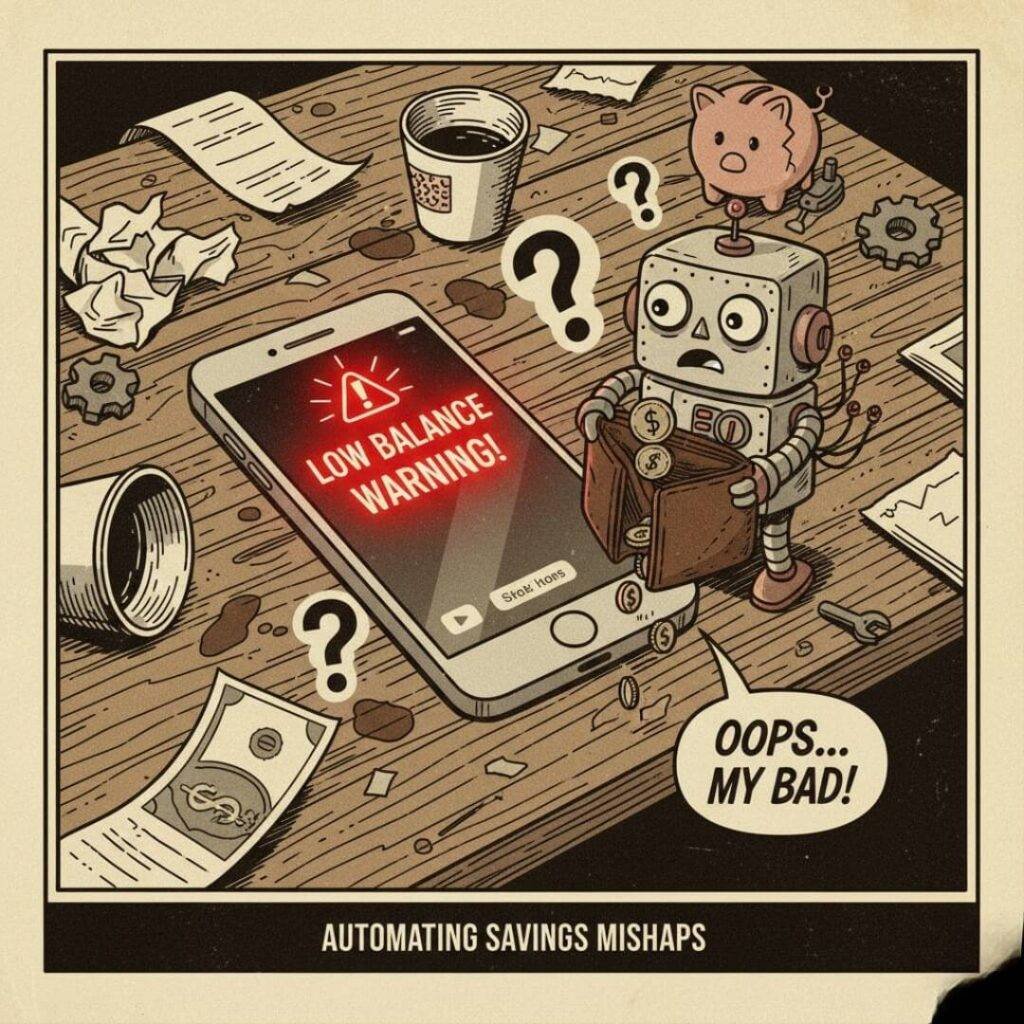

Man, automating savings has been this total game-changer for me, like, I can’t even tell you how much it’s pulled my ass out of the fire lately. Sitting here in my tiny Brooklyn walk-up—yeah, the one with the siren blaring outside every five minutes and that faint smell of yesterday’s pizza delivery—I’m scrolling through my bank app, chuckling at how I used to blow my paycheck on dumb stuff like overpriced bodega sandwiches. Seriously? I remember this one time last month, right after getting paid, I eyed this flashy new gadget online, but bam, my automated transfer had already whisked away $50 to savings before I could hit “buy.” It pissed me off in the moment, I’ll admit, but now? Dude, it’s like having a stern but loving grandma managing my cash.

