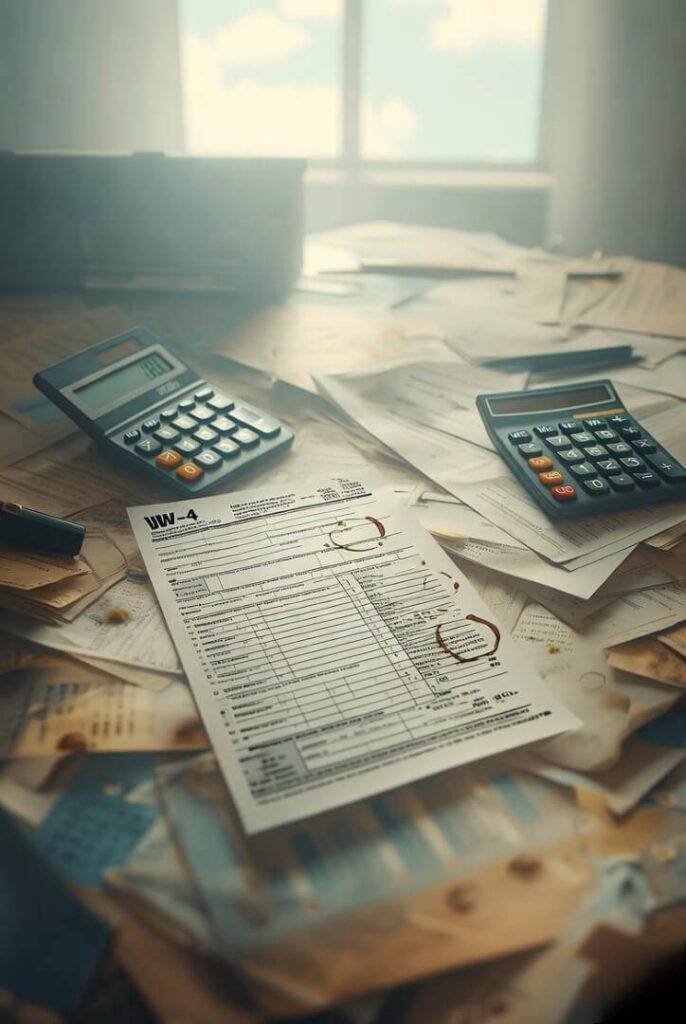

Okay, so why your tax refund was smaller this year totally blindsided me, like, I’m sitting in my tiny Seattle apartment, rain hammering the window like it’s mad at me, staring at my bank account on my cracked phone screen, and I’m like, “Seriously? This is it?” Last year, I got enough back to buy a fancy espresso machine—y’know, the kind that makes you feel briefly adult. But this time? Barely covered my grocery run to Trader Joe’s. It’s embarrassing, like telling my friends I miscalculated my budget again, even though I’m supposed to have my shit together. Turns out, I screwed up my W-4 after starting a side hustle, thinking I’d keep more cash each paycheck, but nope—smaller tax refund slapped me hard.

I was pacing my creaky floorboards, the damp smell of Seattle rain sneaking through the window, muttering about how inflation’s eating my lunch but didn’t touch my refund. Raw honesty? I didn’t max my IRA contributions because I was too busy doomscrolling X instead of budgeting. Like, I’m an American just trying to survive, contradictions and all—one second I’m hopeful I’ll fix it next year, the next I’m side-eyeing the whole tax system. Smaller tax refund stung, but it forced me to dig into what went wrong.

Digging Into Why Your Tax Refund Was Smaller (It’s Not Just Me, Right?)

Let’s break it down like I’m ranting to a pal over cheap beer—why your tax refund was smaller probably comes from a few sneaky reasons. First, if you earned more, like I did with some freelance gigs (sounded cool ‘til tax season), you might’ve jumped a tax bracket without noticing, so Uncle Sam took a bigger bite upfront. Or maybe your withholding was off; I cranked mine down thinking I’d pocket more each month, but ugh—smaller tax refund city. And don’t sleep on expired credits—those sweet pandemic bonuses are gone, leaving gaps in your refund.

I checked out the IRS’s site (they’ve got this myth-busting page on refunds, super useful: https://www.irs.gov/newsroom/myth-busting-federal-tax-refunds), and it’s often about missing life changes. Like, I forgot to itemize deductions for medical bills after a dumb ER trip—slipped on wet leaves outside my place, still smell that hospital antiseptic in my nightmares. Unfiltered: I hate paperwork, but skipping it shrank my refund. And tax law tweaks for 2025? They help some, but if you’re like me, barely over a bracket line, it screws you. My thoughts are a mess, bouncing like ping-pong balls, but that’s life in the US, yeah?

- Higher income, higher bracket: More cash, less refund—sneaky.

- Withholding oopsies: Too little withheld means owing or tiny refund.

- Expired credits: No more stimulus or big child credits for lots of us.

- Deduction fumbles: I donated clothes but lost receipts in my car, which smells like old gym socks.

My Cringe-Worthy Mistakes Behind Why Your Tax Refund Was Smaller

Alright, time to get real—why your tax refund was smaller mirrors my own dumb moves, and it’s low-key mortifying. Picture me in my kitchen, that annoying fluorescent light buzzing like a mosquito, fumbling through TurboTax at 2 a.m., realizing I didn’t update my filing status after breaking up. Single now, but filed like I wasn’t, and bam—smaller tax refund because deductions shifted. Embarrassing, like admitting I still eat instant ramen some nights. And get this, I contributed to my 401(k) but not enough to max the match—my boss sent emails, but I was swamped and ignored ‘em. The office coffee that week? Burnt, like my brain.

Honest? I thought my side gig was genius, but didn’t save for taxes—surprise bill ate my refund. Contradiction: I’m all about budgeting but blew mine on dumb Amazon buys. Living in the US, costs are nuts—gas here in Washington is like highway robbery, draining cash I could’ve used to avoid a smaller tax refund. I laughed like a maniac when I saw the amount, then got pissed. Learned the hard way, man.

Fixing Why Your Tax Refund Was Smaller (So I Don’t Cry Again)

So, how do we dodge this next year? From my screw-ups, here’s the game plan, like I’m yelling at myself in the mirror. Tweak your W-4 pronto—I used the IRS withholding estimator (check it: https://www.irs.gov/individuals/tax-withholding-estimator) and bumped up withholding via my payroll app. Max out IRA or HSA contributions; I set auto-transfers, even if it means no more overpriced lattes. Itemize if it beats standard deductions—track receipts with an app, sipping coffee that’s still too bitter from my mistakes.

Claim every credit: Education, energy stuff (I got LED bulbs, scored a small break). Adjust for life changes early. Contradiction: I loathe planning, but it saved me from another smaller tax refund mess. Pro tip: If you’re lost, talk to a tax pro—I did once, felt like cheating but worth it. Here’s the rundown:

- Fix W-4 to withhold more (less paycheck, bigger refund).

- Max retirement/HSA for deductions—every bit helps.

- Hunt credits/deductions like a treasure map.

- Use IRS tools to double-check.

It ain’t fancy, but from my soggy Seattle view, it works.

Wrapping Up My Rant on Why Your Tax Refund Was Smaller

Man, spilling about why your tax refund was smaller feels like venting over coffee—messy but real. Here in rainy Seattle, I’m just a dude fumbling through, coffee stains on my forms and half-assed plans. Smaller tax refund sucked, but I’m hopeful yet skeptical for next year. Own your mess, learn, and fix it.