. This one’s all about boundaries, which I suck at.

Recovering from Credit Repair Mistakes Like Mixing It Up

Contradictions galore: I love the freedom of freelancing but hate the financial mess it creates. Surprising? Therapy helped me see it as a growth thing—yeah, I went there. Tip: Track utilization under 30%; it’s key to avoiding credit repair mistakes.

Whew, that’s my rant on credit repair mistakes wrapped up—like, if you’re still reading, props to you. From my spot here in the US, dodging these in 2025 feels doable, even for screw-ups like me. Anyway, hit me up in the comments with your own blunders, or better yet, grab your free credit report today and start fixing—seriously, what’s stopping you?