Why I Dove Headfirst into Automating Savings

Okay, so picture this: I’m in the US, grinding through this gig economy BS, juggling freelance checks that come in all erratic-like. Automating savings felt like the only way to not end up eating ramen for the tenth night in a row. I mean, I read up on it—check out this solid piece from Bankrate on growing savings with automatic transfers here—and it hit me that consistent little drips add up without me lifting a finger. But honestly? My first go was a hot mess. I set it too high, like $200 a pop, and next thing I know, I’m overdrafting on rent day. Embarrassing as hell, calling my bank all flustered, but hey, that’s my flawed American life for ya—full of trial and big ol’ errors.

Like, anyway, the whole point was to build that emergency fund without thinking about it. And contradictions? Oh man, I love how automating savings makes me feel responsible, but sometimes I curse it when I wanna splurge on concert tickets. Raw truth: It’s saved me from myself more times than I can count, especially with inflation hitting hard these days.

The Real Perks That Kept Me Going with Automating Savings

Alright, let’s get into the juicy bits—why automating savings isn’t just some buzzword BS. For starters, it straight-up reduces my stress, y’know? No more lying awake at 2 AM wondering if I remembered to sock away cash. According to this Vectra Bank blog on the benefits here, it simplifies everything by scheduling transfers and even earns you better interest. Me? I noticed my savings balance creeping up, like magic, while I was out grabbing overpriced lattes in the city. But get this: I had this surprising reaction where I felt guilty at first, like I was cheating the system or something. Silly, right? Yet that’s my unfiltered brain—cautiously optimistic but always second-guessing.

Another perk? It curbs my impulse buys big time. Remember that BECU article saying automatic plans can boost savings by 1.5 to 3.5 times here? Totally tracks with my life. I used to hit up Amazon for random crap, but now that chunk is gone before I see it. Contradiction alert: I miss the thrill sometimes, but damn, seeing that nest egg grow? Worth it. And in this economy, with gas prices fluctuating like crazy, automating savings feels like my secret weapon against surprises.

- Builds habits without willpower—I’m lazy AF some days, and this just works.

- Avoids late fees on bills if you automate those too, per Huntington’s take here.

- Grows money passively, especially in high-yield accounts.

Tips from My Trial-and-Error Adventures in Automating Savings

So, if you’re gonna jump on this automating savings train—like I did after bombing my budget app setup—start small, dude. I kicked off with $20 bi-weekly, just to test the waters without freaking out my checking account. Big mistake I learned? Not linking it to a high-interest savings spot first; wasted months on crappy rates until I switched. Check out Harvard FCU’s blog for more on that here. Anyway, my advice: Track it monthly, adjust as needed, ’cause life throws curveballs—like that unexpected vet bill for my cat last week.

Oh, and apps? I swear by ones like Acorns or Ally’s auto features; they round up purchases and automate the rest. But here’s my embarrassing confession: I once forgot about a transfer and tried to buy groceries, card declined in line—mortifying, with everyone staring. Lesson? Always leave a buffer. Automating savings works best when you’re honest about your spending flaws.

- Set realistic amounts based on your paycheck rhythm.

- Use tools that notify you—keeps the surprises fun, not scary.

- Combine with goals, like my “vacay fund” that’s actually growing now.

Seriously, the Service Credit Union piece nails it on the power of these plans here.

Whew, alright, wrapping this up like we’re finishing a late-night chat over beers—automating savings ain’t perfect, and yeah, I’ve got my gripes, but it’s hands-down the smartest move for folks like me fumbling through American adulting. It’s built me a cushion without the constant hassle, even if I still sneak in guilty pleasures. My genuine suggestion? Hop on your bank app right now, set up a tiny auto-transfer, and see how it feels. You’ll probably thank your future self—or at least not curse past you. What’re you waiting for? Go automate that savings!